Disputes:

Killing Customer Trust When Loyalty is Already at Risk

No scenario tests trust between bank and customer than when a dispute arises. Resolving a customer’s dispute quickly and transparently gives them peace of mind that their issue is being attended to fairly and expeditiously. But adding unnecessary friction to this process can often exacerbate an already tense customer when loyalty is already at risk. Frustrating dispute journeys can lead to escalation, and risk false starts and service-level issues such as escalation, customer churn, lowered NPS, and regulatory complaints.

Why Current Disputes Processes Are Broken

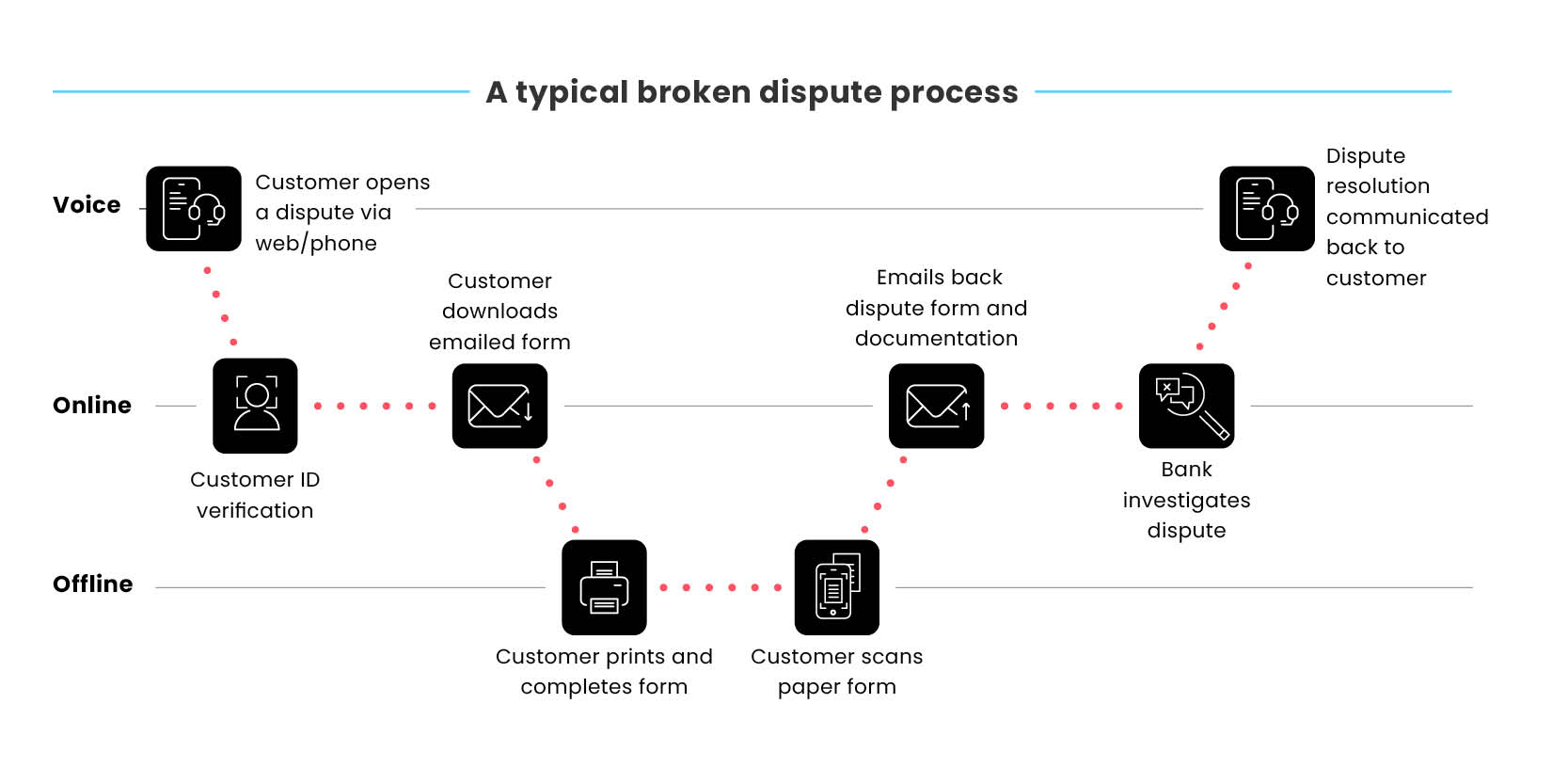

When it comes to customer experience, banking dispute processes today have it backwards: Instead of taking the opportunity to show their customers why they’re in good hands, many dispute processes today make their customers move between channels and complete multiple documents.

The Pain for Customers

-

Can’t complete their dispute process digitally and are forced offline due to legacy formats that rely on PDF-based documents, email, and paper.

-

Submitting proof of the issue or signing forms prolongs the process with more steps and paperwork.

-

Disagreements between customers and banks require clarification, but a disjointed process involving multiple documents and channels makes reviewing and resolving these cases difficult.

-

Increased anxiety and lost trust in the bank due to lengthy and inconvenient process

The Pain for Banks

-

Digitally incomplete and complex processes lead to gaps in communication with customers, leading to open cases that languish and lag.

-

Valuable employee time is wasted on multiple contacts and escalation calls with customers.

-

Paper-reliant admin processes add employee overhead while increasing manual errors that can risk compliance.

-

Lengthy turnaround time leads to serious service-level issues such as escalation, regulatory complaints, and legal disputes.

-

Lost customer confidence damages NPS and increases chances of churn.

Fraud Claims:

Fraught with Friction & Inconvenience

Financial institutions today put tremendous focus on their processes for detecting and preventing fraud on high-value transactions — but too often ignored is the mindset of the customer when reporting a fraud complaint to their bank. Anxiety understandably spikes when a customer first notices a suspicious debit, transaction or withdrawal from their account or credit card, triggering fears they may be a victim of fraud. Their bank’s fraud claim process will either extinguish that fear and secure their trust — or fuel it further and risk burning their relationship for good.

