Introduction: What Digital Priorities Top the Wishlist for Banks & Credit Unions?

With today’s digital-first consumers more comfortable than ever buying banking products from emerging neobanks and fintech services, traditional financial institutions face unprecedented competition to earn new customers and grow lifetime value.

But to accomplish this, decision-makers need to reassess their current digital customer experiences and fulfill their wishlist to ensure banking customers and credit union members are receiving fast, seamless and convenient ways to interact and transact. This means quick and easy onboarding, loan origination and servicing - all from the device they’re with 24/7 - their smartphone.

Allowing customers to complete the majority of day-to-day banking via self-service options is also critical for banks to slash administrative burden and overhead to their workforce both at the call center and branch, improve efficiency, and cut costs.

Meeting these needs requires banks to audit the gaps that are currently preventing completely digital customer journeys, slowing down onboarding and loan processing, and producing the friction that leads frustrated customers to abandon.

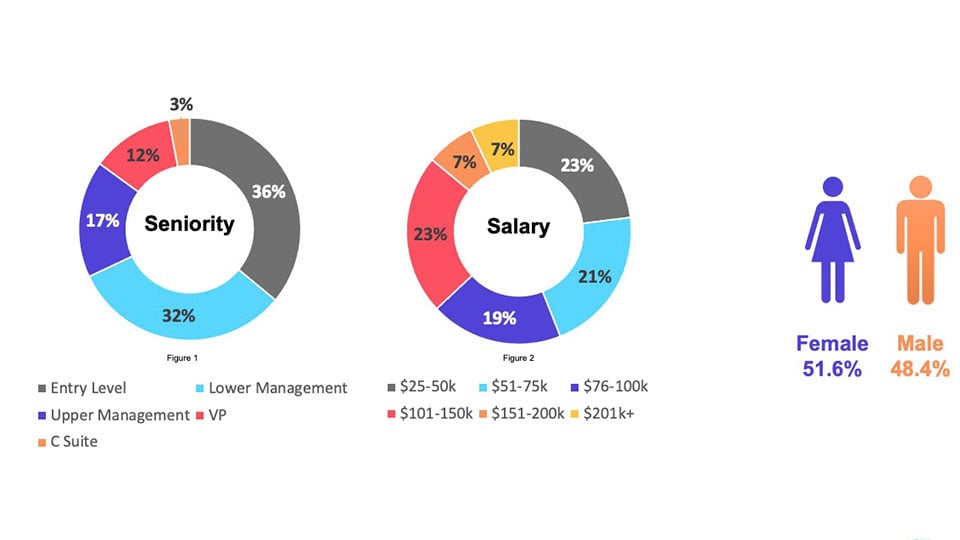

What do banks and credit unions need most to deliver on present and future customer needs? To uncover the answers, Lightico surveyed 151 professionals across banks and credit unions in the United States on the current state of their digital and mobile banking strategies, and the approaches they feel are most vital to accelerate time to funding and enhance customer satisfaction.

About the Survey

Professional data comes from a survey of 151 financial professionals in the United States conducted on October 27, 2021. The survey was done through an online panel and has a margin error of 6% with a confidence level of 95%.

