Part 1:

Companies Have a Completion Problem

Many of today’s companies invest everything possible in creating a stellar customer experience. From glossy advertising to customer-obsessed employees to a massive social media presence, the best brands are pouring time and money into reeling in new customers. But at the moment of truth — when a customer is about to make a purchase, or needs to receive service — the companies tend to slow down. Customers find themselves bounced between agents, touchpoints, and channels, and are lost.

To be sure, in the digital age, much of the customer journey is happening independently. By making it easier to navigate a webpage or app, and by enabling the customer to interact with a brand via chat and social means of communication, businesses have improved customer journeys significantly.

However, research shows that most consumers still prefer to receive agent-assisted help when in need to complete a complex task or process. This last leg of the journey is often long, painful and full of friction. In many cases, these bumps in the last mile lead to a failure to complete the sales or servicing cycle. Customers attempt to finalize their interaction, but their efforts are thwarted.

We have identified two of the primary reasons why companies fail to bring interactions to completion: The prevalence of silos and legacy channels.

Silos

Businesses today usually employ technology to enable digital interaction. Yet many of these technological tools end up creating more silos because they fail to connect the dots of the customer journey. For example, a bank may allow customers to begin the account opening process online, but redirect them to a physical branch when it comes time to sign. Or an insurance company may allow customers to read about various insurance products online, but they have to pick up a phone to make the purchase.

In such cases, digital processes are not integrated and lack cohesiveness. Therefore customers are bounced from one channel to another, leading to frustration. It’s also common to see things like customers being able to fill out some forms electronically, but the forms don’t remember information that was supplied at another stage of the process.

These choppy digital journeys, characterized by too many touchpoints and lack of continuity, are due to the fact that companies tend to adopt digital tools as point solutions.

Many customers who encounter siloed processes or too many touchpoints during their journey will simply give up. As a result, businesses incur huge costs and miss out on opportunities that were almost in the bag.

Legacy Channels

eSignatures and eForms were once inseparable from PDFs sent via email. These forms of digital customer interaction hearken back to the early 2000s, when they gained prevalence and legal recognition.

Today we have smartphones, which allow consumers to get things done from any location. From ordering goods to trading stocks, consumers today are accustomed to taking care of practically any matter from their miniature handheld computer.

With smartphones enabling customers to carry out an ever-expanding range of activity, it’s little surprise that from 2012 to 2018, the total average time people spent on their mobile increased from 88 to 203 minutes per day.

These habits would seem to naturally carry over to how consumers prefer to fill out forms and sign: through their phones. Yet when consumers attempt to fill out information and sign via PDF on their mobile phone, they encounter friction. Many existing software solutions on the market require mobile users to open their email, download the pdf, and complete and sign their documents in A4 or Letter size on small screens. The forms aren’t optimized for mobile. And some formats require users to download a particular app in order to digitally fill out the form.

Legacy channels and formats such as email and PDF contribute to excess time to completion, or failure to complete the transaction at all. A study of over 1,000 Americans surveyed respondents who didn’t complete a contract that required an eSignature. The results show that 27% lost or forgot about it, and 35% said it wasn’t mobile- or user-friendly enough. The digital and non-digital channels of decades past aren’t equipped to promote completion for today’s on-the-go, mobile-first customers.

Notably, some of the legacy eSignature solutions have tried to integrate PDF with additional customer-facing capabilities, but this hasn’t yielded the desired results. The experience is still centered around the PDF and therefore difficult to streamline, automate, and

make intuitive.

Part 2:

The Limitations of Current Systems

Why They’re Still Not Promoting Completion

The pervasiveness of silos and legacy channels has led to the rise of friction-filled — and therefore incomplete — customer interactions. A number of different types of systems have been introduced to update businesses’ processes, but none have so far successfully tackled the issue of incomplete customer journeys.

Here are a couple of the systems that have been introduced to improve business processes. While all of them serve important purposes, none of them actively aid digital customer completion.

eSignature Solutions

Standalone eSignature solutions are unable to handle the end-to-end customer journey, just one aspect of it. As described in the previous section, they are typically centered around PDF and email.

