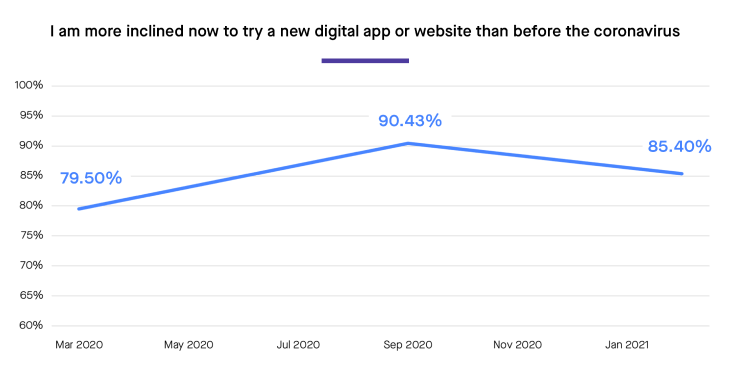

Digital Adoption and Willingness Are Sky-High

The coronavirus is no longer the mystery it was at the beginning of the outbreak, and we understand more about how to take precautions. Crucially, the vaccine campaign is starting to pick up pace.

Yet despite the light at the end of the tunnel, consumers are somewhat more likely to prefer digital, remote transactions now than they were when the outbreak was still fresh. 85% of consumers are willing to try a new digital app or website—an increase from 79.5% in March 2020.

And this number (85%) represents only a small drop from the month when digital willingness was at its highest, in September 2020.

This makes sense given that consumers have had nearly a year to get comfortable with remote interactions throughout the pandemic. We have also seen an influx in digital adoption from non-digital natives, such as senior citizens, who started to rely on digital channels to safeguard their health during the past year. Online and mobile banking no longer seem so intimidating; many now come to see digital channels as an essential convenience.

As of February 2021, 85% of consumers are willing to try a new digital app or website.

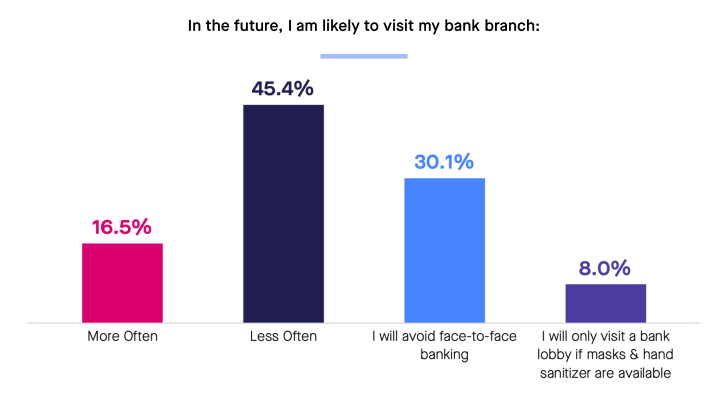

Most Consumers Plan to Visit Their Branch Less

When asked about future plans, and not just current behavior, similar trends emerged. A plurality (45.5%) of bank customers plan to visit their branch less often in the future, and a sizable number (30%) will avoid face-to-face banking altogether. This is presumably less connected to fears of virus transmission, and more connected to issues of comfort and convenience. The pandemic won’t be around forever, consumers know this; the numbers here reflect this reality.

At the same time, a small but notable group of respondents plan to visit their branch more often in the future (16.5%). Therefore branch presence still matters, though bank executives may want to consider merging banks that already get less foot traffic.

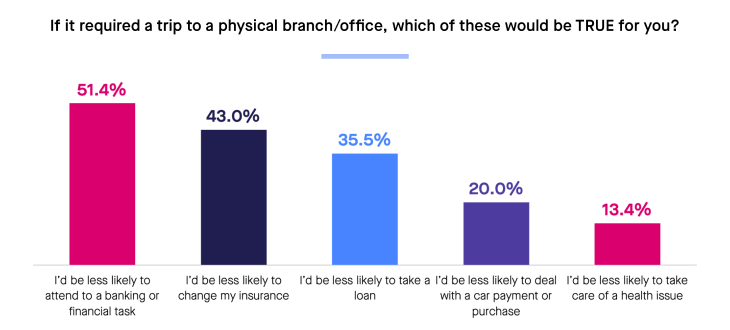

Mandatory Face-to-Face = Lost Business

Banks would do well to maintain many of their existing branches to serve all their customers. But the survey suggests that making branch visits mandatory (rather than an option) could backfire. A majority of respondents (51%) say they would be less likely to attend to a banking or financial task if it required in-person presence. And 35.5% would be less likely to take a loan. While a sizable minority of consumers prefer in-person making, most do not — and most would postpone or fail to tend to financial matters if it required them to show up at the branch.

