Introduction

The already crowded insurance space has seen a wave of digital technology enter the market in recent years, with digital-only companies like Lemonade and global eCommerce giant Amazon expected to intensify competition and bring customer expectations on par with the fast, customized digital experiences they’re already used to when swiping their way to buying their many products online today. These digital trendsetters only add to the heightened demand for seamless digital experiences by insurance customers in the wake of the coronavirus pandemic.

How can providers and industry incumbents ensure they’re prepared to meet these challenges? With insurance premiums in the U.S. alone racking up to nearly $1.3 trillion in 2020, the potential upside for those that future-proof their customer experience today is massive.

A key to unlocking opportunities to level up business efficiency and customer experience is understanding how today’s insurance processes impact the experience of both customers and insurance employees serving them. To this end, Lightico surveyed 137 insurance professionals in the United States on their views on the changing insurance landscape, how their company is currently managing new policy sales and existing customer claims processes, and how they feel accelerating these processes can impact their business.

Survey Background

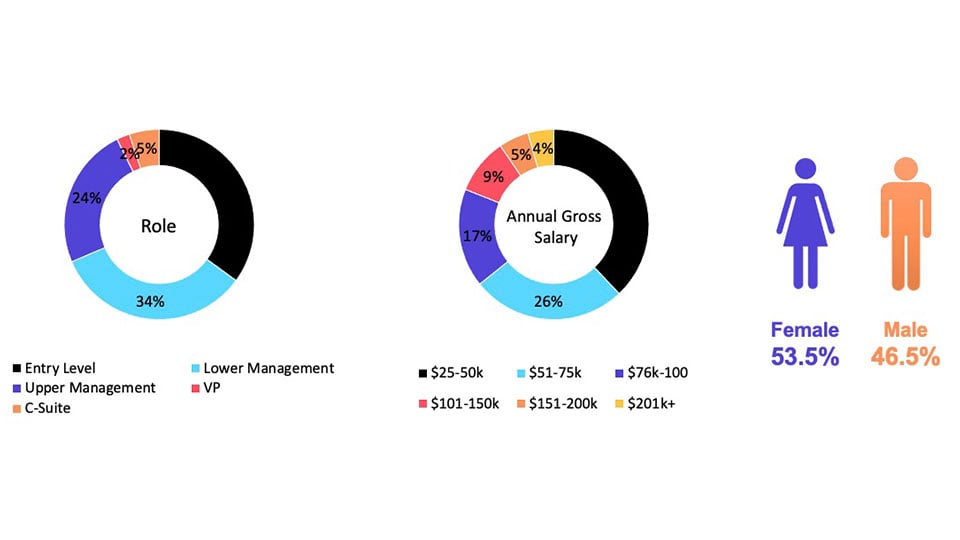

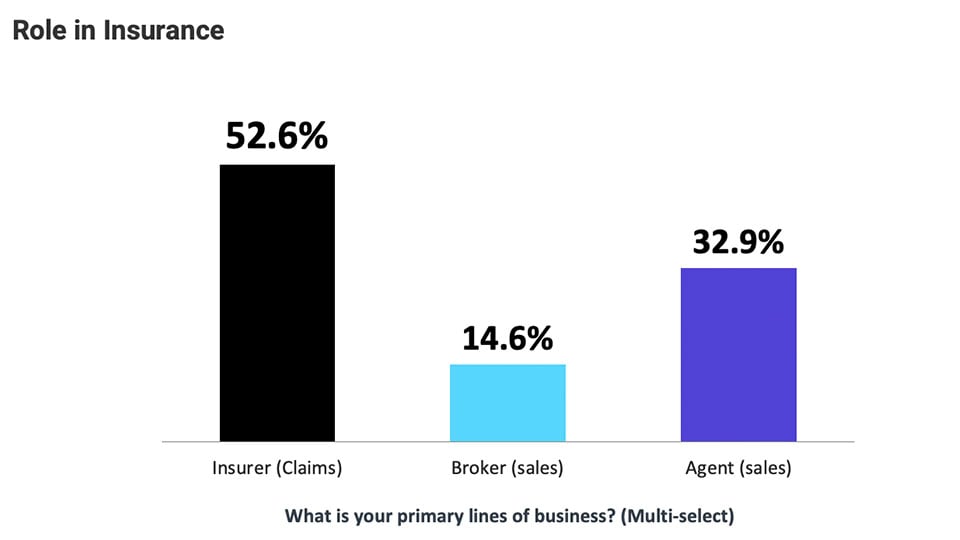

The following data comes from a survey of 137 insurance professionals in the United States conducted on September 24, 2021. The survey was done through an online panel and has a margin error of 6% with a confidence level of 95%. The survey represented various levels of seniority, genders and areas of insurance coverage.

How Digital Will Insurance Go?