Examples: Adobe Sign, HelloSign

Agreement-centric Solutions

Agreement-centric Solutions

Designed specifically for managing contracts between businesses. Agreement types include contracts, offer letters, and the many other types of written agreements used across nearly every business function.

Example: Docusign

B2B-centric Solutions

B2B-centric Solutions

Often rely on PDF or a mobile app that must be downloaded; not conducive to instant completion like DCC. Centered around Contract Lifecycle Management, which helps streamline the contract preparation process and is more relevant to B2B than B2C transactions.

Examples: The vast majority of eSignature and agreement-centric solutions

Business Process Management (BPM) Solutions

Business Process Management (BPM) Solutions

Focused on automating Focused on automating any and all aspects of the business, but especially operational processes.

Examples: Nintex Process Platform, Pipefy, Kissflow

Robotic Process Automation (RPA) Solutions

Robotic Process Automation (RPA) Solutions

Focused on automating individual backend tasks, not a unified customer frontend.

Examples: Automation Anywhere, UiPath RPA

Experience Management Solutions

Experience Management Solutions

Focused on getting actionable insights about the customer experience (via surveys or analytics), but doesn’t improve the experience itself.

Examples: Qualtrics, Birdeye, Medallia

All of these categories and solutions serve important purposes: improving the efficiency of backend employees’ work, digitizing one aspect of the customer experience, or gauging customer satisfaction. But no matter how well-oiled a backend is, how great a single customer- facing tool is, or how well a business understands the customer, if a business isn’t closing deals and resolving issues, those worthy efforts are for naught.

In fact, companies that only employ the types of systems described above often find themselves at a loss: They are investing so much in digital, but aren’t getting the kinds of bottom-line results they want.

Part 3:

Principles of Digital Completion

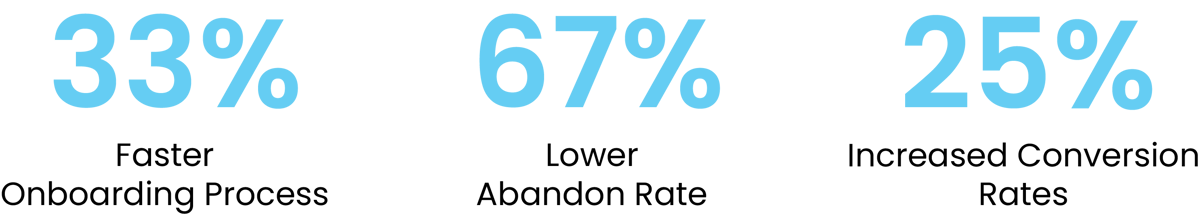

In today’s competitive and fast-paced business environment, it’s no longer enough to improve back-office operations, as RPA does. Nor is it enough to simply digitize single aspects of customers’ journeys, which eSignatures do. Businesses need a smooth and coherent flow straight to the end. Just like a dropped ball at the end zone negates any of the wins beforehand, a great customer experience doesn’t matter if businesses botch the final transaction. Getting to completion, whether it’s finishing onboarding, resolving a servicing issue, or closing a deal purchase, is where businesses need to now direct their efforts.

This is where the Digital Completion Cloud steps in and takes over.

Digital Completion Defined

Digital Completion is the science of intelligently and easily completing entire processes without the need for undue human involvement. This requires moving from a narrow, siloed view of features towards an end-to-end view of processes and leveraging intelligent automation, digitalization, and integrations.

The Digital Completion Cloud is:

Truly Real-Time

Truly Real-Time

The Digital Completion Cloud is unique in the market, allowing enterprises to share all related tasks in real-time with customers and receive immediate responses. All interactions take place in the Lightico Completion Zone, a live digital session between the business and the customer. Thanks to sound backend technology, the system responds in a split second.

![ecovered]-04](https://info.lightico.com/hs-fs/hubfs/ecovered%5D-04.png?width=73&name=ecovered%5D-04.png) All In One Place

All In One Place

The Digital Completion Cloud allows enterprises to consolidate all their customer-facing tasks into a single interactive experience, giving them the privilege to choose between the primary vendor’s micro apps and third-party integrated apps. Some examples include eForms, eSignature, ID verification, OCR extraction, payments, document collection, and more.