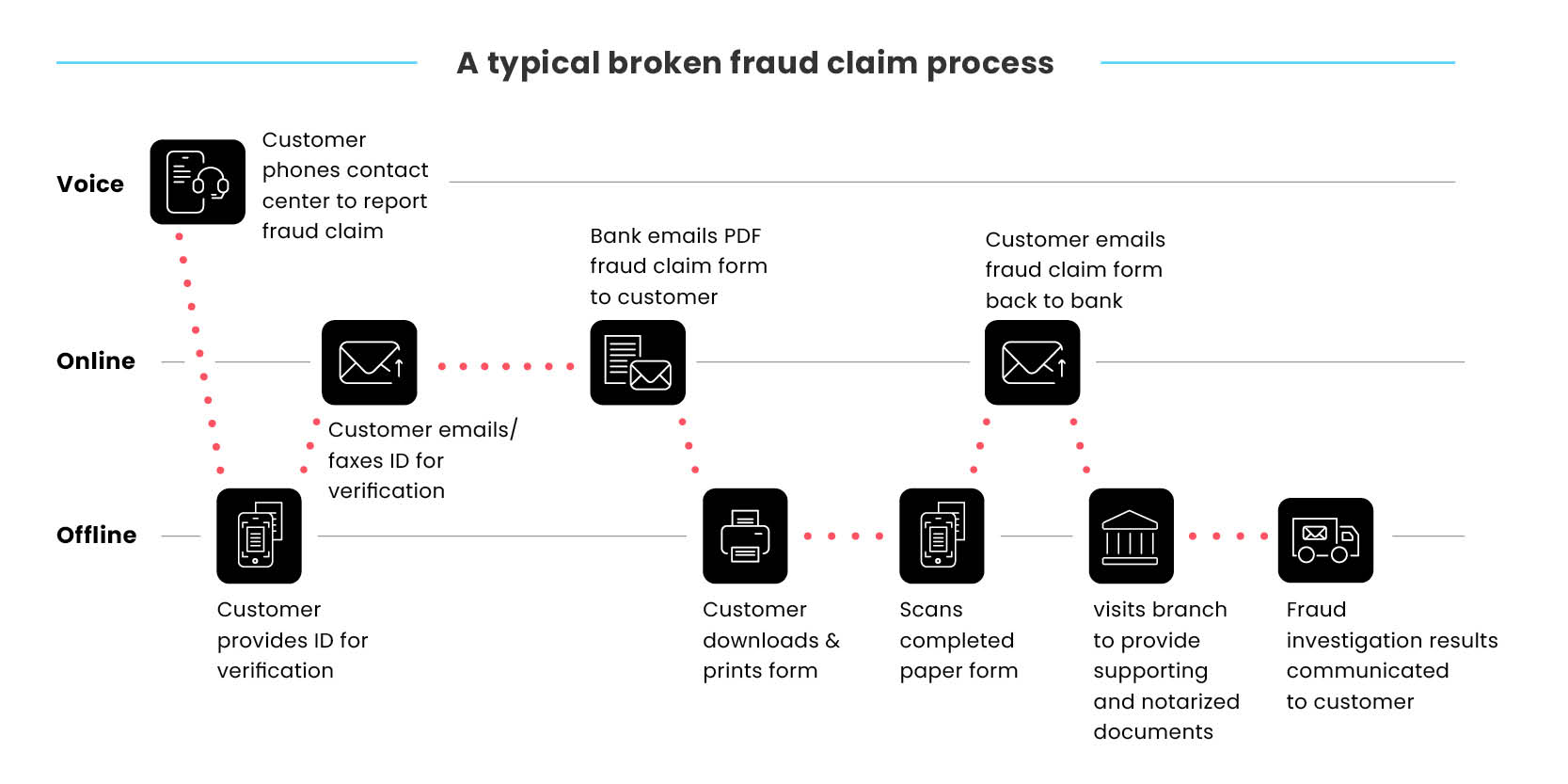

Why Digital Silos & Legacy Processes Slow Fraud Resolution

Many steps during the fraud claim process require separate forms and documents, while others require uploading documents and verifying the customer’s ID. Banks use numerous solutions for e-signatures, eForms, ID verification, and document collection — but none of these siloed technologies integrate with one another, prolonging and complicating the entire fraud claim process.

Many customers would happily complete this process digitally — but instead are continuously bounced across online and offline channels. For example, a customer will most commonly call the bank’s contact center to report a fraud complaint, only to be redirected to their email to fill out and sign a lengthy fraud claims form. Depending on the bank’s fraud policy and process, they're often re-routed yet again to the branch to pass identity verification requirements.

The Pain for Customers:

-

Banking customers are forced to work outside their digital channel of choice just to have their fraud complaint reviewed

-

Submitting proof or signing forms is inconvenient and involves multiple engagements with call center agents and branch staff

-

Fraud journeys may require additional information, supporting documentation, and even notarization of specific forms –– increasing touchpoints and delaying time to resolution

-

Disconnected processes leave customers frustrated and waiting to hear back regarding the fraud investigation process for which there is little to no transparency

The Pain for Banks:

-

Managing siloed systems, manual processes, and paperwork during separate stages of the process causes breaks in customer communication, false starts or open cases that lag

-

Insufficient documentation or responses resulting in multiple contacts with customers to resolve each fraud claim

-

Extra steps lead to long turnaround times, leading to serious service-level issues such as escalation and regulatory complaints

-

Manual admin processes risk gaps and errors risking compliance issues

-

Poor customer experiences damage NPS and increase chances of churn

Terms & Conditions:

A Compliance & Experience Problem

From routine requests to high-value transactions, legally binding consent of terms and conditions is a key requirement for banking customers, who regularly seek to open, modify, or upgrade several banking products, such as:

-

Applying for a new bank loan or credit card

-

Upgrading an existing account

-

Requesting a balance transfer

-

Adding services such as online bill pay and mobile banking solutions

But inconsistent ways of how T’s and C’s are currently managed delay the completion of these processes, risks non-compliance, and creates repetitive and frustrating work for both banking customers and employees.