We asked professionals how they view tech-first insurance companies that have emerged in recent years and found that perceptions are quite divided. 38% of insurance employees think that the emergence of insurtech and tech trend setters like Amazon entering the market actually open opportunities for industry incumbents to improve the way they deliver insurance services. Surprisingly, while 33% view these digital-first providers as competitors, 29% of professionals still see them as a passing fad, and do not view them as a long-term threat.

33% of professionals see the underinsured and uninsured segment as an opportunity for providers, while just over 26% view servicing these customers as an obligation. Almost 20% feel that providing insurance to this market is actually a business liability.

Much has been debated about the impact that climate change may have on insurers in coming years. Despite that, only 17% of professionals expect climate change to have a major impact on their business, with a leading 45% believing it will carry some impact.

Today Insurance Sales and Claims Are Anything But Digital

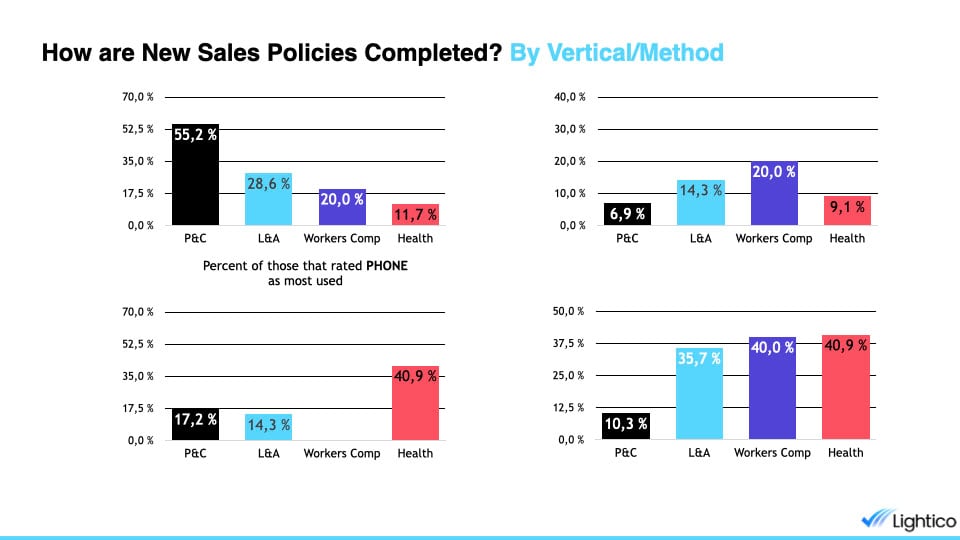

When it comes to opening a new policy, a leading 39% of professionals indicate that they complete most new policies over the phone, while 23% said that most policies are opened in-person at the office. Only 27% stated that new policies are completed digitally via a website or mobile app.

Looking at insurance sales policies by vertical, health insurance policies are those most completed digitally, yet at only 41%, just as many customers end up opening their new health insurance policy in-person at the office.

More new P&C policies are completed over the phone with an agent than any other method, with website and mobile apps covering only 24% of new P&C sales.

For L&A policy sales, only 28% are opened digitally via site or mobile app - the rest are completed in-person or over the phone.

