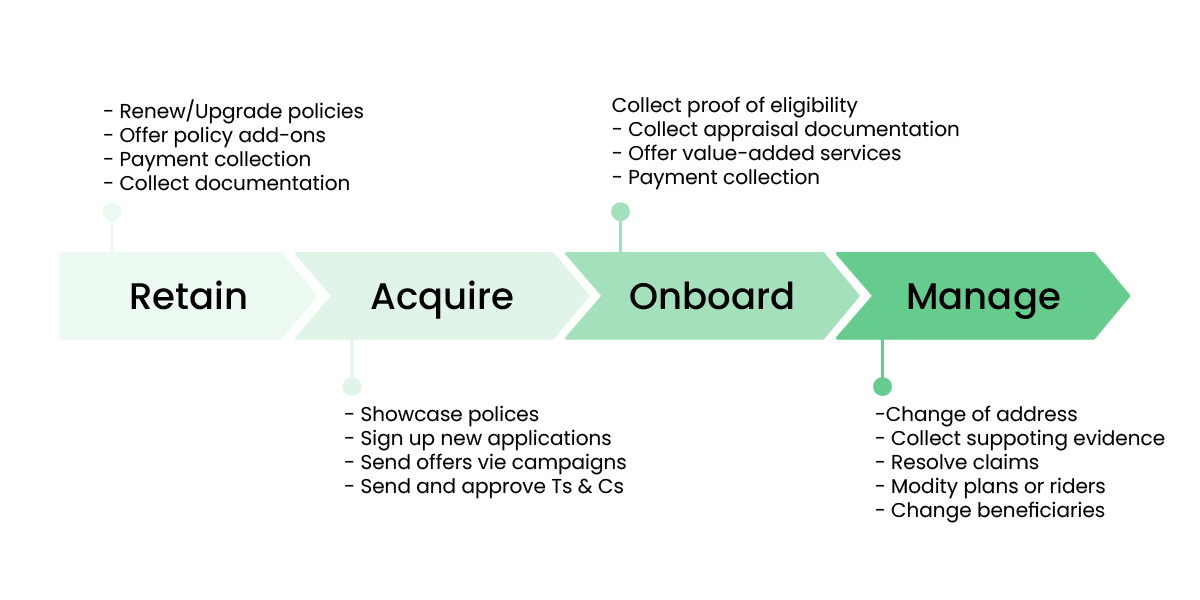

You can hardly blame incumbent insurers for viewing this digital renaissance as a threat - Data shows that consumers switching to another insurance provider costs businesses $2.59 billion in the U.S. alone. But on the flipside, the opportunity is massive if they can infuse convenience, speed and seamlessness into every pivotal moment of the customer lifecycle - from acquisition, to onboarding, managing and resolving claims and servicing needs, right on to retention strategies:

Insurance Customer Lifecycle

Data shows that the average insurance customer’s lifetime value can reach $125K, while Gartner estimates that 80% of businesses’ future revenue is generated by just 20% of their existing customers.

In an era where customers can easily compare insurance products and services and read reviews from fellow consumers on every aspect of their experience, removing any barrier to acquisition, any needless friction from resolving claims or requests, and any hesitation standing in the way of retention will make or break insurers’ ability to compete successfully and unlock long-term profitability.

Achieving that means insurers must - finally and for good - shedding the entrenched silos and legacy processes that slow down efficiency and drive friction in so many of these experiences throughout the lifecycle that harm customer confidence and lead them to abandon.

This guide will examine the most critical processes in each stage of the lifecycle and how digitizing them end-to-end can accelerate growth and strengthen customer loyalty for insurers.

Acquisition: Speeding Policy Sales With Effortless Journeys

While for most industries it costs around 5 times as much to attract a new customer than it does to sell to existing ones, insurers typically spend even more with Customer Acquisition Cost (CAC) averaging 7-9 times what’s required to sell to an existing customer.

To reduce these costs and boost insurance sales, engaging prospective customers and guiding them through the policy application process must be swift and effortless no matter how they prefer to inquire and ultimately purchase a policy.

Legacy processes prevent insurance advisors from efficiently guiding customers to the finish line

Customer demand to buy insurance products digitally dramatically accelerated during the Covid-19 pandemic - survey data shows this is how 89% of consumers prefer to purchase insurance.

Yet a recent survey of insurance professionals shows that only 27% are currently completing policy sales digitally via web or mobile channels. Contact centers are still relied on the most to present policies or offers and communicate terms to prospective customers. But current legacy systems depend on customers filling out and signing PDF documents that they typically must fetch from their inbox which are often hard to read and understand - especially on mobile.