Customer Experience & Mobile the Top Investment Priorities for Bankers

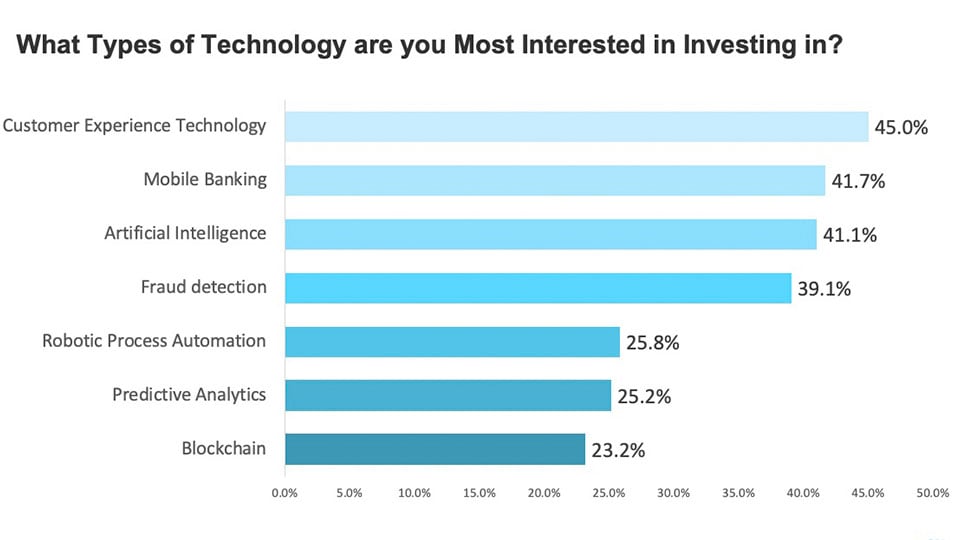

We asked professionals from banks and credit unions across the country about which areas are most top of mind to positively impact their business results.

A leading 45% of professionals selected customer experience technology as the top investment priority. 41.7% cited mobile banking, closely followed by Artificial Intelligence at 41.1%.

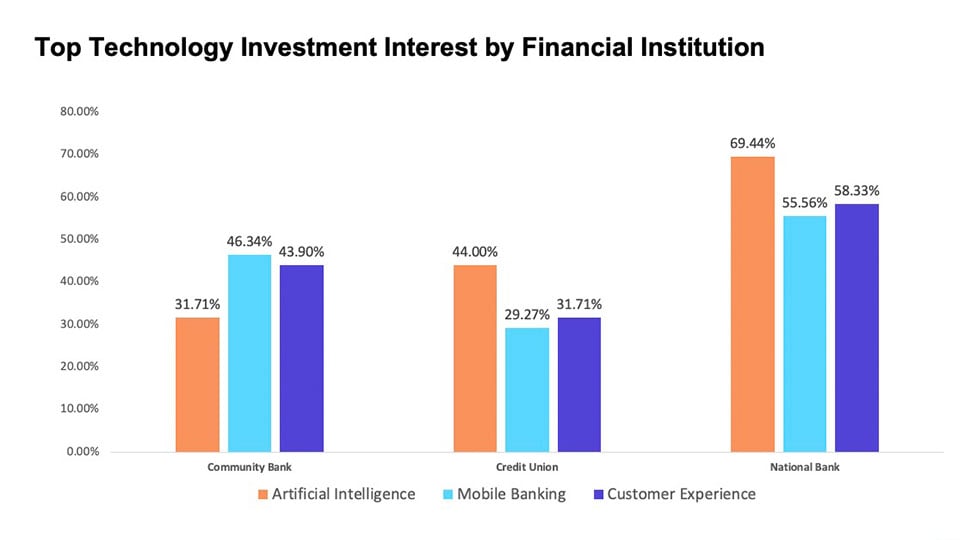

These 3 areas also topped the priority list for professionals across credit unions and national and community banks:

Considering that 85% of Americans own a smartphone and 57% spend 5 hours or more on them each day, it’s no surprise that digital banking and mobile banking are becoming more synonymous with each other with each passing year.

Therefore banking investments will need to deliver mobile banking experiences fast, seamless and intuitive if they are to meet the standard of today’s customers.

Lack of Mobile Options Needlessly Complicate Customer Onboarding

While the financial community has upped investment in recent years to improve digital and mobile onboarding, the reality according to banking professionals falls way short of the experiences consumers expect today.