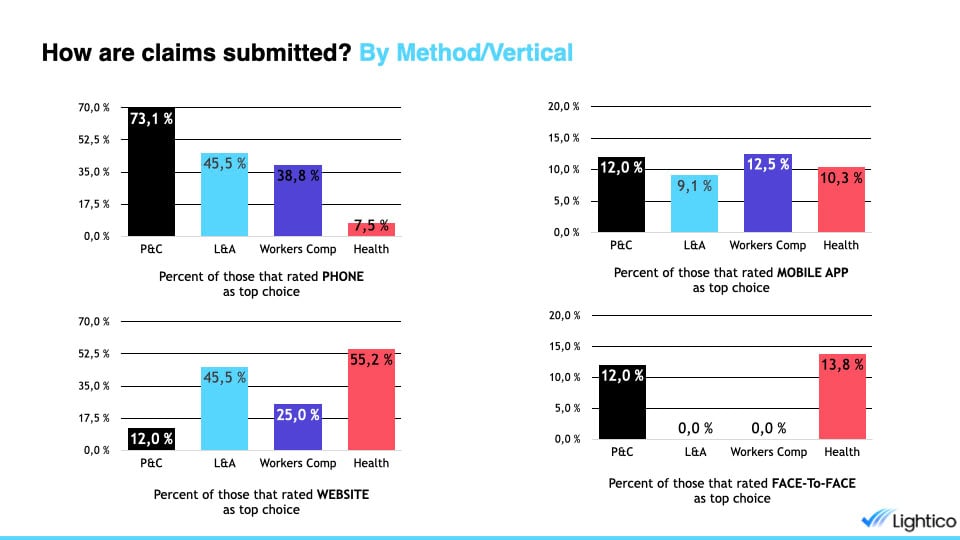

Most (44%) of insurance professionals indicate that customers call the contact center in order to submit an FNOL/FROI claim, with 38% of these claims submitted online using a website form.

Here we can see the responses broken down by product vertical:

Slow Sales & Claims Completion Times Still the Norm

54% of professionals stated completing a new insurance policy takes 3 days or less, while 16% indicated it takes them over 2 weeks to open up a new policy. This highlights a dramatic gap between insurers over their capabilities to swiftly complete new business.

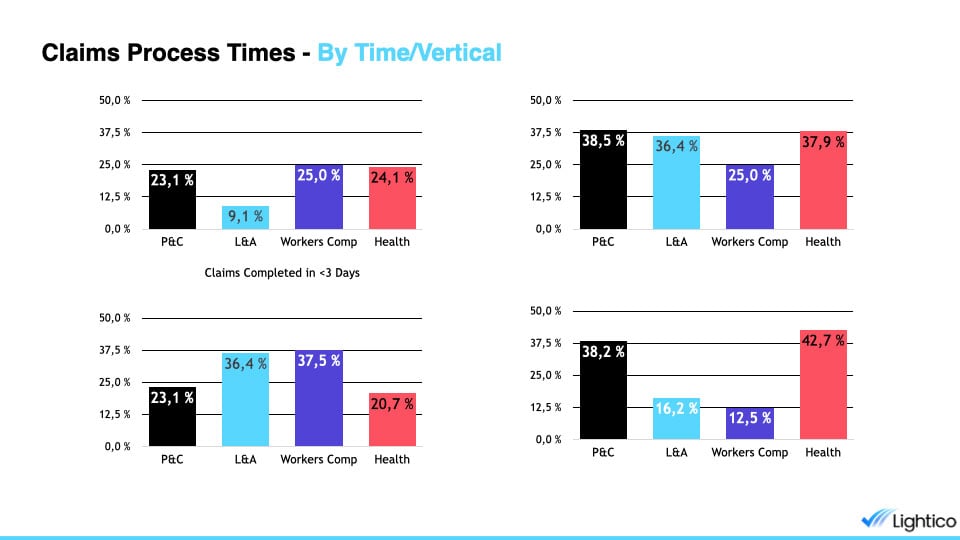

Unlike new policy sales, only 23.5% of insurance professionals indicated processing a claim can be completed in 3 days or less. Nearly 34% said this will take 1-2 weeks to complete with their existing processes, while 16% indicate processing completion times will exceed 2 weeks.