The result? More time spent by customers putting in follow-up calls to the contact center, and more time exhausted by insurance professionals repeatedly fielding menial questions.

This also needlessly creates high-effort experiences for customers that require multiple touchpoints, many of which print out forms and sign them manually. Then they must source out machinery like scan or fax machines just to get required documents into the hands of their insurer.

Accelerating Customer Acquisition with Digitization

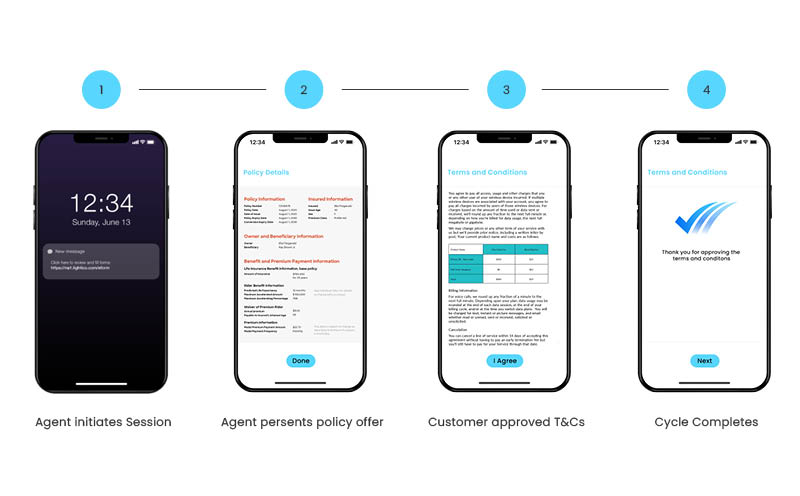

Instead of sending out PDF-based forms and documents to acquire all required data and consents, insurers can use an end-to-end digital platform to accelerate vital acquisition processes, including:

- Distributing offers via campaigns

- Showcasing the benefits of policies

- Signing up new applications

- Gaining binding consent of Terms & Conditions

- Collecting supporting documentation

Advisors can initiate an intuitive and mobile-optimized digital session with the customer that enables them to visually display insurance products and walk them through relevant policies. All steps required to apply for a policy can be streamlined in one workflow. The customer can verify their ID, sign and complete policy applications, and tap approve to consent to terms and conditions. All data needed to bind a policy can be collected within a unified secured channel, simplifying compliance. This streamlines acquisition for insurers, enabling them to boost first-call resolution rates and shorten Time to Sale while delivering the effortless experience needed to convert today’s insurance customers.

This streamlines acquisition for insurers, enabling them to boost first-call resolution rates and shorten Time to Sale while delivering the effortless experience needed to convert today’s insurance customers.

Onboarding: Harmonizing Seamless Self-service with Agent Assistance

Once a customer has signed up for a new insurance policy, insurance agents and brokers work to issue a policy while collecting and last additional documentation and setting up payments. This is also when clearly conveying to value-added services (e.g. tire hazard coverage for auto insurance) to the customer can help lower risk and increase profitability.

The way insurers and brokers consulting with customers today has been impacted tremendously due to coronavirus and widespread fears of transmission. Since the pandemic, 73% of consumers remain concerned about going out to meet their insurance agent or provider in person - stressing the need to provide easy and convenient self-service options. However, research shows that most consumers still prefer to receive agent-assisted help when in need to complete a complex task or process. Without striking the balance between fast and simple digital self-service and agent assistance when they need it, insurers risk costly delays in onboarding new customers and risk having policy sales evaporate due to frustratingly inconvenient experiences.

Pairing Digital Onboarding with Agent Assistance a Win-win for Insurers & Customers

Human interaction is still vital to accelerating insurance onboarding processes while delighting customers. Self-service options and agent assistance do not have to be mutually exclusive: Insurers can benefit from both with Digital Completion capabilities that help agents guide a customer through a digital self-service process from beginning to end.

The agility of pairing that digital convenience with the assistance of an agent to answer any questions a prospective customer has about the terms of a policy and specific requirements needed to complete the policy application can quell any hesitations delaying the transaction.

Instead of sending out forms for additional coverage options, or requiring customers to scan or fax in appraisal documents, insurance professionals can start an interactive session through Interactive Voice Response (IVR), website engagement, or any other self-service link option.

By using automated digital workflows, insurance companies can dynamically build customized onboarding processes. Customers are asked to provide only the information that is needed from them, no more and no less. Automated workflows ensure insurers keep the ball rolling between critical steps in the insurance onboarding cycle, promoting both better compliance and efficiency.