Most Customers are being forced to the branch - whether they like it or not

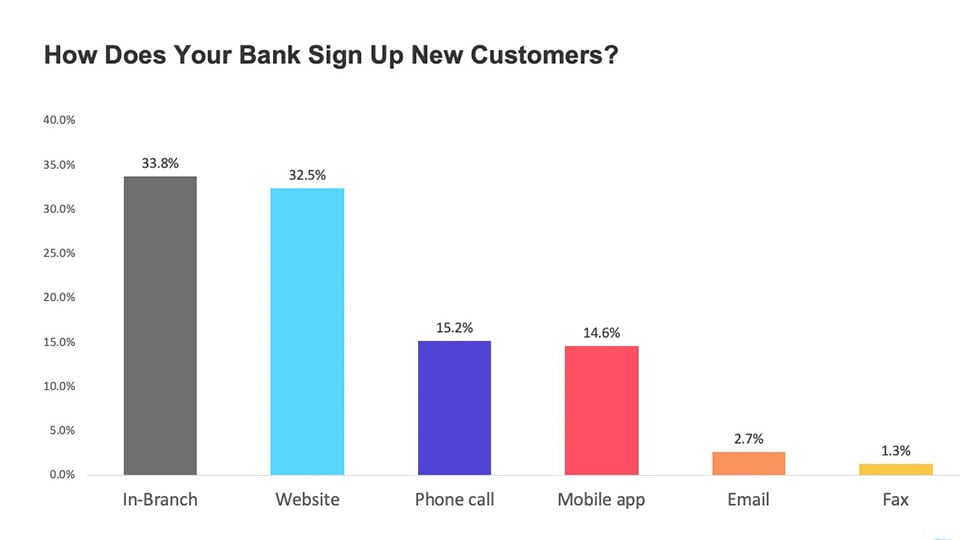

Only 32% of professionals said their banking website is the channel most used to open new customer accounts - and only 14% stated customers are being onboarded via mobile. A leading 33% indicated customers are still typically onboarded in-person at the branch.

While branches play an important role in consulting customers on high-value loans, mortgages and other important life decisions, forcing them to the branch just to sign up for a checking or savings account is not in step with speed of life for customers who are on the go and looking to complete tasks with minimal friction or hassle.

Slow Onboarding Completion Times Not Competitive with Fintech Services & Neo Banks

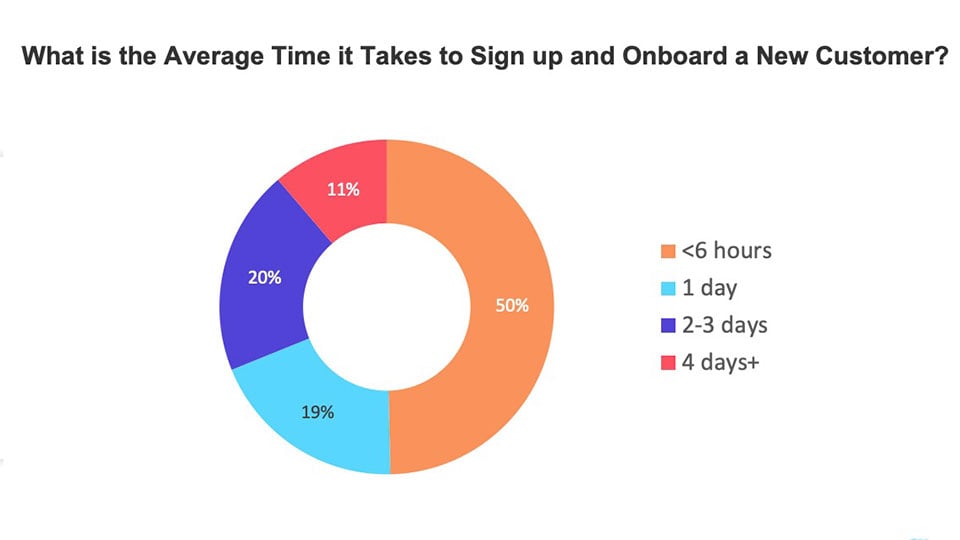

Half of the professionals said their bank is able to onboard a new customer in 6 hours or less. Yet still - 31% said signing up new accounts takes them 2 full days or more. These completion times fail to compete with neobanks, who allow customers to complete digital onboarding in minutes.