Zooming in on claims processing times by vertical, a whopping 80% of health insurance claims take a week or more to process, with 42% taking 15 days or more to complete. This is also true for just over 76% of all P&C claims, and over half of L&A claims.

Multiple Touchpoints adding Delays & Complications to Insurance Sales & Claims

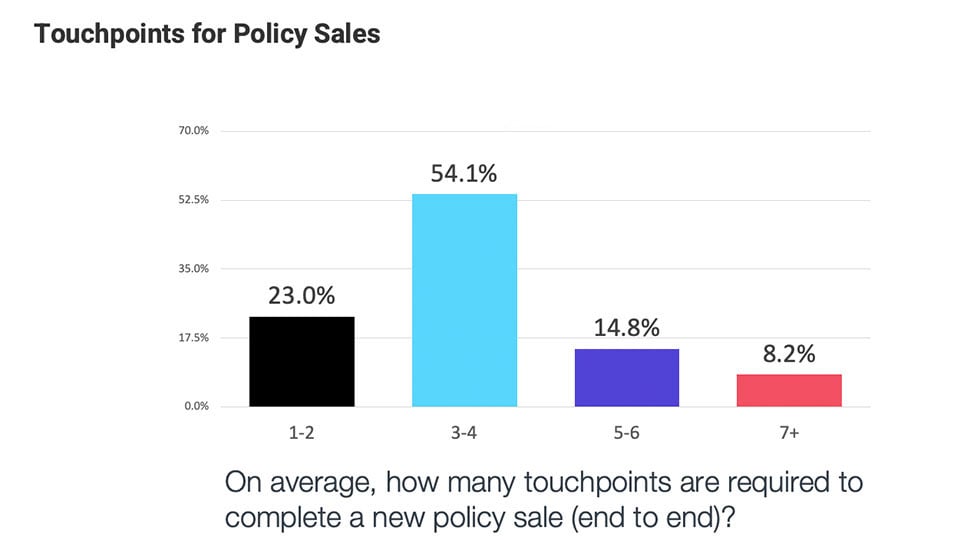

54% of insurance professionals estimated that completing a new policy sale requires no less than 3-4 touchpoints for the customer. Only 23% indicated they could open a new policy for a customer using just 1 or 2 touchpoints.

For 63% of professionals surveyed, claims also involve 3-4 touchpoints in order to process, while for 20%, 5 or more different touchpoints are needed just to resolve these critical customer requests.

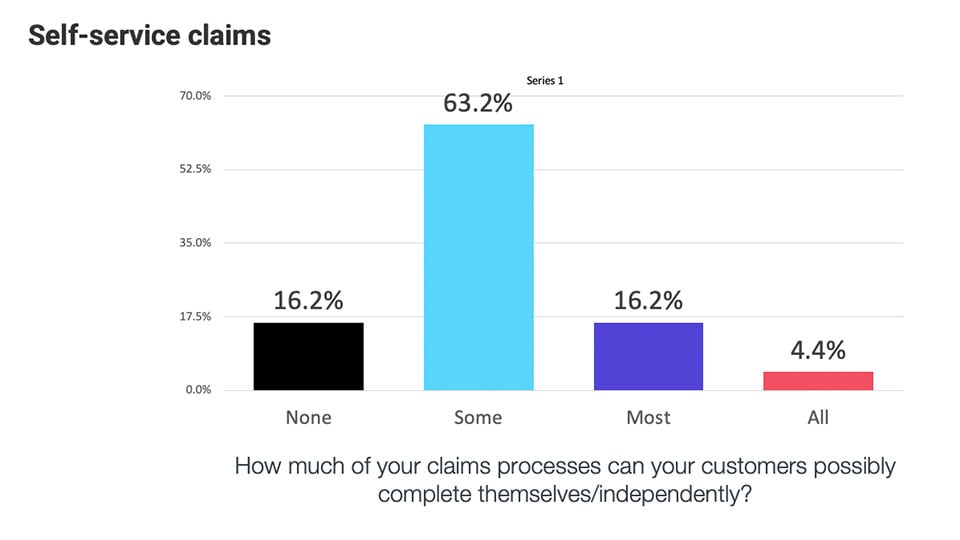

Only 4% of Professionals feel Self-Service Insurance Processes Are Completely Digital

