How Insufficient Digitization is Hurting Utility Companies

Many utility companies have existed for a while, offering a name and service that has stood the test of time. This also means that legacy processes tend to be deeply entrenched. Manual work and paperwork still dominate. Printers, copy machines, and fax machines are still rampant.

According to McKinsey’s Journey Pulse survey, just 33% of customers have experienced a “wow” moment with a utilities company in the past year (as compared with 58% for airlines, for example). Lack of innovation and bureaucratic processes prevents customers from feeling satisfied.

In addition, McKinsey’s recent e-care survey indicates that 60% of customers were less than fully satisfied with the channels available for contacting the utility, and almost 45% would prefer to use digital channels as their primary means of interacting with it — though only 22% were actually doing so.

While some utility companies have begun their digitization journey, they tend to adopt point solutions and not go far enough. For example, customers may be able to pay their electricity bill online, but the bill comes in the mail. Or customers may be able to sign up for automatic payments, but requesting a change of address requires showing physical evidence.

This spotty use of technology leads to silos that infuriate customers, leading to frequent calls to the call center, escalation, and complaints. But these broken digital journeys aren’t just bad for customers — they’re bad for business.

On the onboarding side, it’s a struggle to quickly and compliantly get customers signed up.

On the collections side, it’s a struggle to collect outstanding amounts from delinquent accounts.

On the servicing side, it’s a struggle to prevent billing errors and respond to urgent customer issues in a prompt way.

When systems don’t communicate automatically with each other, when agents are forced to rely on manual data entry and decision-making, when digital tools are tacked onto otherwise non-digital processes, a number of KPIs are negatively impacted including:

- Poor compliance:

Paper forms, Terms and Conditions, and signatures can be tampered with or lost. With manual paperwork, processes are prolonged, misunderstandings are rampant, and regulators raise eyebrows.

- Poor conversion rate:

Disjointed sales cycles lead prospects to drop off from the process due to confusion or frustration.

- Slow turnaround time:

Whether it’s signing up for a new service or getting a utility issue sorted out, holes in the digital journey slow everything down.

- Low NPS:

Net Promoter Score (NPS), a measure of customer satisfaction, drops as customers struggle to get basic services such as gas and electricity due to bureaucracy.

- Agent turnover:

Frustrating, lengthy, and manual processes contribute to frequent employee turnover.

- Inflated costs:

choppy customer journeys drive up costs as customers choke call centers, paperwork needs to get re-done, and agents quit from frustration.

Yet all of this can be remedied by turning to digitization. According to Kearney research, energy companies can increase their short-term earnings by 3-4%, and their long-term earnings by 25% or more by leveraging technological solutions. By focusing on improving customer journeys, utility companies can see a real business impact.

But the time to act is now. A McKinsey study found that the opportunity for traditional companies to get ahead of the pack on digitization can be narrow: by the time industries near the 40% digitization mark, digital leaders have already secured large market shares.

Top Use Cases for Digital Customer-Facing Processes in the Utilities Industry

There are plenty of ways utility companies can apply automated workflows to streamline and expedite their customer-facing processes. Whether it’s by creating a full end-to-end workflow, or harnessing select capabilities to complete specific tasks, utilities companies can achieve a higher ROI. The following are the main use cases we’ve identified.

1. Joining a New Utility Company

When a customer moves properties, they need to set up a new electricity or gas account with their local supplier. The supplier needs to provide competitive terms for purchasing products and abide by strict rules for managing the purchase. In addition, customers tend to have many questions about pricing, feeds, insurance, and installations.

Therefore, the agent in charge of onboarding new customers must provide complete visibility into the process as soon as it’s initiated. A mobile-friendly process guided by a remote live agent can allow the entire signup process to be completed in one shot.

The customer can simply call the supplier, notify them of the gas and electricity meter readings at their new dwelling, and provide any additional details in a secure eForm — sent in a mobile-friendly format.

In addition, terms and conditions can be digitized and sent to the customer for quick approval. This saves the agent from having to read these scripts out loud, which is both inefficient and a compliance risk since there’s no written record.

