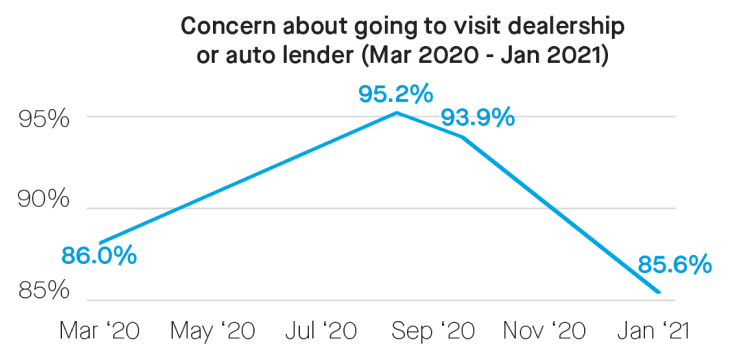

People Are Still Fearful of Going to a Dealer or Lender

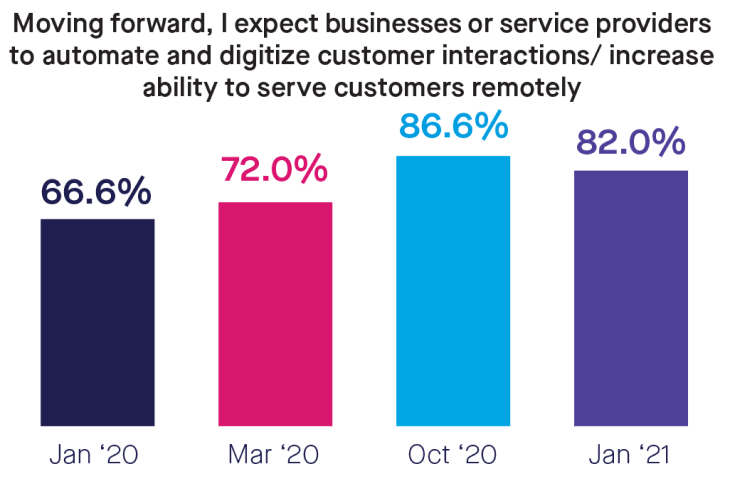

While many people have felt “pandemic fatigue”, which is characterized by people becoming complacent about coronavirus restrictions due to burnout, the data says different.

86% of consumers are still concerned about visiting a dealership or auto lender

The survey results show that fears surrounding virus transmission are still alive and well. This is understandable given that most of the U.S. (and the world) had yet to be vaccinated against the virus, and new mutations threaten to undermine efforts to bring the pandemic to an end.

.png?width=730&name=image%2017%20(1).png)

As a result, the vast majority of consumers (86%) remain concerned about going out to visit a dealership or auto lender. The proportion who said they were concerned about virus transmission at a dealership or auto lender only slightly declined since October 2020 (93%).

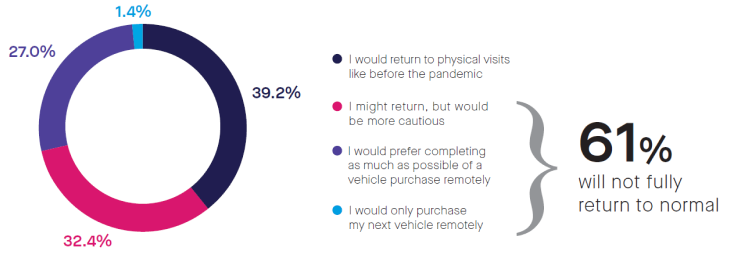

Pandemic Continues to Impact Car Purchasing Habits

As we’ve seen, consumers are very reluctant to leave home to deal with the financing side of a new car purchase. But does this hesitance about face-to-face financing carry over to the purchase of the vehicle itself?

According to the survey, it would appear so, albeit to a lesser extent. While a plurality of consumers (39%) say that wider vaccine availability will make them want to “return to physical visits like before the pandemic,” a sizable proportion (27%) “would prefer completing as much as possible of a vehicle purchase remotely.”