Pairing this seamless mobile session with agent assistance, humanizes the experience and gives customers the guidance and peace of mind to complete onboarding hesitation-free. Agents can help answer any questions the customer has on a live call with the customer views required documents, consents or signatures. This helps the customer complete the process with minimal stress or friction while enabling insurers to efficiently process onboarding requirements, such as:

- Proof of eligibility

- Appraisal documentation

- Value-added services and additional coverage options

- Payment collection

Claims & Servicing: Removing the Friction That Leads to Churn

By its very nature, the relationship between insurers and their customers will touch stressful and often trying life events. Customers rely on their insurance company to manage the implications of their policy throughout the lifecycle so that they have certainty and peace of mind about their coverage and how it supports them and their loved ones.

This trust between insurer and customer is put to the test when a customer needs clear and immediate support to review and process a claim, or make any important changes to their existing policy.

Handling claims and customer service requests efficiently is critical for insurers to avoid delays, gaps in communication, and misunderstandings with customers that can waste time and frustration for both sides, escalate into disputes, and lead customers to seek better experiences elsewhere.

Multiple Touchpoints Prolong Turnaround Times & Kill Customer Trust

Today’s digital and mobile-first consumers expect to complete insurance transactions and resolve claims quickly and effortlessly. But for too many insurers, siloed systems and legacy processes force both customers and the employees that serve them on processes that require multiple touchpoints that make fast and compliant servicing impossible.

In a recent survey of insurance professionals, 63% said they require no less than 3-4 touchpoints in order to process a customer’s claim, while a further 20% need 5 or more different touchpoints to resolve these critical requests.

Research by Gartner shows that an overwhelming 96% of customers become disloyal after having a high-effort interaction — emphasizing that the more effort banks make their customers go through just to do business — the higher the risk that they’ll lose their loyalty to a competitor.

Stitching together siloed systems that are only capable of handling parts of claims and servicing processes - be it ID verification, or collecting signatures, claims forms, and needed evidence or supporting documents - produces multiple tasks and contact cycles, wasting valuable time for both customers and employees at a critical customer moment.

Legacy processes - like email, PDF-based forms, printers, fax, and scanning machines — needlessly add more touchpoints for customers, who may start a process digitally, but soon after resort to calling the contact center to ask questions not understood from a lengthy and cumbersome form or terms and conditions document. They’re then bounced completely offline, printing out forms instead and using outdated machinery just to fax or scan forms and required documents back to their insurance company.

This is why so many claims processes today are frustratingly stressful for customers and time resource-intensive for insurance professionals.

The result of these lengthy and friction-filled experiences? Failed customer service that increases churn, all while exhausting back-end operations and agents and complicating compliance.

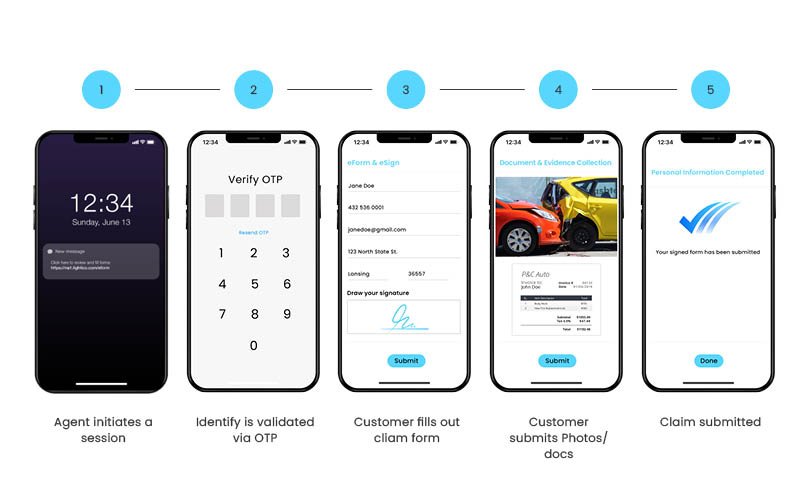

Accelerating Claims & Servicing with Once Compliant Platform

Eliminating the digital silos and legacy processes that leave many insurance providers and brokers stuck dealing with the consequences of complex and friction-filled customer interactions requires a CX evolution.

The good news? Everything a customer needs today to process a claim or turnaround a service request can be accessed and shared with the one device they use the most - their smartphone.

An end-to-end digital insurance platform can easily and swiftly guide customers through every step and requirement needed to open up a new policy or file an FNOL so that agents acquire all of the data and evidence they need to efficiently resolve a claim.