2. Changing Address

Some customers may be able to stay with the same utility company even when they move. In this case, the company will need to verify the customer’s identity, as well as their new address. The problem is that when customers move, they don’t always have access to their computer or printer. But they do have access to their mobile phone.

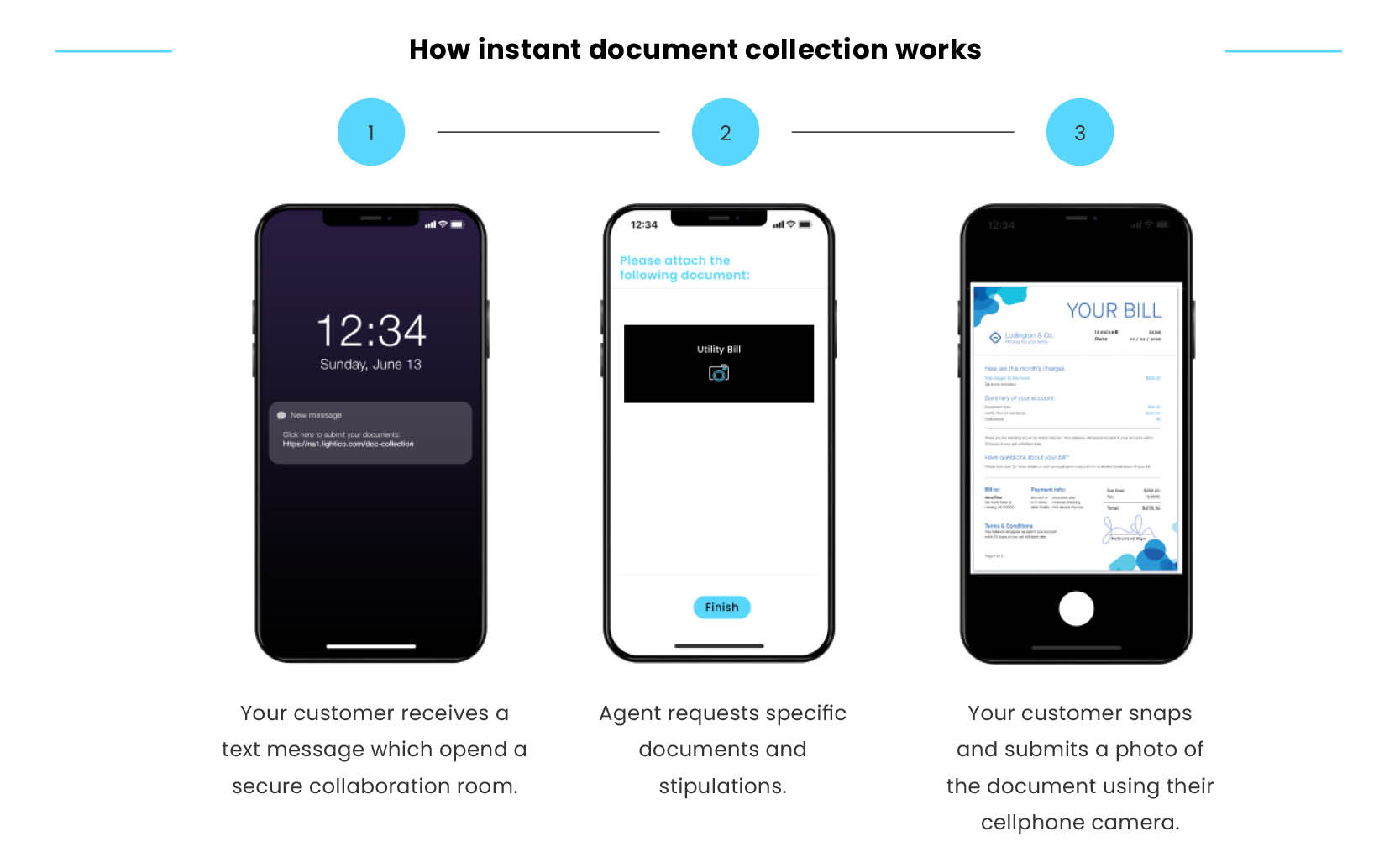

The utility company agent can send a text message to the customer containing a link to a secure session. In this session, they can request two key things: the customer’s ID and proof of residence.