Intelligent and Automated

Intelligent and Automated

Manually selecting the relevant customer tasks or relying on code-heavy solutions creates high compliance risk. With no-code workflow automation, any business user can design flows that automate the journey and tailor it per customer — all in real-time based on API or manual data input.

Fully Integrated

Fully Integrated

With rich REST API and pre-built integrations, any enterprise can get started with the Digital Completion Cloud in weeks and get value from the platform immediately.

Part 4:

Core Capabilities of the Digital Completion Cloud

The Digital Completion Cloud allows banks to:

Unify the frontend experience for customers, allowing them to complete entire journeys (which piecemeal functionality isn’t equipped to do).

Streamline data-collecting tools into a single channel.

![ered]-05](https://info.lightico.com/hs-fs/hubfs/ered%5D-05.png?width=100&name=ered%5D-05.png) Automate workflows that tie all the customer-facing capabilities together.

Automate workflows that tie all the customer-facing capabilities together.

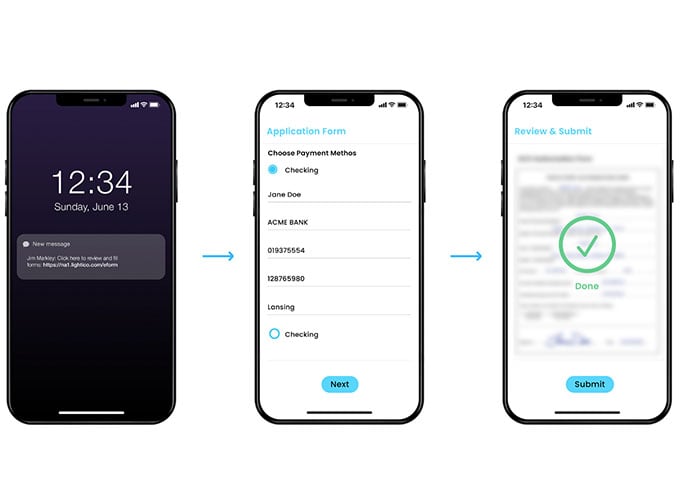

We have identified six core capabilities that allow businesses to bring customer journeys to completion faster.

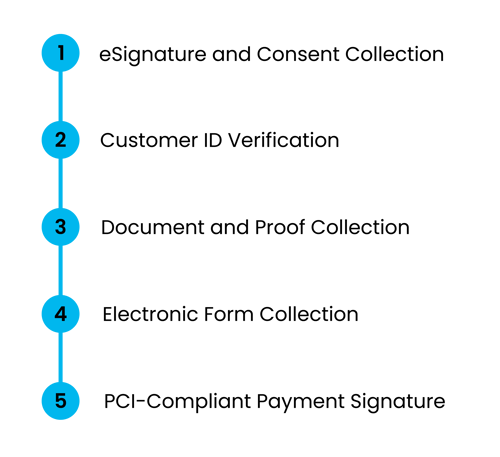

Capability 1:

eSignature and Consent Collection

eSignatures are an integral part of a completion-focused workflow in that they legally prove customer consent. But PDF-based eSignature solutions, or those that require users to download special software or an app, often prolong rather than accelerate time to completion.

The Digital Completion Cloud eSignature is built for busy, on-the-go customers. It requires no extra software from the customer — just the smartphone in their hand. An admin enters into a console with a drag-and-drop interface, configuring business rules to trigger requests for eSignatures. For example, customers may be required to add their eSignature to some digital documents, but not others. Admins can set up relevant rules based on conditional logic (“if”/”then”).

Not only is it easy for customers to sign from any digital channel, from any location, it’s easy for agents to receive them in the moment, when they are instantly stored for future reference. There is zero lag time between any of these steps, allowing eSignatures to be a seamless part of the customer journey.

Capability 2:

Customer ID Verification

Growing KYC requirements and the rise of digital customer interactions have made it more important than ever to remotely and accurately verify customers’ identities.

Typically, authenticating ID requires comparing an ID card and other official documents to external databases. But the problem with many traditional and commonly used identity verification methods is that they can be easy for fraudsters to manipulate, and burdensome for customers and employees.