For banks and credit unions to compete, processes that can be accelerated via fully digital and self-service options must allow them to simplify customer acquisition with quick and easy onboarding that can be completed on the consumer’s smartphone.

Multiple Touchpoints Fail Digitally-minded Customers

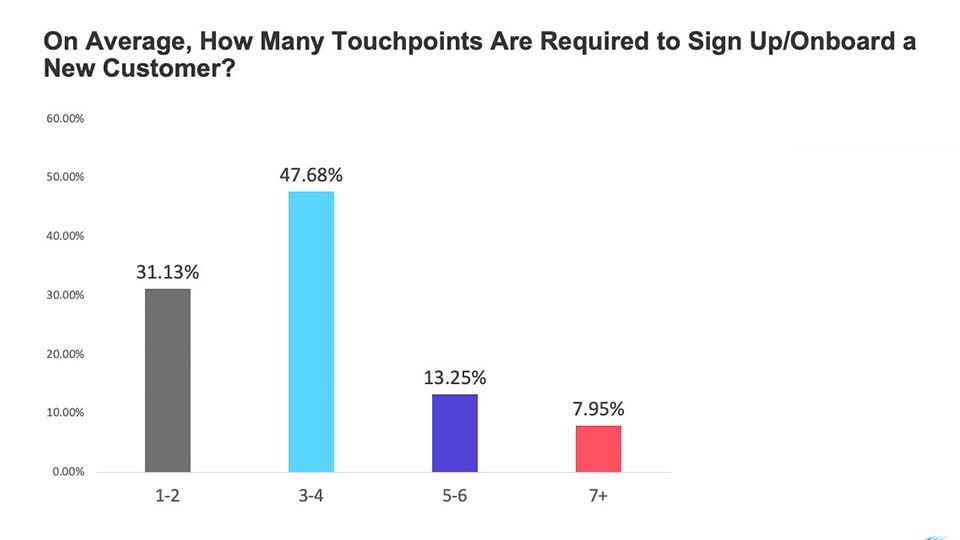

Despite investments into digital and mobile, 68% of professionals shared that their onboarding processes still require 3 or more touchpoints to complete, while over 20% require 5 or more. Only 31% are able to limit the onboarding process to 1 or 2 touchpoints.

Onboarding experiences still requiring multiple channels risk losing prospective customers due to long and friction-filled experiences. Customers are well aware that purely digital banking alternatives exist - therefore their tolerance for needlessly high-effort interactions is lower than ever. Tracking and managing