Self-service options are a major priority for insurers in meeting today’s customer’s expectations - but only 4% of all professionals surveyed said that all customers can complete self-service claims independently, and only 16% indicate that most of their customers can complete self-service claims on their own. 16% indicate that their customers still can’t complete any self-service insurance claim on their own.

This shows that digital self-service options are simply not the reality for most insurance customers today, with the majority having no other option but to take their digital claims process offline.

The Price of Broken & Digitally Incomplete Insurance Experiences

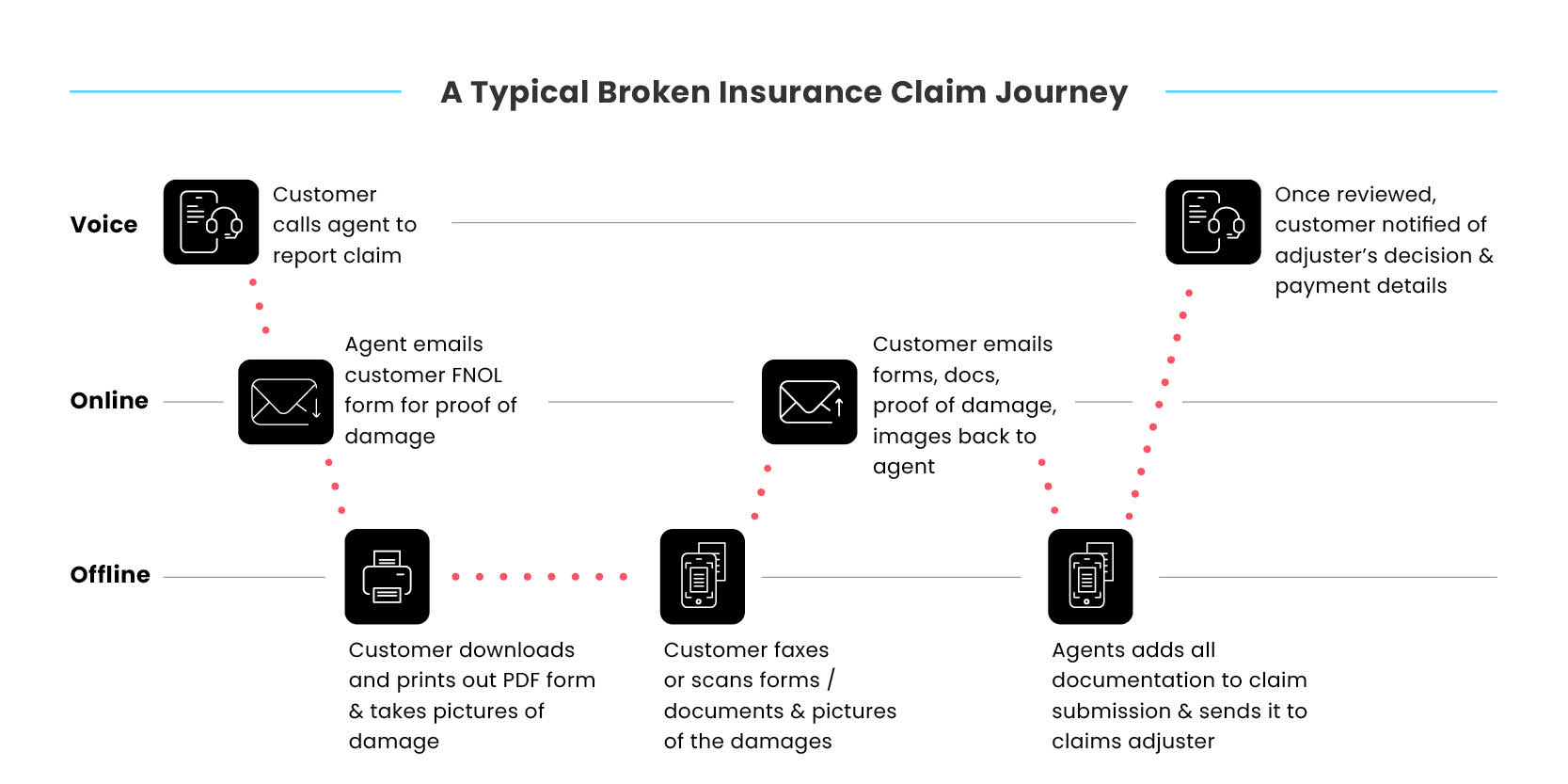

In an age where most customers expect to complete transactions in minutes from one device - their smartphone - the current speed of business and customer service for insurance providers still takes days if not weeks and requires multiple touchpoints. This is because despite insurance companies’ investment to digitally transform their back end core systems, their customer-facing experience is typically sewn together using several digital solutions that are not integrated and operate as silos.

Using siloed systems that don’t seamlessly talk to each other adds extra steps for prospective customers wanting to apply for a new policy and for existing ones during that critical time when they need to file a claim.

Legacy processes - like email, PDF-based forms, printers, fax, and scanning machines - needlessly add more touchpoints for customers, who may start a process digitally, but soon after resort to calling the contact center to ask questions not understood from a lengthy and cumbersome form or terms and conditions document. They’re then bounced completely offline, printing out forms instead and using outdated machinery just to fax or scan forms and required documents back to their insurance company.