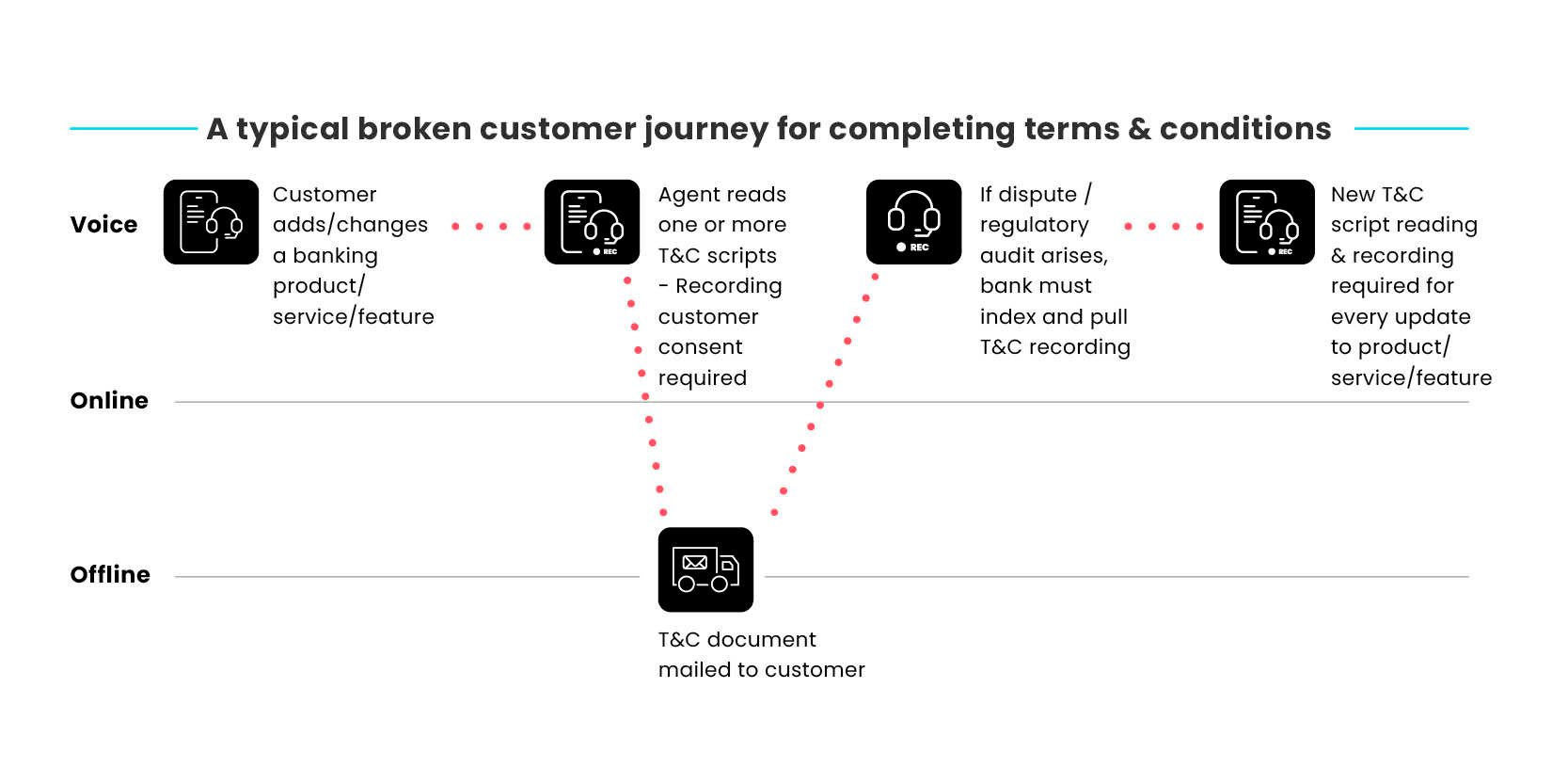

Why Verbal Terms & Conditions Are Failing Both Banks & Their Customers

Banks resort to having employees read the customer verbal T&C scripts that can be misread by agents or misunderstood by customers, prolonging the process and opening risks for disputes and compliance issues. Current digital consent processes bounce customers from channel to channel, risking churn and lowered NPS.

The Pain for Customers

-

Customers endure a cumbersome process — they must give consent on hardcopies, or listen to lengthy agent scripts

-

Customers may receive multiple T&Cs during an engagement when just one blanket consent form would suffice

-

Customers are more likely to dispute verbal T&C engagements, due to misunderstandings during verbal consent approvals.

The Pain for Banks

-

Fail to guarantee compliance as tracking/auditing recorded sessions requires call logging and archival research to extract

-

Verbal T&Cs take more time to complete, prolong AHT and lead to employee burnout due to the repetitive nature of these engagements

-

Mail & Email T&C documents increase the risk of customers forgetting to complete them or pushing them off, risking delayed or even lost deals

-

Increased risk of disputes due to lack of shared review capabilities

Self-Service:

Choppy Workflows Equal Overworked Call Centers & Branches

Seamless and end-to-end self-service helps banks maximize profitability by accelerating key banking processes that drive revenue such as loans, lines of credit, credit cards, and more. But when self-service options are digitally incomplete — increased overhead costs banks significantly: Call centers are flooded with mundane customer issues that should be Do-it-Yourself. Branch staff wastes time with servicing while rightly hearing questions from customers about why they can’t just do this online.

This friction also spills over to the customer. The more effort they make their customers go through just to do business — the further away banks find themselves from gaining their loyalty. Research by Gartner shows that an overwhelming 96% of customers become disloyal after having a high-effort interaction.