Most Consumers Can’t Become Customers On Their Own

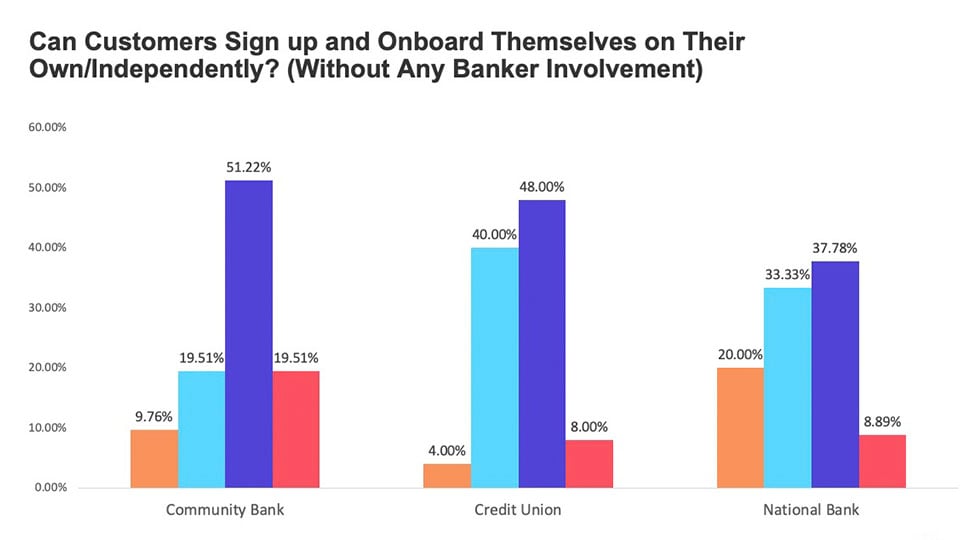

Only 11% of banking professionals surveyed said that customers can sign up for a new account completely on their own, with 27% indicating that “most” of their onboarding process can be completed independently. Over half of professionals said customers today can “somewhat” complete onboarding on their own, or not at all.

To understand how this impacts the effectiveness of onboarding processes, honed in on the fastest onboarding times to see how independent or dependent these interactions are for their customers.

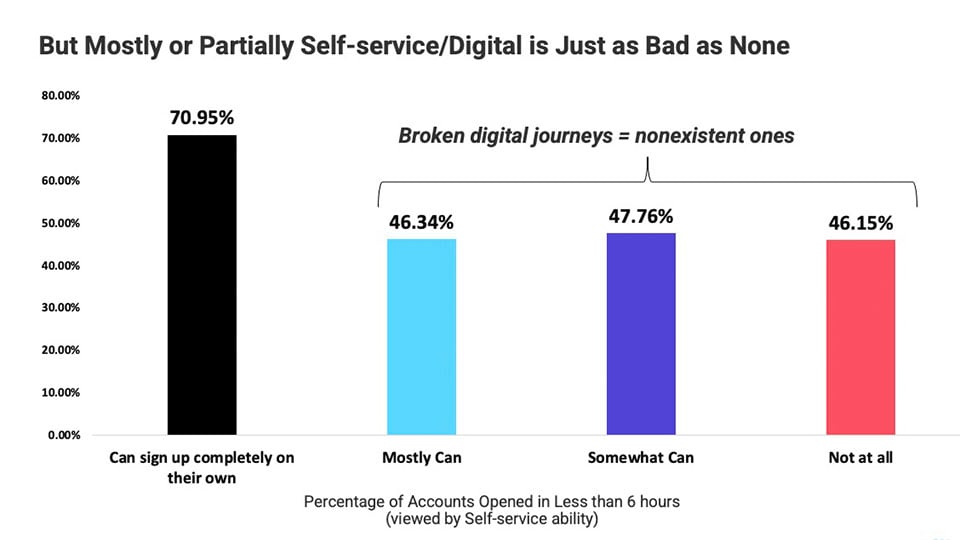

As we can see below, 71% of those that said customers are to sign up for a new account completely on their own, are able to complete the process in 6 hours or less.

When customers can’t onboard independently to any degree whatsoever, less than half end up doing so in 6 hours or under.

This helps explain why so many onboarding processes today still take banks and credit unions days to complete: Partially digital or self-service journeys are just as ineffective as non-digital journeys when it comes to how quickly banks can onboard new customers.

Digitally Broken Loan Originations Delay Time to Funding

Efficiency is especially critical for banks and credit unions when it comes to closing product sales and while minimizing management costs. Empowering customers with digital capabilities to apply for banking loans should help expedite completion. But data from professionals we surveyed shows that despite investments made by their organizations, loan processing today still relies heavily on branches and requires several touchpoints from customers - inevitably delaying financial providers’ ability to complete them