These additional steps and touchpoints create friction and frustration for the customers, harming NPS and customer satisfaction, and risking that they’ll abandon the sub-par experience and take their business to a competitor altogether.

But the pain isn’t just limited to customers: Insurance employees are flooded with high call volumes which inflate Average Handle Time(AHT). Inordinate time must be spent fielding menial questions that could easily be covered by a digitized process. They also are mired in the paperwork that comes with digitally incomplete processes. These broken insurance journeys waste valuable employee time and resources, and lower productivity.

Accelerating Insurance Processes: The Impact on CX & Costs

Over 65% of insurance professionals believe that their customer’s experience would improve significantly if they could accelerate new policy sales processes by half, while almost 30% indicate this would also help cut costs.

Similarly, nearly 65% say that cutting claims processing time by 50% would improve customer experience significantly, while 44% indicate it should also help cut costs.

Conclusion:

Future-Proof the Insurance Journey Today to Boost CX & Cost Savings

Eliminating the digital silos and legacy processes that leave many insurance providers and brokers stuck dealing with the consequences of complex and friction-filled customer interactions requires a CX evolution.

To meet the expectations of today’s mobile-first consumers, insurers require one end-to-end digital insurance platform that can easily and swiftly guide customers through every step and requirement needed to open up a new policy or file an FNOL so that they efficiently have their claim reviewed and resolved.