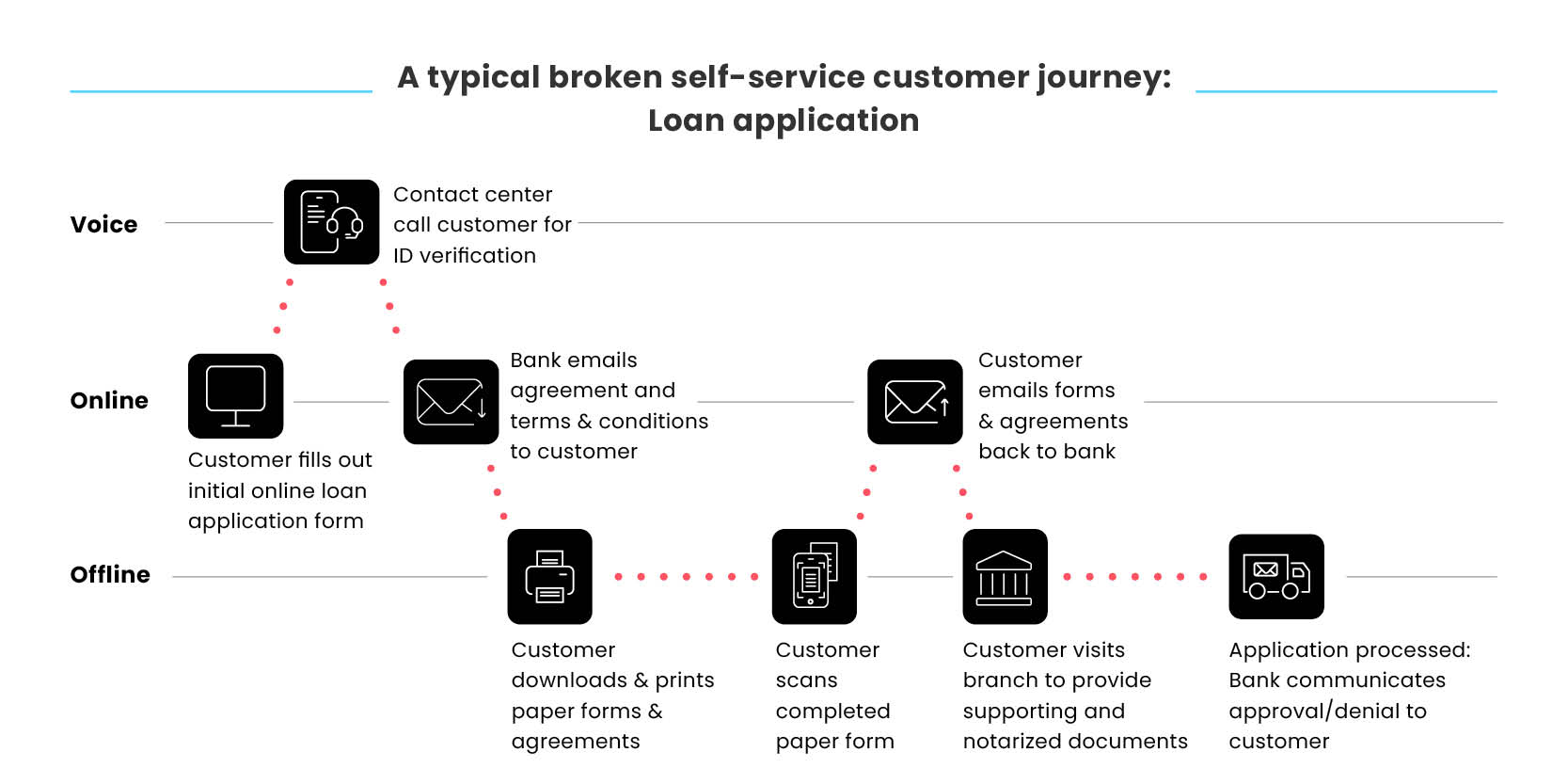

Why Broken Self-Service Customer Journeys Simply Don’t Work for Banking Customers

Digital silos and legacy processes repeatedly undermine the goal of self-service options by taking them offline. For example, a customer applying for a loan may start out using a self-service option from their smartphone. But as soon as more information is needed, they’re bounced to email to open a crowded PDF form that can be a struggle to read from their mobile screen. More often than not they’ll wait until they can print out the form. And if they’re unclear on important loan terms and conditions, they’ll need to put in a call to the contact center and wait to speak to an agent, while toggling back and forth from call to PDF form on their phone.

The Pain for Customers

-

Have very limited options to engage the bank online to complete forms or submit documents

-

Forced to engage in the slowest and least desirable channels to complete a process –– including contact center and the branch –– and need to complete processes on the bank’s schedule instead of their own

-

Leave application processes incomplete due to lengthy, unclear, and often painstaking manual processes.

The Pain for Banks

-

Poor onboard rates as a result of higher abandonment due to time-consuming tasks and repetitive compliance requirements

-

Slower Turnaround times due to excessive amount of banking employee time and resources

-

Existing infrastructure may not be up-to-date enough to support automatic handling of requests

-

Require increased staff time and resources to assist or support requests that often should not require up-front staffing to help a customer complete

-

Damaged NPS due to lower customer satisfaction

Service members Civil Relief Act (SCRA) Benefits:

Painful for Troops, Risky for Banks

The Servicemembers Civil Relief Act (SCRA) is enacted to support U.S. citizens enlisted in the military and their families in coping with financial challenges they face during active duty. SCRA benefits include:

-

A 6% cap on interest rates for any bank mortgage, loan, line of credit, or credit card opened prior to the customer being called to active duty

-

Enforced limits on foreclosures

-

Protection against repossession of a vehicle

Any bank or financial institution proceeding with a foreclosure or vehicle repossession without obtaining a court order can be hit with severe fines for non-compliance with these laws.

Why Digitally Incomplete SCRA Processes Can Inflame Customers & Have Banks Facing Steep Fines

Digitally complete banking solutions are especially important to servicemen and women serving abroad. A customer on-duty overseas may call a toll-free number to report their SCRA status and request benefits. But to approve SCRA requests banks typically require these additional supporting documents:

-

The servicemember’s name

-

Social Security Number

-

Active duty start date

-

Branch of service

To acquire these documents, the bank will email the customer a PDF form to fill out and sign. Lengthy PDF forms are uncomfortable to read, especially on mobile, prompting customers to wait until they arrive home and download that PDF form using their desktop or laptop. A customer on-duty may not have that option.

Whereas a Digital Completion solution provides one seamless way to process SCRA benefits, legacy processes like printers and fax machines only trigger frustration for customers serving in the military.

But banks can ill-afford to have failed SCRA processes - non-compliance leads to stiff fines and penalties, as well as damaging press coverage that can hurt their brand.

The Customer Pain

-

Communication with bank employees during staffed hours is a struggle as they may literally be on the other side of the world

-

Servicemembers lack access to many banking communication channels

-

Frustration is widespread due to paper-heavy processes when printers, scanners, and fax may be out of reach

-

Already working in high-stress conditions — they don’t need a banking process that adds to it

The Bank Pain

-

Incomplete SCRA journeys risk fines and penalties for non-compliance and bad press when not managed effectively

-

Major time gaps and delays in receiving documentation and contacting forward-deployed troops due to complex, manual processes

-

Many other channels are less secure or not easily accessed

Account Transfers:

Making Trying Times Harder for Banking Customers

The relationship between banks and their customers often spans a lifetime. Customers rely on their bank to manage the financial implications of personal and family milestones — good and bad — throughout the lifecycle. That’s precisely why transferring an account or assuming that of someone else often involves particularly crucial and often stressful events impacting banking customers, such as:

-

Death of a family member or loved one

-

Divorce

-

Disability due to illness or injury

-

Planning for future family milestones such as a child’s education or wedding

-

Lack of income due to unemployment or underemployment

Account transfer processes that heap more stress and complexity to these situations risk damaging their relationship with the bank for good.