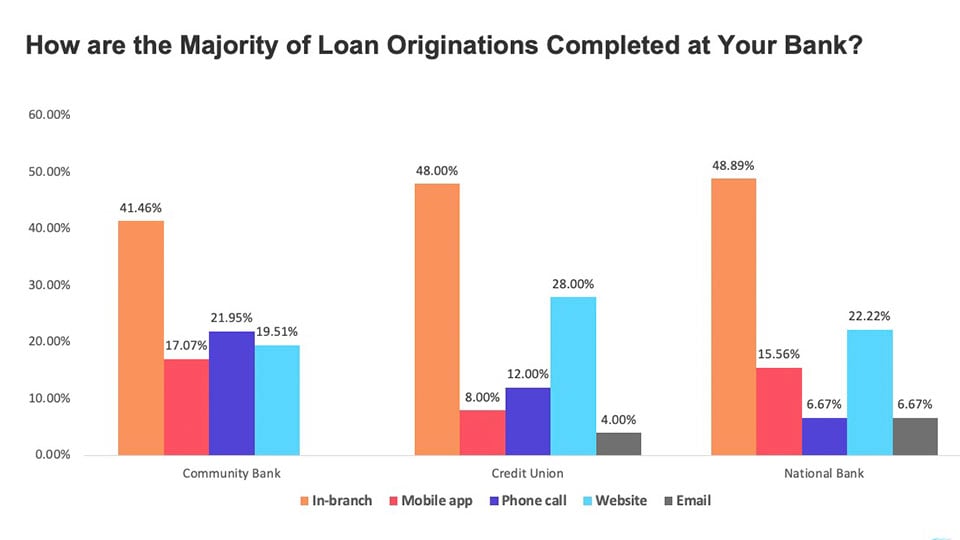

Customers Still Being Forced to the Branch Despite Mobile Banking Investments

Only 11% of banking and credit union professionals today indicated that they are completing loan originations using their mobile app, while just 27% said they can complete new loans via their website. For the majority, processing a loan still requires the customer to make the trip to the branch.

Low Mobile Adoption Equals Longer Time to Funding

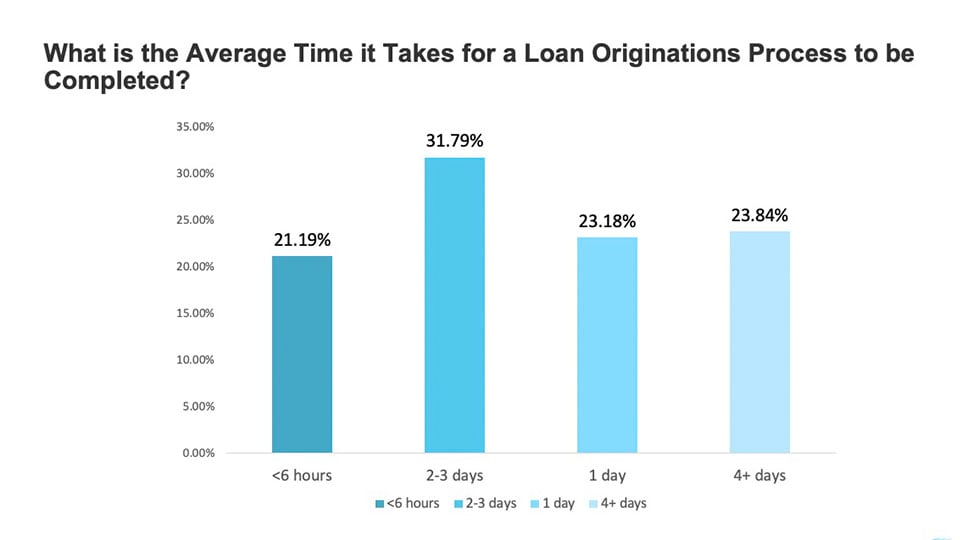

Even more so than onboarding, mobile adoption - or lack of it - is strongly linked to completion times for banks and credit unions. When asked how long it takes their bank to process new loans, the vast majority, over 55%, shared that completing a loan origination process takes them 2 or more days. Only 21% can process loans for new customers in 6 hours or less.