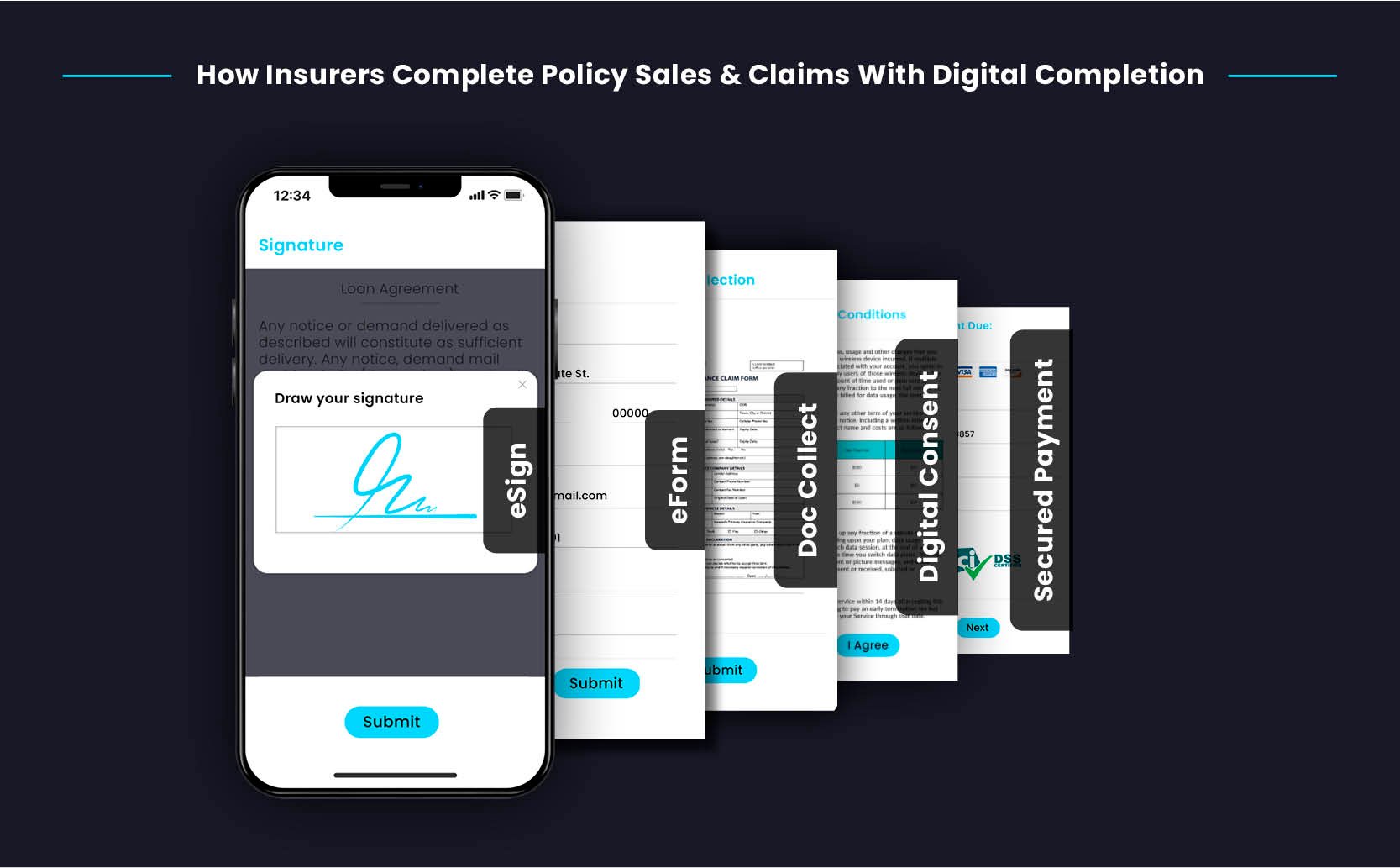

Emerging Digital Completion technology has enabled insurers to complete all customer-facing steps, such as eSignatures and eforms, ID verification, document collection, and digital consent on terms and conditions.

Instead of experiences that suck time and resources from staff across contact centers and branch offices, necessitate admin and paperwork, and complicate compliance, one unified digital session guides customers in completing everything that’s required to service their request, and can be combined in-tandem with live agent assistance to support customers in real time.

How Insurers Complete Policy Sales & Claims With Digital Completion

Insurers currently leveraging the capabilities of Digital Completion are:

- Settling insurance claims 85% faster

- Reducing touch points per policy by 60%

- Increasing customer satisfaction by 15%

- Ensuring 100% compliance

As consumer expectations continue to evolve, digitizing and accelerating insurance processes will be customer deal breakers even more in the next few years. Insurers adopting a digitally complete CX today will position themselves to compete successfully against Insurtech challengers, grow their customer base, and power long-term growth.

Learn how Lightico

can accelerate your organization's insurance processes.