With automatic identity verification capabilities, companies can protect their customers and their organization from fraud and compliance breaches by enabling a frictionless KYC experience and customer authentication without slowing sales and service cycles.

The customer is requested to take a smartphone picture of the front and back of the photo ID, and take a selfie photo. Both are sent back to the company’s employee, also via smartphone.

Using image processing and smart algorithms, the system authenticates the identity document.

Unstructured data placed on the document such as first name, last name, address, date of birth, document expiration date, and document ID is extracted using the Optical Character Recognition algorithm (OCR). The extracted data can be inserted directly into a document, reducing errors and time to completion, and promoting a streamlined customer journey.

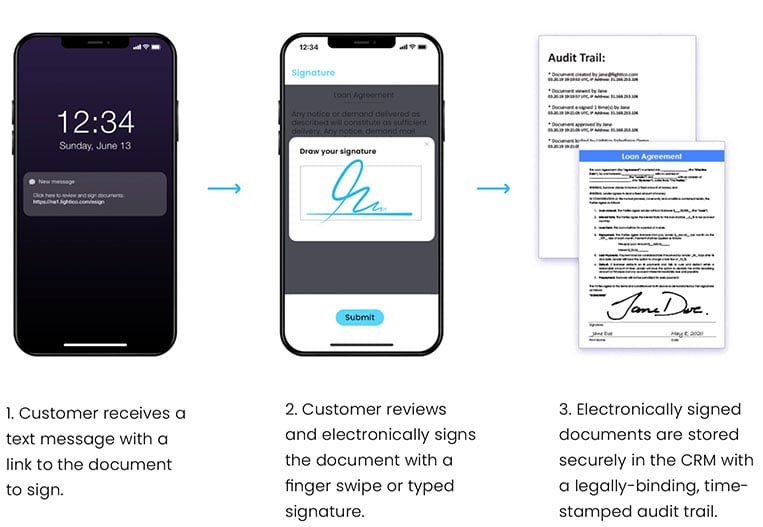

Capability 3:

Document and Proof Collection

Collecting documents such as a driver’s license, proof of income, invoices, and utility bills are often a requirement for customer servicing in regulated industries. However, current processes prolong time to completion as customers are required to scan, email, fax, and sometimes even make in-person visits to submit these documents.

The Digital Completion Cloud empowers today’s impatient customers to submit documents and stipulations more efficiently. Customers can use their smartphone cameras to instantly snap and submit pictures of their documents to the agent for review and secure storage.

Capability 4:

Intelligent Document Processing with AI ( IDP)

DP accurately identifies and interprets textual content within documents, transforming unstructured data into structured, machine-readable formats. This automated extraction process not only expedites the input of applicant information into data systems but also significantly reduces the burden of manual data entry or 'human-in-the-loop' validation for underwriting analysts and other loan processing personnel.

Discover the Transformative Power Lightico AI-Powered IDP

Refined Document Classification: Lightico's AI adeptly categorizes incoming documents, from pay stubs to utility bills and W2s, simplifying document management. This organizational strength expedites identification and retrieval of essential paperwork during loan processing.

Efficient Data Extraction and Association: Seamlessly extracting pivotal borrower information such as names, salary details, and addresses, Lightico meticulously associates them with relevant attributes within documents. This streamlines data extraction crucial for contract generation and assessment, enhancing accuracy and expediting processes.

Seamless Interaction via Natural Language: Lightico’s natural language interface empowers loan officers with effortless document interaction. This intuitive feature enables swift retrieval of pertinent borrower details, augmenting the pace of decision-making.

Q&A Data Query Capabilities: Interact with your documents through a natural language interface, making it effortless to find and retrieve the information you need. Common Questions can be pre-configured, or manually entered.