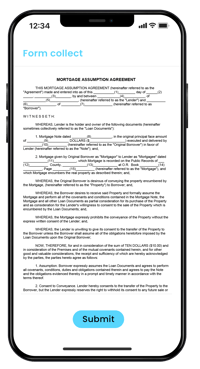

Why Broken Account Transfer Processes Add Grief To Difficult Lifetime Events

Current account transfer processes tie up the time and efforts of both customers and bank employees in bureaucracy and often exacerbate customer stress that’s already running high.

For example, a relative of a deceased customer wishing to pay off their loan may visit the branch or call the contact center to update them that the original customer has passed away and that they would like to make installment payments on the account.

They may not already be a customer of that bank and may need to verify their identification in person at a local branch. Other times, they may be driven to a secured web portal for KYC identification. The bank will then email them a form to complete and sign agreeing to assume responsibility for the bank loan… But receiving a crowded PDF form filled with legal statements and stipulations is difficult to understand and complete. They’re more likely to wait until they can print and sign that form manually and then must find a fax machine or scanner just so they can send it back to the bank.

The paper chase doesn’t end there. The bank also requires a slew of supporting documents, such as the death certificate of the original customer, income tax statements, pay stubs, and additional documents that can prove their ability to pay on the loan.

The Pain for Customers

-

Interact with many channels and often least convenient ones for them

-

Dealing with the annoyance of submitting lengthy and complex forms

-

Multiple touchpoints to send banks supporting documents leads to gaps throughout the process

-

Wait for a reply to a process they have little to no visibility into

The Pain for Banks

-

Struggle to capture all requirements to process account transfers and experience delays in completing them

-

Rely on manual processes and must engage each party separately to complete account transfers instead of in a joint, unified manner

Loan Deferments & Extensions:

Exacerbating Already Stressed Customers

With many Americans still regrouping from the economic effects of COVID, The Consumer Financial Protection Bureau (CFPB) recently issued a new rule to help make loan modifications easier for homeowners.

In the vast majority of cases, customers contacting their bank about a loan deferment, extension, or modification of terms are proactively taking steps to manage temporary financial hardship and avoid falling into delinquency. They’re looking to stop the bleeding early with their bank’s help and they want to do so without significantly harming their credit rating.

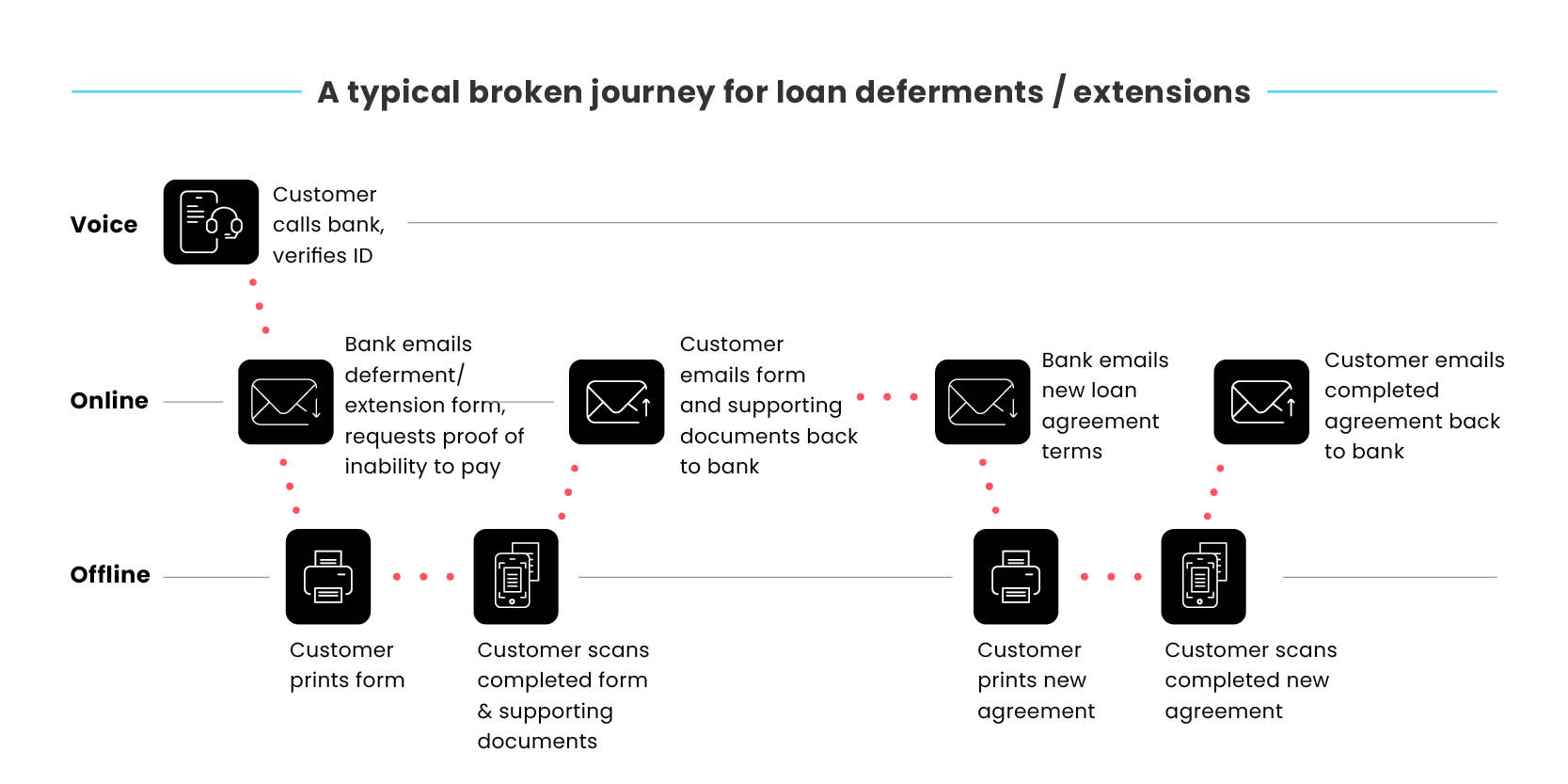

Why Digital Silos & Legacy Processes Add Hassle to Loan Deferments & Extensions

To review and process complete loan deferments or extensions banks need to:

-

Confirm the customer’s identity

-

Review the customer’s outstanding balance

-

Collect proof of the borrower’s inability to pay - i.e. income and expenses - and capture the reasons they’re asking for a deferment/extension

-

Draw up a new loan (extension/deferment) agreement that details how many payments can be deferred, the new payment schedule, any changes to the loan terms, and any penalty fees

-

Send a new loan agreement and terms for the customer to sign and accept

-

Receive signed consent to the new loan terms

To complete this process, banks currently use a patchwork of disconnected point solutions in order to verify ID, obtain signed and completed forms and customer consent on new terms and conditions, and receive supporting documents needed to approve deferring loan payments. These digital silos make it impossible to accelerate the process for both banks and their customers.