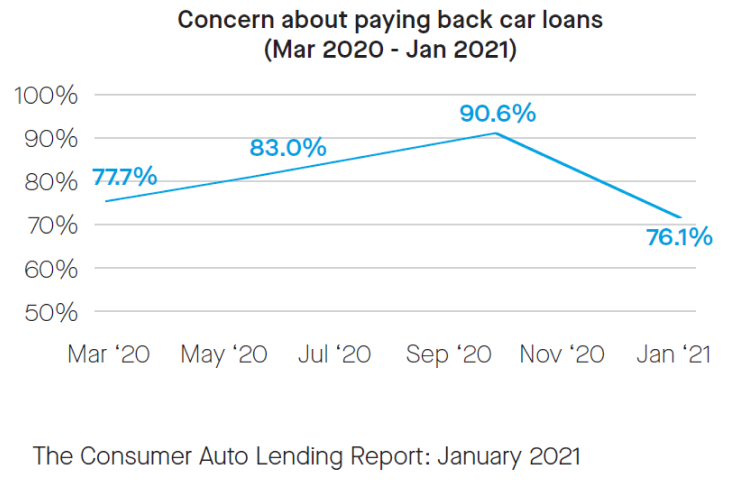

Consumers Are Still Concerned About Their Finances

Fear of catching the coronavirus isn’t the only thing that has consumers up at night.

A major period of employment uncertainty, and in many cases furloughs or job losses, has taken its toll. At the time of this writing, more than 10 million Americans are unemployed, 14 million renters are behind on payments, and 29 million adults – and at least 8 million children – are struggling with food insecurity.

Given the struggle of many Americans to have their basic needs met, it’s little surprise that a large proportion also struggles to stay on top of their car loans. In fact, 76% of borrowers are concerned about their ability to pay back their car loan over the coming months.

While this proportion has declined from its peak of 91% back in October 2020, it still indicates that Americans are far from relaxed about their financial situation.

In fact, 55% of borrowers have already or are looking to change the terms of their car loan.

In this reality, auto lenders may want to consider proactively lowering interest rates or even allowing temporary deferments on the condition that customers will sign up for automatic payments, otherwise known as ACH. With car payments deducted automatically each month, there is a reduced likelihood of borrowers defaulting.

37% of consumers would be won over with the promise of "completing the process in a few clicks online"

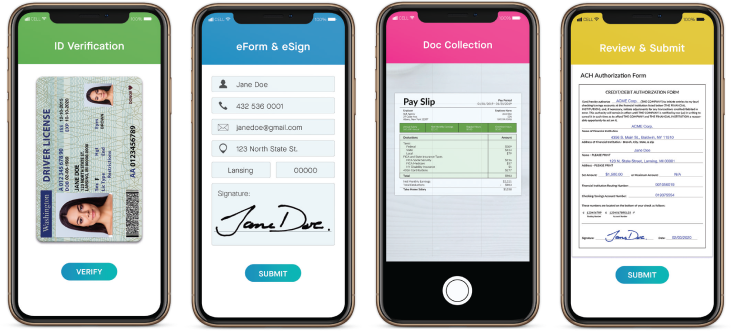

But are borrowers open to signing up for ACH? The answer is yes, and they don’t always need a financial incentive to do so. While discounts can help, a sizable proportion of respondents would be inclined to sign up for ACH if the process was simply easier. In fact, “completing the process in a few clicks online” would win over 37% of borrowers. And nearly 17% would be persuaded by an auto lender walking them through the process. In other words, a more streamlined and intuitive process makes a tremendous difference, especially if they are given an incentive to do so.

Auto Loan Processes Are Still Not Digital Enough

Given this uptick in loan servicing demands, lenders need a way to process loan modification requests faster and more efficiently. Unfortunately, the survey shows that car loan servicing is still not digital enough. While many lenders have made great strides in digitizing loan originations, the servicing side of the equation has largely been neglected. Only 28% of borrowers were able to change their loan terms online (up from 20% in October 2020 — an improvement but most customers remain without digital options).