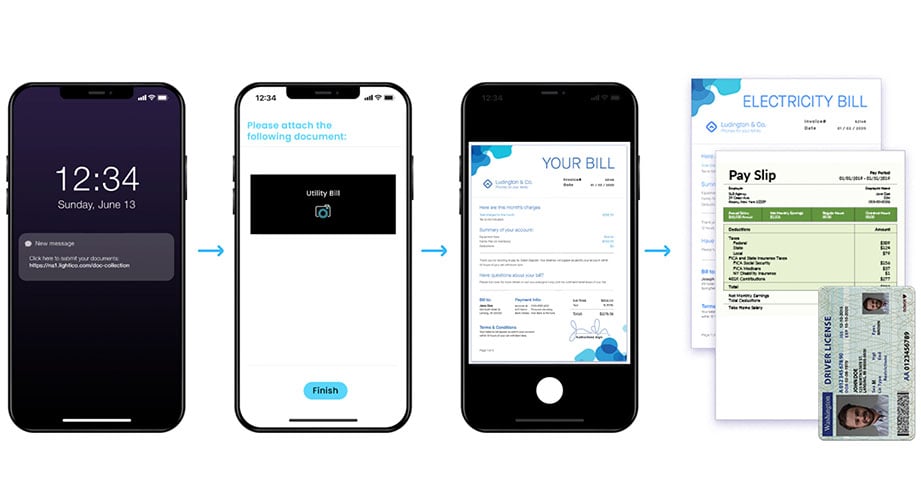

Capability 5:

Electronic Form Collection

Electronic forms make it easier for customers to reach completion, faster. They are optimized for whatever channel the customer is currently using, including smartphones.

User-friendly digital forms provide customers with an intuitive interface so they can complete all the required information correctly the first time, eliminating rework and chasing. Digital forms simplify the paperwork that often slows processes and frustrates customers and employees.

The Digital Completion Cloud includes conditional logic capabilities that can be added to smart forms and reveal to customers only the fields that pertain to their unique characteristics. This allows customers to breeze through forms that populate with fields based on their previous responses. Forms get completed faster and with higher accuracy.

Capability 6:

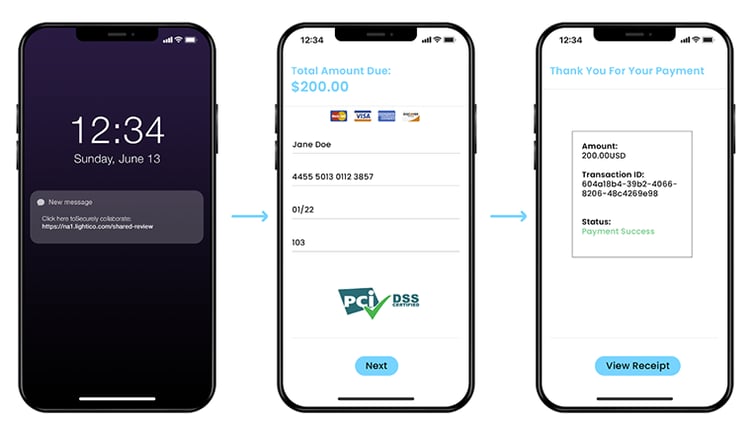

PCI-Compliant Payment Collection

If eSignatures are the last and final stop of the approval process, payments signify the completion of the entire customer journey (at least for sales).

Digital payments from a smartphone or other digital channel make the process instant, convenient, and fully PCI-compliant. Given that fraud attempts constantly become more sophisticated, it is more critical than ever to implement secure ways to process customer payments — without sacrificing speed or ease.

With the Digital Completion Cloud, call center agents can receive payments from customers in real-time. Agents simply Input the required amount, select the currency, and send a digital request. The customer receives a text message to complete payment immediately, all without exposing payment information to the agent. The payment is processed securely with a fully compliant audit trail, transaction ID, and receipt.

Instant, PCI-compliant payments allow businesses to reach completion more efficiently, without sacrificing compliance. They represent a very promising alternative to start/stop software and other clunky payment compliance mechanisms.