Further complicating and delaying this journey are legacy processes, like PDF-based forms, outdated tech like printers, fax machines, and scanners, and even snail mail that repeatedly force customers offline just to complete their requests.

The Pain for Customers

-

Exacerbates customers already stressed by financial challenges, complicating and prolonging the process of requesting deferments or extensions on their loan payments

-

Forced to use several manual outdated processes rather than the digital channels most convenient for them

-

Gaps in communication in between each step that delay the process and can result in the customer falling into delinquency - further inflaming customer frustration

The Pain for Banks

-

Employees can spend days or even weeks chasing customers to complete pdf and paper forms

-

Delinquency can overlap the customer account with collections processes and deteriorate, needlessly sparking disputes and complaints while exhausting staff time and resources

-

Human errors in collecting signatures, consent on terms and conditions, and processing forms can risk non-compliance

Presidential & Regulatory Complaints:

Accelerating Escalation Instead of Resolution

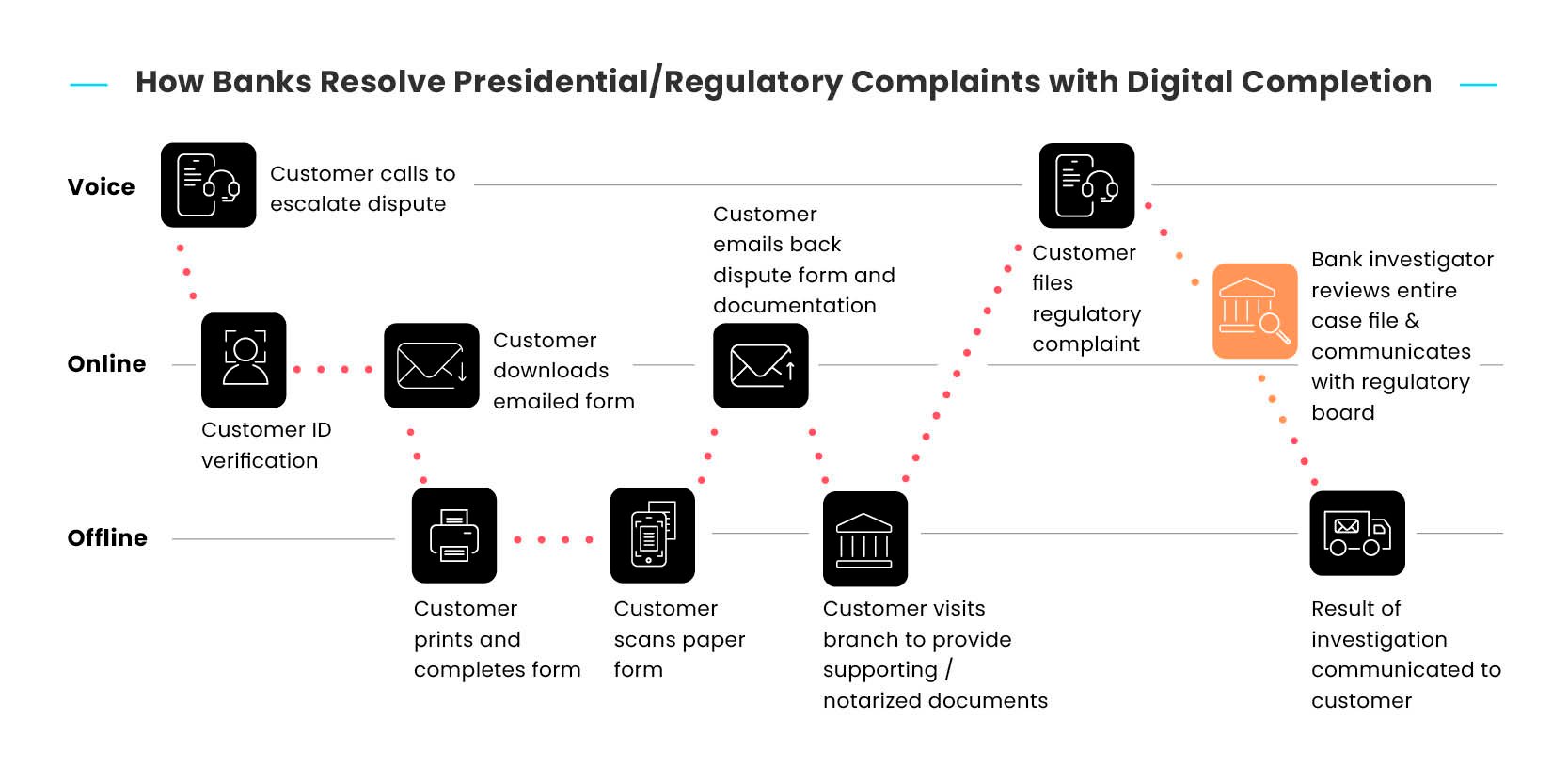

A wide variety of issues and disputes can inevitably escalate between banks and their customers. At times the Office of the President or highest escalation point, and if poor customer experiences fail to resolve the matter, customers will file a complaint with their state regulator or the Consumer Financial Protection Bureau (CFPB). Managing these advanced disputes as swiftly and transparently as possible is critical — both to prevent needless regulatory complaints and investigations and resolve them compliantly.

Why Current Advanced Dispute Workflows Push Customer Patience Over the Edge

The deeper and more complex the banking journey, the more disjointed and inefficient customer journeys become due to separate digital silos that depend on legacy and manual processes.

During an escalated dispute, customers will often call the contact center, often multiple times to follow up on the status of a dispute, ensure complaints’ forms and supporting/notarized docs have been received by the bank, and often simply to vent frustration about being bounced across departments.