ID verification for the customer is as simple as snapping a selfie from their mobile and taking a picture of their ID which is then swiftly matched up and verified. They can complete customized forms in a secured mobile session. They no longer need to download long PDF documents from their email, fill them out manually and attach evidence or required supporting documents just to get them back to their insurer. Instead, they can easily add all of these documents within the same session, saving significant time for them while giving insurance employees one complete digital audit trail, and all they need to have claims and requests reviewed without delay.  Insurers can leverage digitally complete customer experiences to accelerate all customer service processes, including:

Insurers can leverage digitally complete customer experiences to accelerate all customer service processes, including:

- Claims processing

- Change of address

- Updating eligibility

- Payment collection

- Modify existing policies (e.g. plans, premiums, riders)

- Changing / updating dependants or beneficiaries

Fast and hassle-free customer service experiences not only help insurers accelerate time to settle a claim and boost customer satisfaction, they also unlock immense cost-savings by minimizing significant paper and admin work for employees.

Retention: Making Renewal a No-Brainer for Customers

Data shows that improving customer retention by 5% can increase a company’s profitability by 75%. Of course, successful retention simply won’t work if managed in isolation from the customer’s life cycle leading up to it.

The reliability and efficiency of those experiences are the critical investments that strengthen your relationship with the customer and make them much more receptive to renewing their policy and considering add-ons or upgrades, which can increase profits and lifetime value for insurers.

Capitalizing on these critical opportunities means that any actions required by customers must be quick and simple. But this can go awry if new information that needs to be collected requires too much time and effort from the customer.

Customers often juggle dealing with these scenarios while multitasking or on-the-go — upgrading their current policy can fall through the cracks of their busy lifestyle if it adds the errands of printing out forms and having to scan or fax them back.

This can lead to costly lost opportunities for insurers when it comes to upgrades. It can also jeopardize renewal and their ability to keep customers on board. The days of blind or assumed customer loyalty are well in the rearview mirror. Digital-first customers of today have a myriad of choices, and are more open than ever to buying insurance from new entrants into the market.

Enhancing Retention Through Effortlessly Simple Customer Interactions

For traditional insurers and brokers, the new competitive reality means there’s no more room for digitally incomplete retention strategies. Insurers must focus on capabilities that eliminate high-effort tasks and minimize touchpoints for processes that can be completed digitally.

Giving their customers the convenience of consenting to new or additional types of insurance coverage, providing any required documents or records, and setting up payments directly from their mobile device cuts out the delays and frustrations that can frustrate customers considering renewals or upgrades.

With all capabilities needed to compliantly acquire customer documents and data, and securely set up payments, insurers can leverage an integrated digital completion solution to share upgrades and add-ons in a real-time mobile session, enabling customers to understand the value proposition, provide consent and close the deal without delay.

Insurers and brokers today are using digital completion technology to accelerate key retention processes such as:

- Renewals

- Upgrades and add-ons to policies

- Payment collection

- Collect documentation

Eliminating customer experience gaps improves retention and customer loyalty for insurers and brokers, enabling them to increase customer lifetime value.

Conclusion:

Enhancing Customer Relationships Through Digitally Complete Insurance Journeys

Each and every stage throughout the insurer-customer lifecycle presents critical opportunities and risks that determine their decision to deepen their loyalty or seek a more convenient insurance alternative.

With digital and mobile interactions now the standard expected by customers, the time is now for insurers and brokers to future-proof those interactions with their customers and deliver the seamless experiences that accelerate their ability to complete policy sales, onboard new customers, eliminate friction from claims, and enhance retention.

Emerging Digital Completion technology has enabled insurers to complete all customer-facing steps, such as eSignatures and eforms, ID verification, document collection, and digital consent on terms and conditions.

Digitizing entire insurance journeys from start to finish enables insurers to finally leave behind the limits of siloed systems and manual processes that bog down both their back-office operations with costly and time-intensive maintenance and customer-facing employees with paperwork.

Instead of experiences that exhaust time and resources from staff across contact centers and branch offices, necessitate admin and paperwork, and complicate compliance, one unified digital session guides customers in completing everything that’s required to turn around their request, and can be combined in-tandem with live agent assistance to support customers in real time.

This eliminates the pain and friction of frustratingly long and complex experiences for insurance customers, while giving providers the ability to complete processes with speed and convenience — translating to a major competitive differentiator.

Insurers and brokers currently delivering digitally complete insurance process are:

- Slashing Time to Settle a Claim by 85%

- Reducing Touchpoints per Policy by 60%

- Increasing customer satisfaction and NPS by 15 points

With seamless and compliant digital insurance journeys, insurers can build strong and profitable long-term relationships with their customers, from their first conversation with an adviser or broker and getting them onboard, supporting them seamlessly when they need to make a claim or change to their policy, and making them feel valued when it’s time to renew.

Learn How Lightico Can Accelerate Insurance Processes Throughout Your Customer Lifecycle

Experience the Interactive Video