Part 5:

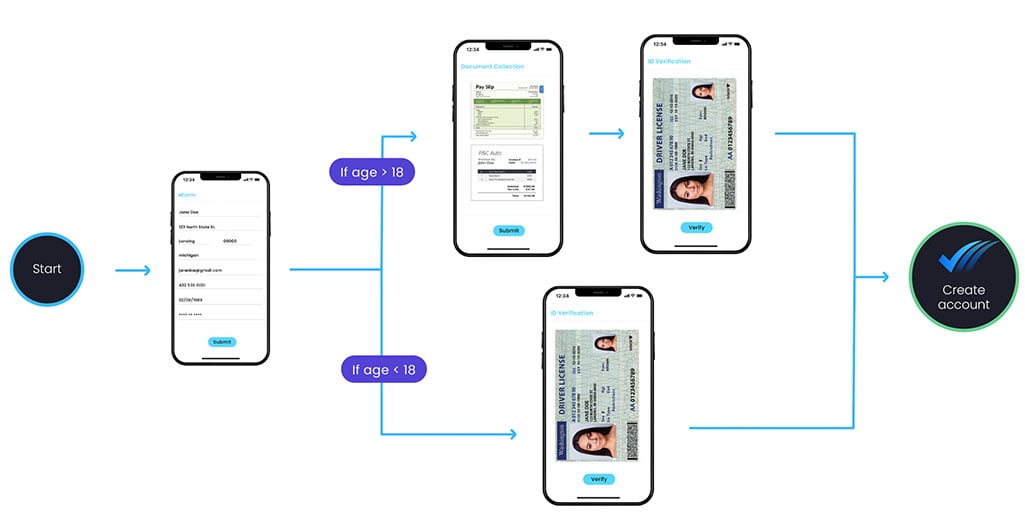

Core Capabilities as Part of Automated Workflows

Workflow automation enables businesses to automate requests to customers based on information provided in smart forms. These digital forms are based on conditional logic; this means that project managers can set up rules that only reveal fields that pertain to their particular characteristics. For example, a customer filling out an insurance enrollment form may be asked to provide additional details only if he or she has a preexisting condition.

Such forms improve turnaround time, reduce the likelihood of error, and improve the form-filling experience.

But workflow automation takes the principles of conditional logic and applies it to the entire process. Depending on the customers’ characteristics, the solution triggers or blocks requests for additional actions or documents.

Project managers can set up their own business rules and make adjustments on the fly, without developer or IT involvement. In today’s constantly changing business and regulatory environment, such self-service is a must.

What Executives Are Saying

“Since implementing Lightico’s solution, we’ve been able to accelerate funding turnaround time thanks to automated workflows.”

DennisMorris, COO

“We chose Lightico over DocuSign because of better technology and mobile experience and without reliance on an app.”

Chris Bailey, SVP & CTO

“Lightico has made an incredible impact on our operations, bottom line and customers.”

Brian Renfro, CMO, SVP Collections

“We’ve cut turnaround times of consent form completion down to 8 minutes thanks to the speed and ease of Lightico’s form and signature collection.”

Vincent Atalese, Manager of Operations

"Lightico has really changed the game for us in being able to make it more convenient for our customers. We can now collect multiple signatures on new account applications in under two hours — often within 45 minutes — and 90% are fully complete.”

Stacie Smith, Vice President

Conclusion

Despite herculean efforts to adopt new efficiency-promoting technology, businesses today continue to struggle to reach closure. This is often due to a one-sided focus on improving backend systems, or adopting one-off, piecemeal technologies such as RPA or eSignatures.

This is no longer tenable given how radically consumers’ expectations have shifted in a digital direction. It is no longer enough to optimize individual aspects of the customer transaction — the entire journey must be built with fast completion in mind.

Here at Lightico, we created the Lightico Digital Completion Cloud™ — an end-to-end frontend platform, with deep integrations to back office systems through a robust set of APIs, that ensures customers spanning different industries reach completion, faster. It was designed from the ground up to incorporate all the digital tools into one seamless automated workflow, from sending documents to eSigning and making payments. All this takes place in the Lightico Completion Zone™, a live digital session between the business and the customer.

The Digital Completion Cloud is as lightweight as the clouds in the sky, requiring minimal IT effort. And yet as soon as it’s plugged in, it rains its magic on customers, who experience lightening-fast, friction-free transactions.

Best of all, it’s future-proof, as companies can update the workflows in response to changing customer needs, business conditions, and regulatory requirements.

Learn how Lightico

can streamline your processes.