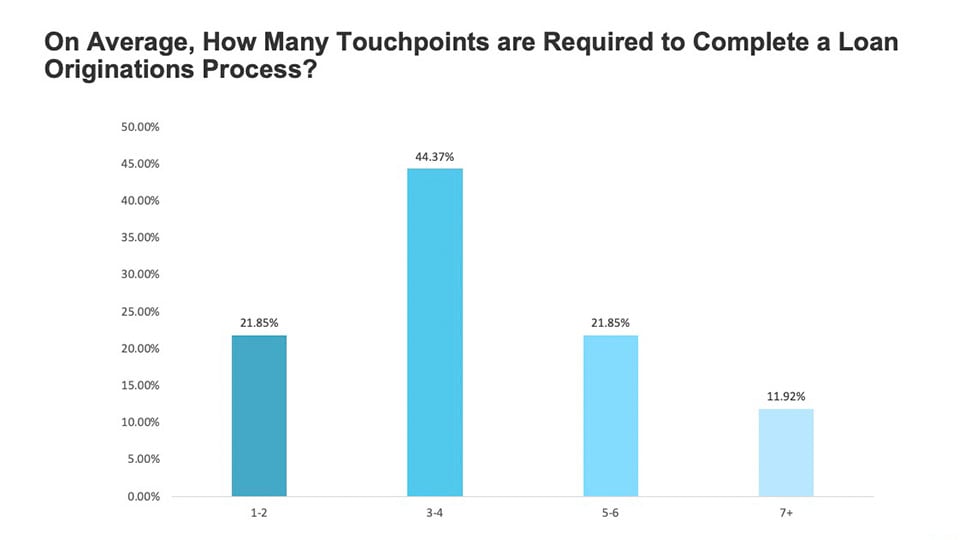

Despite banks’ digital investments to date, customers are being bounced across several channels is still the customer experience norm. A leading 44% of banking professionals indicate that 3-4 touchpoints are required to complete the loan origination process, with a further 33% requiring 5 or more. Just 21% said they’re able to complete these processes with 1 or 2 touchpoints.

Digital Silos & Legacy Processes Doom Banks to Friction-filled Customer Interactions

Despite great investment and strides made with banks and credit unions’ backend core systems, siloed digital systems fail to address the all-important experience of the customer, necessitating multiple touchpoints and regardless of how that customer initiates their request to open a new account or apply for a loan.

These siloed systems stitch together customer-facing steps, but they’re not capable of being integrated seamlessly. That disconnect is passed onto the customers, and therefore banking customers must still go through multiple and very separate experiences just to satisfy all that’s required for essentially one process.

For example, most banks have invested in eSignature software to help customers digitally sign for a new loan application. But since the eSign solution is not integrated smoothly with other business workflows, it’s only capable of handling one of several actions needed by the customer - signing a loan application. What about other critical steps such as ID Verification, document collection, and consent on terms and conditions?

Esignature apps simply don’t cover these next steps. Other siloed solutions pieced together to complete the customer journey are also not designed to take it all the way in one unified digital workflow.

This prolongs and complicates digital and mobile processes for banks. Just as problematic is these siloed solutions’ reliance on outdated legacy processes, such as cumbersome PDF forms that defeat the purpose of mobile. The minute a banking customer needs to leave a banking app to download a PDF form, the chances they end up completing that form digitally drop markedly.

Reading and understanding long and cumbersome agreements in a clunky PDF form are a mobile experience no-go. Most customers will delay completing the process - many opt to print off those forms which means they’ll need to find a fax or scanning machine to send them back.

Multiple siloed systems, bound by outdated legacy processes result in broken journeys that prolong turnaround times while generating paperwork and frustration for both customers and banking employees.