51% say they would be less likely to attend a banking or financial task if it required in-person presence.

The Future is Digital

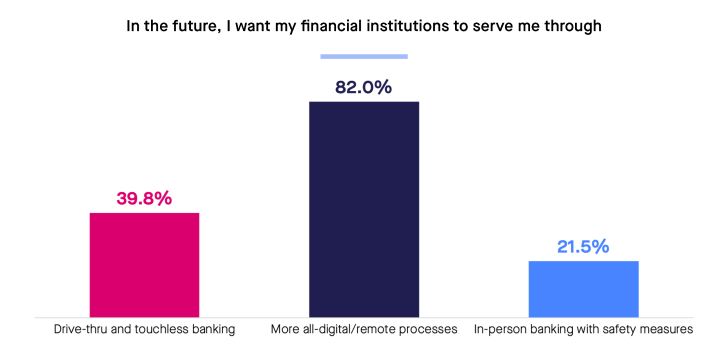

More than anything else, consumers overwhelmingly want to be served through digital channels (82%). This means that offering robust, complete, and consistent digital services on the bank’s website and app is key. Digital offerings should no longer be a supplement to the bank branch; rather, digital service should be the default, and just as comprehensive as in-person interactions.

82% of consumers want their financial institution to serve them through more digital/remote processes.

Digital-First Banks Win Consumer Loyalty and New Customers

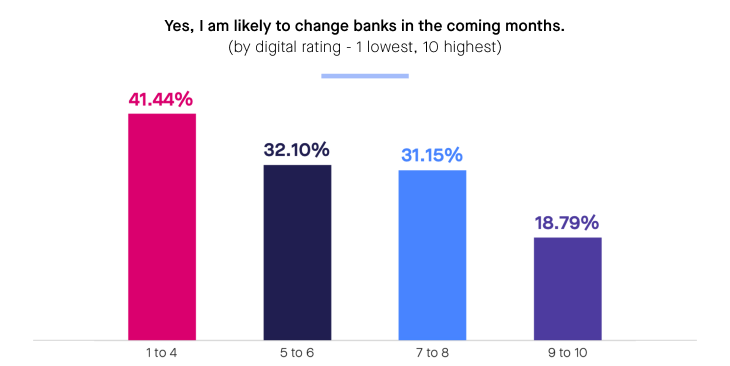

Banks that fully cater to their consumers’ digital needs are rewarded. Banks that consumers rate as the most digital (scores 9 to 10) also have the most loyal customers, with only 19% saying they are likely to switch banks. In contrast, a whopping 41% of customers at the least digital banks (scores 1 to 4) plan on changing banks.

By expanding digital services, banks can significantly and directly prevent customer churn.

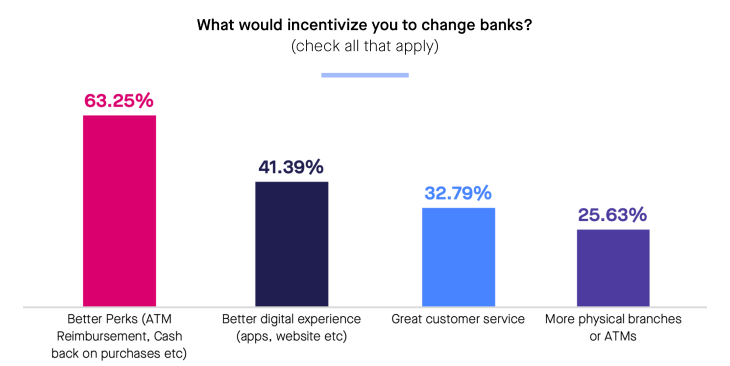

Digital banking doesn’t just lead to more loyal existing customers; it attracts new customers. 41% of banking consumers say that a better digital experience, including a better app and website, would incentivize them to switch banks. The promise of effortless and intuitive remote banking is a powerful thing.

By expanding digital services, banks can significantly and directly prevent customer churn.

Opportunities For 2021: Put Customers First With Greater Automation and Digitization

Full-service digital offerings isn’t just a stop-gap until the pandemic fades away — it’s here to stay. While banks shouldn’t be rushing to close down branches, the survey points to a powerful and undeniable surge in consumers’ digital banking preferences.

Having a website or app is no longer enough; consumers want to be able to accomplish everything from those digital channels. A smooth digital journey, with no redirects to in-branch banking, is key to maintaining consumer loyalty and winning over new customers.

By accommodating growing preferences for digital processes, banks can ensure they are among the leaders, setting the bar for everyone else rather than scrambling to catch up. This is indeed a powerful position to be in.

Feel the Power of

Streamlined Digital Banking