Here’s how the ID verification process works:

Submitting proof of residence can be completed through an easy mobile document collection process:

In this way, customer addresses can be updated securely and efficiently. It also prevents gaps that can trigger mistaken collections processes, causing friction with customers and even escalation.

3. Filling Gaps in Servicing

When customers aren’t getting electricity or gas, the last thing they want is to be bounced through an IVR system or be put on hold. With a digital workflow, customers can simply fill out an eForm request from their mobile phone or utility company website, which gets routed to the relevant professional in real time. The professional can then submit the request to the technicians, or call the customer to provide an update.

4. Enabling a Wide Range of eForms to Be Submitted

eForms are a crucial part of the automated workflow process. With mobile-friendly, dynamic eForms, utility companies can allow customers to quickly provide information from their smartphones. The next-generation of eForms uses conditional logic to hide or reveal fields based on customers’ answers, ensuring forms are relevant and effective. Customers who make mistakes do not need to resubmit the entire form — they can just update it in real time. And all information gathered from eForms syncs with the utility company’s CRM, ensuring customer records are up-to-date.

Here are some of the form types that can be collected as part of a digital, automated workflow:

- Proof of bill

- Payments plans

- First payment acceptance

- ACH/direct withdrawal

Customers can also provide their eSignature on any of the forms they’re required to submit. This signature is tamper-proof, legally admissible, and effortless to submit.

5. Enabling Quick Electronic Payments

According to McKinsey, utilities that approach customers via email or text rather than a phone call can improve payments by as much as 12%.

Utilities companies should therefore introduce electronic payments across their customer base to encourage prompt payment. Delinquencies are expected to be reduced as it’s easy and quick for customers to complete the payment process.

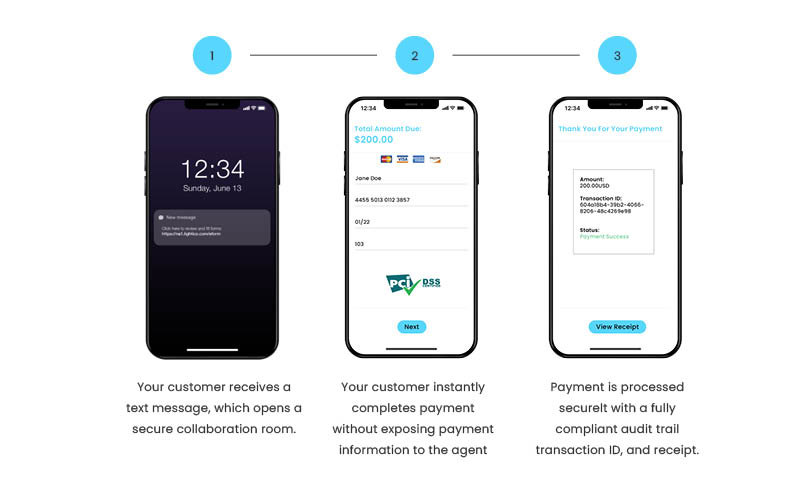

A utility company can simply send a text message containing a link to a secure session, where PCI-compliant payment can be carried out.