Accelerating Mobile Banking ROI with Agent-assisted Loan Origination

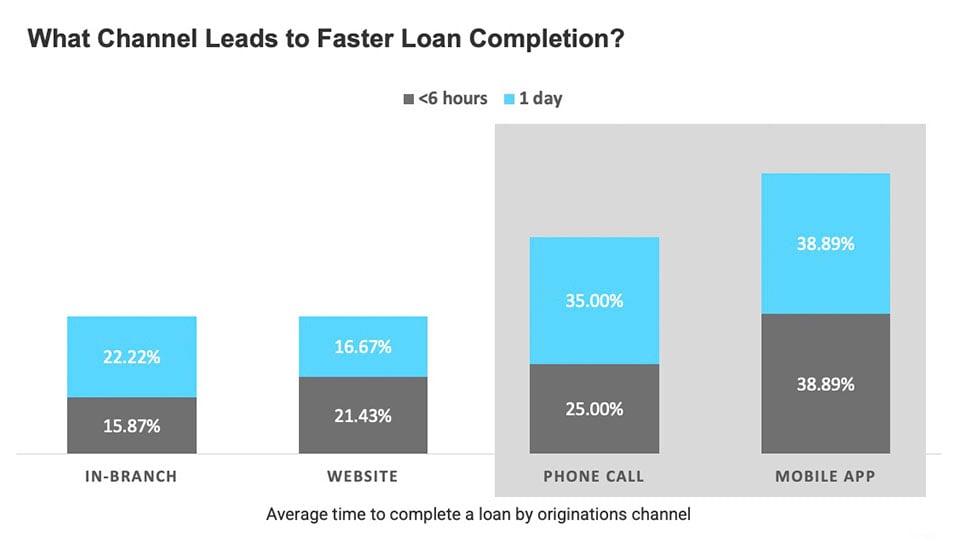

How can banks accelerate loan originations while enhancing customer service? We asked banking professionals which channels most enable faster loan completion in one day or less. Mobile was the most cited channel, which was followed by a phone call with a contact center agent.

Combining these channels with a Digital Completion solution helps banks guide them swiftly through all requirements needed to complete their application - while also giving them live agent support to assist them with any questions they have regarding the terms and conditions of the loan or any specific documents they need to provide to process the application.

Instead of bouncing back and forth between online and offline channels, customers can complete eSignatures and eForms, snap a selfie and upload a picture of their ID to verify their identity, instantly consent to terms and conditions on a new loan, and upload any supporting documents needed to approve their application - all from the convenience of their smartphone.

Completing every customer-facing action in one seamless mobile session allows banks to eliminate the multiple steps and channels that can be so infuriating for their customers. It also prevents the frustration and productivity drain of paperwork for employees, enabling them to onboard new customers and process loans faster.

And delivering mobile banking in-tandem with live agent assistance allows agents and customers to review the status of their loan application together while on a call, providing a transparent process for customers, and giving them the confidence and peace of mind that traditional banks need to boost satisfaction and loyalty.

Banks and financial institutions delivering digitally complete customer journeys:

- Speed up onboarding by 67%

- Increase completion rates by 25%

- Reduce touchpoints by 60%

In the case of community bank First Bank, using Digital Completion technology sped up completion rates for all retail banking transactions by 85%. And specifically for loan agreements, that process end-to-end has enabled them to reduce turnaround time from 2 days to 40 minutes.

Maximizing Time to ROI While Cutting Costs

Leading analyst firm Forrester recently completed a Total Economic Impact study on the results of digitally complete journeys to banks’ bottom lines. Their study found out that financial institutions and lenders are cutting costs by 250K a year by completing processing loans more efficiently with Lightico’s Digital Completion solution.

And by removing the burden and frustration of handling manual processes, paperwork, and needless repetitive tasks, employee turnover dives 10% - helping businesses save 155K every year by freeing employees to accomplish more in less time, improving job satisfaction.

Dramatically more efficient loan processing capabilities and cost savings across the organization is delivering a 360% return on investment for financial institutions in 6 months or less.

Enabling customers to smoothly and quickly onboard themselves and apply for loans directly from their smartphone allows banks to deliver the experiences today’s customers expect, speed time to funding, and get the most out of their digital banking investments.

Learn how Lightico

can transform your organization's business results.