For banks, lack of a formal and well-documented audit trail not only prolongs resolution, it also opens the door for errors and missteps that can jeopardize compliance in the event of an external regulatory investigation.

Sadly for banks, many of these issues escalate to the point of no return not because they and customers can’t come to terms, but because steps to getting to that resolution are made so complex and painful that the customer’s frustration boils over, making them lose faith in them entirely.

The Pain for Customers

-

Time and efforts exhausted on phone calls, emails, physical branches, and post mail, while needing to complete paper forms and access printers, fax, and scanners.

-

Lengthy turnaround time due to digital silos and legacy processes

-

Prolonged wait times in between steps exacerbate already agitated customers and increase risk of escalation and regulatory complaints

The Pain for Banks

-

Communicating with customers is difficult to do both securely and efficiently

-

No unified comprehensive audit trail or documentation sharing complicates resolution and increases risk of non-compliance

-

Regulatory investigations or challenges often spawn from this journey, putting efficiency at risk

Replacement & Additional Card Processes:

Making Simpler Requests Slow & Complex

Replacing an existing credit or debit card or authorizing an additional cardholder from your bank sounds like a simple and straightforward request — but for many banking customers that process today is still an unnecessarily complex and lengthy one.

Digital-first customers expect these requests turned around with the same speed and convenience they’re used to with e-commerce giants like Amazon and other retail brands they’ll be charging those cards at. But many banks still find themselves trailing behind that digital curve — and that’s currently creating unnecessarily painful journeys for their customers.

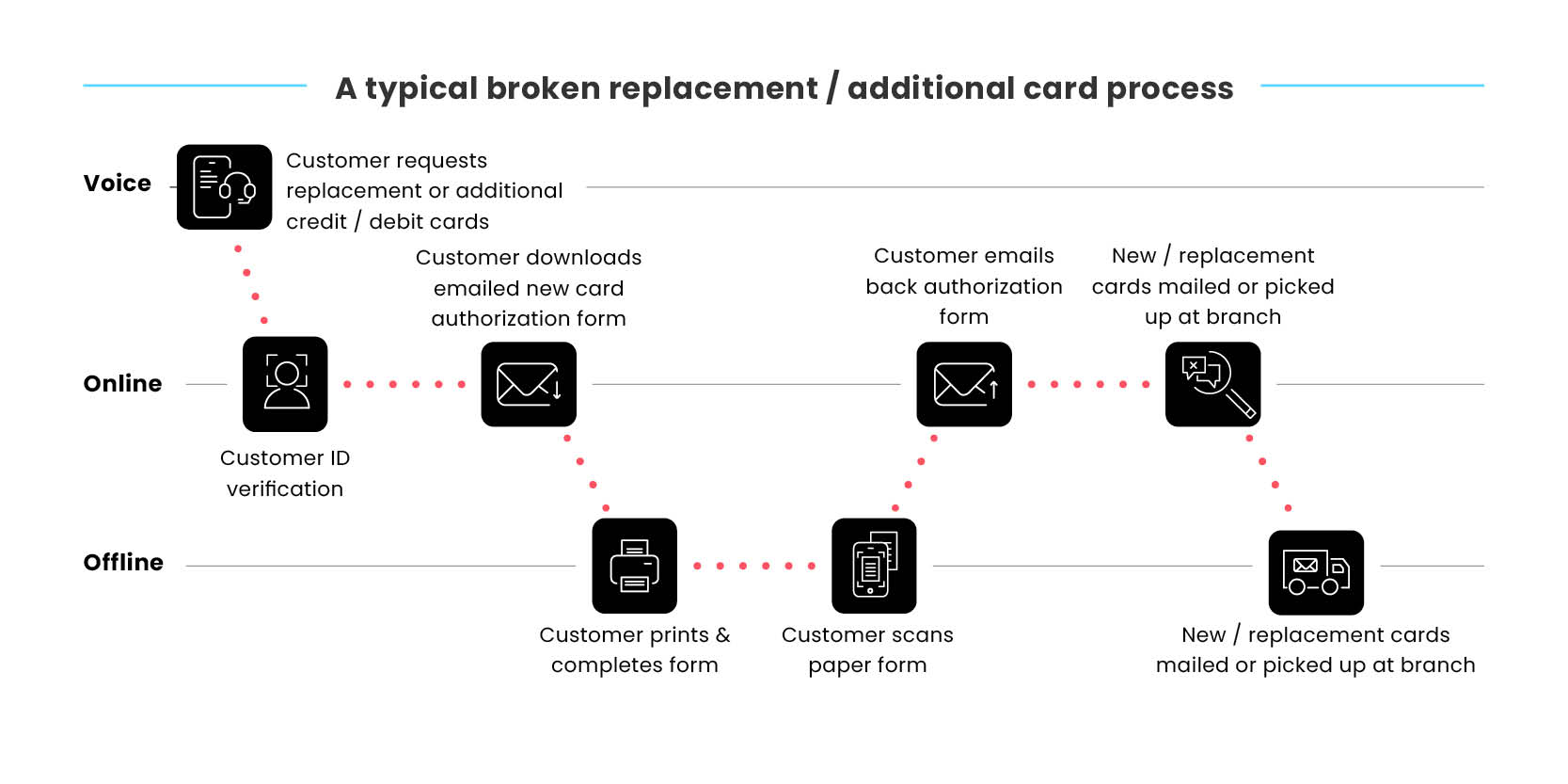

Why Broken Replacement Card Journeys Are Painful Both Banks & Customers

Banks and financial institutions want to make processes just like this as quick and easy as possible, but here’s what usually happens.

First, the customer may already be agitated when calling the contact center since they may have been unpleasantly surprised while trying to make a purchase. Already frustrated, they must now wait in line to get an agent on the phone. The agent first needs to verify the customer’s ID to ensure privacy and compliance… and asks the customer a common KBA question, such as what was the first school they attended — but a stressed-out customer may well not be able to recall the answer.

They now have no choice but to verify themselves in-person at the branch — but it’s 8 p.m. and that branch has already closed for the day. Resolving this relatively simple process today? Not possible. The customer’s frustration understandably boils over.