6. Co-Review of Bills

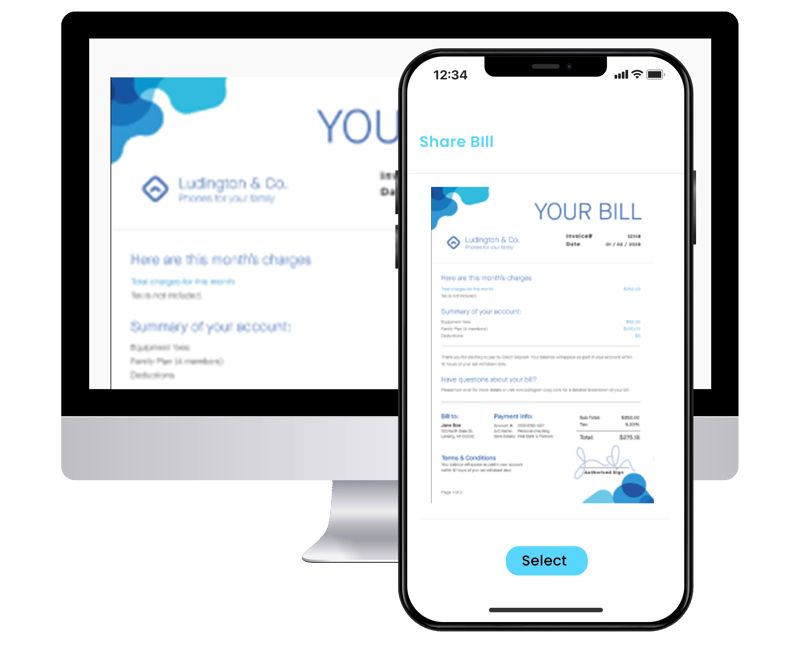

No utility company wants to deal with customers doubting a bill or service. And no customer wants to deal with an incorrect claim of unpaid bills. With digital co-review, agents and customers can view and mark up documents together in real time, while on a call. This allows ambiguity or misunderstandings to be cleared up quickly and fairly.

A Unified Digital Platform: The Pinnacle of Digitized Interactions

All of the tools mentioned in the previous section — eSignatures, eForms, document collection, ID verification, digital payments — are impactful on their own. But their power to transform customer interactions is multiplied when they fit into a greater digital platform.

A digital frontend links together all relevant digital capabilities, and relies on conditional logic to move customers onto the next step, all in a single mobile session. Such workflows allow admins to update business rules on the fly to trigger entire agent workflows during the signup or servicing call.

Key Benefits of Adopting a Unified Digital Platform

- Simplified processes:

A single system controls the entire end-to-end process with a simple drag-and-drop interface. - Digital tools in one digital suite:

At various stages of the workflow, rules trigger the sending of T&C documents, requests for eSignatures, and digital payments. - More streamlined processes:

Easy and intuitive conditional rules can be set to ensure business logic between and within steps. - Optimized:

Each customer interaction can be optimized across touchpoints and existing systems. - More visibility:

Digital workflows come with dashboards that allow business leaders to gain visibility into the KPIs that matter most.. - Higher NPS:

Customers are happier due to reduced frustrations, and more likely to stay with the utility company for the long term. - Lower agent churn:

Employees are more satisfied with their work since they aren’t burned with confusing, manual processes.

- Reduced cost:

The company saves money on manpower and resources that go into chasing customers, requesting re-work, and maintaining physical records.

- Zero IT involvement:

Admins can adjust their business rules according to their needs without requiring IT support or coding.

How A Digital Frontend Platform Works

Automated digital workflows allow utility companies to connect all customer-facing aspects of their onboarding and servicing cycles. Here’s how it works:

- Agent sends the customer a text message containing a link to a secure mobile session.

- The session automatically populates with all the relevant forms, document requests, ID verification requests, and anything else the customer needs to complete the journey.

- The customer completes all the tasks using only their mobile phone — no special apps or software needed.

Automated workflows are effective because they simplify and streamline the customer journey, allowing everything to be completed from a single digital session.

Conclusion: Streamlined Customer Interactions Yield Higher ROI

When it comes to getting access to basic services, customers expect prompt and seamless service. By adopting automated digital workflows, utility companies can provide customers with peace of mind while reaching their KPIs. Companies that use automated workflows and their associated capabilities experience:

- 35% higher first-call resolution (FCR)

- 25% reduction in average handling time (AHT)

- 15% higher net promoter score (NPS)

- 100% compliant journeys

Automated workflows ensure utility companies keep the ball rolling between critical steps in sign-up and servicing processes with no manual effort, allowing for both total compliance and rapid resolution.

Learn how Lightico can accelerate your organization's business results.

Experience the Interactive Video