.png?width=730&name=callout%20(2).png)

Digitization can make a tremendous difference on the servicing side of the business, allowing lenders to modify more loans in less time, without the need to hire additional personnel. With digitized loan request forms and document collection, lenders can streamline their servicing processes and keep operational costs down.

And digitization is absolutely critical for customers who are originating loans. A dramatic 85% of borrowers believe they should be able to complete auto lending processes fully online. A seamless digital option increases the probability of borrowers completing the pre-approval and stip submission process.

Fully remote auto loan originations tick two boxes for customers: the health factor and the convenience factor. Consumers face enough daily stressors these days, and a seamless online experience can make or break the loan application’s success rate.

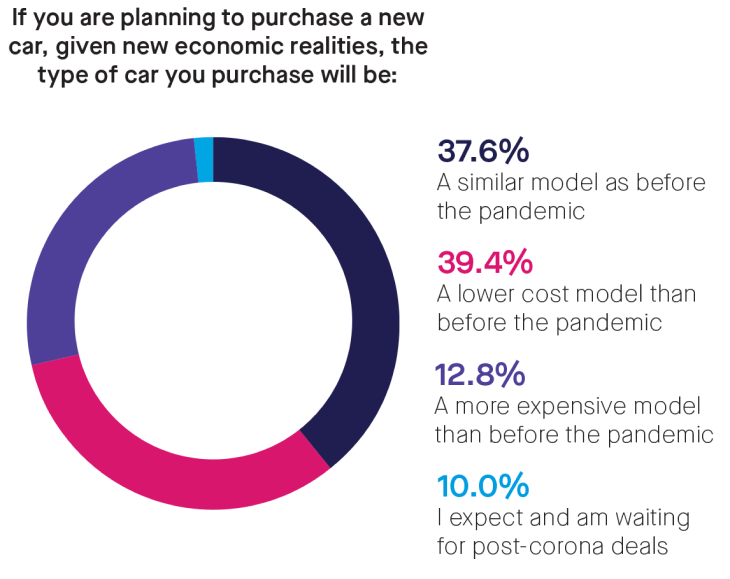

Consumers are Carefully Weighing New Car Purchases

As a result of this increased financial strain, 57% of prospective car buyers are reconsidering a car purchase they had planned to make in the coming months. While this number is also down from its peak of 70% in October 2020, it is still significant.

.png?width=730&name=callout%20(1).png)

In addition, the survey found that those consumers who are going through with their car purchase are buying cheaper cars. In light of the current economic realities, a plurality of consumers (39%) will be buying a lowercost model than they would have prior to the pandemic. If the average car price is lower, it stands to reason that auto lenders will be profiting slightly less.

The implication here is that auto lenders must maximize the opportunities that do come in by making it as easy and quick as possible to get preapproved for a car loan — and secure financing for those qualified applicants. The last thing lenders need right now is for potential borrowers to avoid their application or drop off from the process halfway through due to friction.

The survey confirms that expanded digitization would lead to more originations, even if people are overall buying fewer and cheaper cars. An astounding 85% of consumers would be more likely to purchase a vehicle in the next few months if they could complete the process online. Only 10% would be unswayed by better digitization.

Opportunities for 2021: Put Customers First With Greater Automation and Digitization

If the coronavirus pandemic holds any lesson for auto lenders, it’s that they need to proactively win customers over. Flashy marketing campaigns and strong dealer relationships are helpful, but they are not everything.

Today’s borrower is more risk-averse, financially strapped, and remote than ever. There are two significant layers that will continue to impede originations in 2021. The first is a tightened wallet; consumers are reluctant to take on new financial obligations during times of economic uncertainty. And the second is fear of virus transmission; consumers are reluctant to go to physical locations to get financing.

Convincing today’s borrowers to take out auto financing means lenders need to meet them where they are: online. A combination of online prequalification calculators, intuitive digital loan application forms, and automated ACH forms and document collection are a couple of ways successful auto lenders have adapted to these challenging times.

By catering to consumer preferences for digital processes, the automotive industry can attract and close more opportunities, and service existing customers with greater efficiency and speed.

Feel the power of a fully-digital auto loan solution

Experience the Interactive Demo