5 Ways Current Self-service Options Are Failing Both Credit Union & Member

With such intense competition to attract and retain members, traditional credit unions can ill-afford to keep turning their experiences into a lengthy and arduous process. To improve efficiency and member service, credit unions have invested in developing web pages, portals, and mobile applications. Yet still, self-service options today are not capable of meeting these priorities.

There are 5 main reasons why:

#1 Members Are Still Being Driven Offline By Processes That Should Be 100% Self-Service

Far too many of today’s self-service options fail to enable members to quickly and easily complete a request without forcing them to make that call to the contact center or visit their local branch.

In fact, a recent survey shows that 63.9% of members have been directed to a physical branch during an online interaction within the past 6 months.

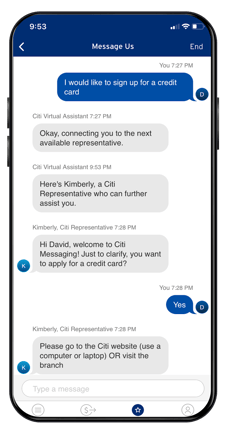

One of many such interactions is when a consumer simply looking to apply for a credit card online ends up experiencing this instead:

Whether it’s applying for a credit card, or simple tasks like a change of address, most credit union workflows today bounce members across different channels — and more often than not the slowest and least convenient one for them.

#2 Digital Silos: A Patchwork of Solution That’s No Solution At All for Self-Service

Digital silos and legacy processes, which increase effort for both members and credit union employees. Cobbling together multiple siloed solutions that are not integrated results in vital gaps that leave members with no other choice but to get off the self-service track and turn to contact center agents for assistance to complete them.

#3 Legacy Processes Prevent Agents from Efficiently Guiding Members to the Finish Line

Siloed digital systems used by credit unions today are also heavily dependent on manual and paper-heavy legacy processes, such PDF-based forms and agreements that are often lengthy and difficult to understand. 62.5% of members surveyed have been asked to print, sign, and email papers during an online transaction in the past 6 months.

#4 Outdated Legacy Processes Equal High-Effort Member Interactions

Multiple channels and paper-based processes needlessly add effort and frustration to the entire member experience. Routinely they contact the call center or branch because they:

- Can’t clearly read or understand the details of a PDF form or Terms and Conditions document that they must sign, or supporting documents they’re required to provide to process an application or request

- Must print these documents out and once ready to complete them, have to look for printers, fax machines, and scanners just to simply get these documents back to their credit union.

- Need to verify their ID and undergo authentication processes that the credit union’s current self-service process can’t cover digitally, leaving no other option than to email copies of identification back to the contact center or paying a visit to the branch.

The result is higher effort and burden for members and employees alike. Members needing and expecting digitally complete credit union processes continually find themselves bouncing from site/portal to the contact centers and branch, and must use email, printers, and scanners all along the way.

These high-effort interactions are not only frustrating, they fall short of the standard members expect today, who expect digital-only alternatives to complete their needs.

Research by Gartner shows that an overwhelming 96% of members become disloyal after having a high-effort interaction - emphasizing that the more effort credit unions make their members go through just to do business — the higher the risk that they’ll lose their loyalty to a competitor.

#5 Frustrated & Less Productive Employees Cost Credit Unions in Overhead & Turnover

Members’ effort and friction also spills over to credit union employees in the form of significantly increased overhead costs. Call centers are flooded with mundane member issues that should be Do-it-Yourself. Branch staff wastes time with servicing while fielding complaints from members about why they can’t complete these requests online (and rightly so). And agents are not just tied with a slew of needless phone conversations, they also must expend time and effort dealing with the paper and admin work resulting from these broken journeys - That slows down productivity, ramps up frustration and damages employee job satisfaction, leading to increased turnover costs for credit unions.

Broken credit union self-service interactions results in:

- Poor onboard rates and higher journey abandonment due to uncomfortable, time-consuming tasks and repetitive compliance requirements

- Longer turnaround times as due to excessive employee time and resources spent chasing members for documents and signatures

- Damaged NPS as a result of lengthy, unclear, and often painstaking manual processes

- Lowered employee productivity due employees fielding excessive member calls and complaints and handling paperwork

- Higher employee turnover and associated costs as agents are frustrated with mundane, manual tasks that prevent them from focusing on tasks that make a positive impact

How Credit Unions Can Make True Self-Service Happen with Digital Completion

To eliminate the costs, delays and friction caused by broken member self-service, credit unions today need to swap the digital silos and manual legacy processes for one end-to-end digital solution designed for the way members today expect to get them done.

A Digital Completion solution integrates these workflows seamlessly into a credit union’s existing infrastructure using flexible APIs. To scale yet customize automated workflows across a wide variety of member-facing processes, this solution should require no code by IT, and should enable project managers to easily set up their own business rules and make adjustments on the fly by applying conditional logic.

This allows for one completely digital self-service member experience from start to finish, and just as importantly enables them to complete each step from their smartphone.

One intuitive digital session guides the member through workflow tailored for precisely their scenario, allowing them to complete eForms and digitally sign them, verify ID, upload supporting records or documents, and instantly grant consent to the terms and conditions of an agreement.

One Digital Journey Enhances Agent-Assisted Interactions & Powers Productivity

Human interaction is still vital to accelerating credit union processes while delighting members. Self-service options and agent assistance do not have to be mutually exclusive: Credit Unions can benefit from both with Digital Completion capabilities that help agents guide a member through a digital self-service process from beginning to close.

Instead of printing out forms, terms and conditions, and other documents, an agent sends the member an SMS or email with a link that starts an interactive session through Interactive Voice Response (IVR), website engagement, or any other self-service link option. From here, the agent can help answer any questions the member has - this helps the member complete the process with minimal stress or friction while enabling the credit union to process loans and transactions far more efficiently.

The Total Economic Impact of Digitally Complete Self-Service Experiences

Eliminating needless time and effort on processes that can be digitized significantly enhances credit unions’ relationships with their members - and their employees.

Leading research firm Forrester recently conducted a commissioned study to assess the Total Economic Impact™ credit unions are reaping from Lightico’s Digital Completion solution.

Forrester’s study assessed that using Lightico generates a 360% return on investment for credit unions. And while many businesses must often wait 3-5 years to see ROI on their technology investments, credit unions digitally completing their member experiences with Lightico are gaining this return in 6 months or less.

What makes these bottom-line results possible in so little time with Digital Completion?

- Credit Unions processing loans far more efficiently: Digitizing every step of the loan application process alone is saves over 250K cost-savings annually

- With legacy processes gone, employees are more productive and committed: Freeing up employees to accomplish more in less time lifts employee satisfaction, reducing employee turnover by 10% and associated costs by 155K every year

- Digital processes also minimize the need for paper, helping slash paper costs by 10%-15%

- Member experience improves and abandonment lowers with Digital Completion, lifting Net Promoter Score by 15 points

By implementing a Digital Completion solution, credit unions can instantly close more valuable transactions through end-to-end digital self-service, improving both their members’ experiences and empowering employees to work productively and deliver greater value to their bottom-line.

Lightico Delivers 360% ROI

Lightico Delivers 360% ROI