The Customer Pain

-

Forced outside their channel of choice or required to visit branches during their business hours –– instead of being able to engage from any location or on their own time

-

Manual processes and time-consuming requirements to request additional/authorized users add friction and delay completion

The Bank Pain

- Not always able to engage customers outside of staffed hours for these types of requests

- May require signed forms or processes not readily available online

- Remote identity verification is a challenge

Conclusion:

How Banks Can Take Customer & Employee Pain Away by Digitally Completing the Journey

Today’s banking processes need to be re-imagined to eliminate needless pains that damage customer relationships, add overhead and costs, and exhaust and frustrate employees.

It’s time for a smarter approach to digital banking — It’s time for Digital Completion.

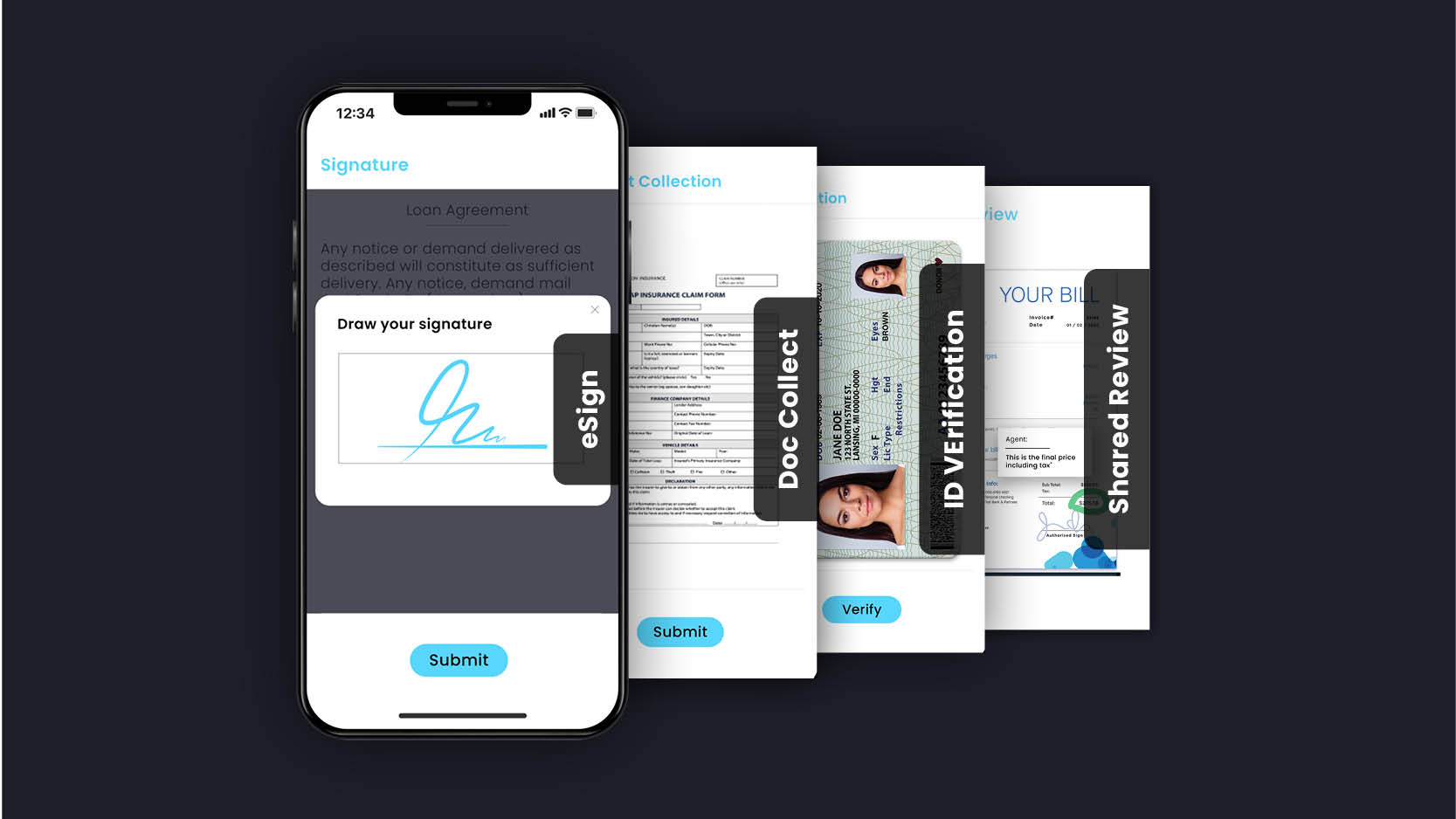

To put an end to broken journeys financial institutions need to replace disconnected digital silos and manual legacy processes with one that integrates all customer-facing steps from start to finish.

By leveraging Digital Completion technology to digitize banking processes end-to-end, customers’ tasks are brought to completion, faster.

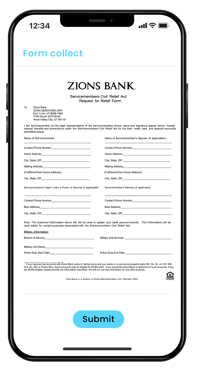

Instead of requiring customers to download multiple legacy PDF forms and bouncing them across online and offline channels, banking customers today can open an SMS or email link from wherever they are on their mobile device, where they simply tap and swipe through each step in one simple and intuitive interactive digital session in real-time, including eSignatures, ID verification, document collection, and digital consent of terms and conditions.

Project managers can use intelligent and automated workflows to define all aspects of every banking journey and customize for each scenario — making sure customers only need to complete what’s required to process requests, resolve issues, and close the deal.

Swifter, simpler, and seamless journeys instantly improve customer experience and loyalty.

A leading Texas-based bank, Happy State Bank was seeking such innovation to improve in-branch processes and deliver clear ROI, while enhancing their customers’ experience. After digitizing their customer-facing processes with Digital Completion, Happy State Bank’s executive team saw completion rates and turnaround times accelerate dramatically.

For banks, accelerating processes all in one digital platform enables them to reduce significant staffing and overhead costs demanded by paper-heavy admin tasks, freeing up employees to focus on objectives that add value to their bottom line, while ensuring 100% compliance.

Banks and financial institutions today are already digitally complete their banking journeys, and are seeing:

67% Faster Resolution

25% Increased Completion Rates

60% Fewer Touchpoints

20% Shorter AHT on Consent of Terms & Conditions

The time has come to choose technological solutions that simplify rather than complicate customer-facing processes, removing obstacles on the path to completion.

Learn how Lightico

can accelerate your organization's banking processes.