5 Ways Current Self-service Options Are Failing Both Bank & Customer

With such intense competition to attract and retain customers, traditional banks can ill-afford to keep turning banking experiences into a lengthy and arduous process. To improve efficiency and customer service, banks have invested in developing web pages, portals, and mobile applications. Yet still, self-service options today are not capable of meeting these priorities.

There are 5 main reasons why:

#1 Banking Processes That Should Be 100% Self-serve Are Still Driving Customers Offline

Far too many of today’s self-service options fail to enable customers to quickly and easily complete a request without forcing them to make that call to the contact center or visit their local branch.

In fact, a recent survey of over 1,000 banking customers shows that 63.9% of banking customers have been directed to a physical branch during an online banking interaction within the past 6 months.

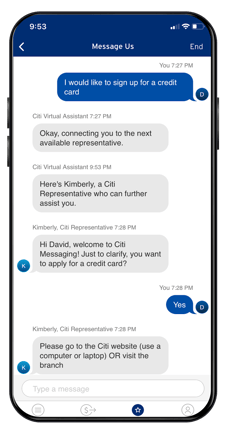

One of many such interactions is when a customer simply looking to apply for a credit card online ends up experiencing this instead:

Whether it’s applying for a credit card, or simple tasks like a change of address, most banking workflows today bounce customers across different channels — and more often than not the slowest and least convenient one for them.

#2 Digital Silos: A Patchwork of Solution That’s No Solution At All for Self-service Banking

Digital silos and legacy processes, which increase effort for both customers and banking employees. Cobbling together multiple siloed solutions that are not integrated results in vital gaps that leave customers with no other choice but to get off the self-service track and turn to contact center agents for assistance to complete them.

#3 Legacy Processes Prevent Agents from Efficiently Guiding Customers to the Finish Line

Siloed digital systems used by banks today are also heavily dependent on manual and paper-heavy legacy processes, such PDF-based forms and agreements that are often lengthy and difficult to understand. 62.5% of customers surveyed have been asked to print, sign, and email papers during an online banking transaction in the past 6 months.

#4 Outdated Banking Processes Equal High-Effort Customer Interactions

Multiple channels and paper-based processes needlessly add effort and frustration to the entire customer experience. Routinely they contact the call center or branch because they:

- Can’t clearly read or understand the details of a PDF form or Terms and Conditions document that they must sign, or supporting documents they’re required to provide to process an application or request

- Must print these documents out and once ready to complete them, have to look for printers, fax machines, and scanners just to simply get these documents back to their bank.

- Need to verify their ID and undergo authentication processes that the bank’s current self-service process can’t cover digitally, leaving no other option than to email copies of identification back to the contact center or paying a visit to the branch.

The result is higher effort and burden for customers and employees alike. Customers needing and expecting digitally complete banking processes continually find themselves bouncing from site/portal to the contact centers and branch, and must use email, printers, and scanners all along the way.

These high effort interactions are not only frustrating, they fall short of the standard customers expect today,who expect digital-only alternatives to complete their banking needs.

Research by Gartner shows that an overwhelming 96% of customers become disloyal after having a high-effort interaction - emphasizing that the more effort banks make their customers go through just to do business — the higher the risk that they’ll lose their loyalty to a competitor.

#5 Frustrated & Less Productive Employees Cost Banks in Overhead & Turnover

Customer effort and friction also spills over to banking employees in the form of significantly increased overhead costs. Call centers are flooded with mundane customer issues that should be Do-it-Yourself. Branch staff wastes time with servicing while fielding complaints from customers about why they can’t complete these requests online (and rightly so). And agents are not just tied with a slew of needless phone conversations, they also must expend time and effort dealing with the paper and admin work resulting from these broken journeys - That slows down productivity, ramps up frustration and damages employee job satisfaction, leading to increased turnover costs for banks.

Broken banking self-service results in:

- Poor onboard rates and higher journey abandonment due to uncomfortable, time-consuming tasks and repetitive compliance requirements.

- Longer turnaround times as due to excessive employee time and resources spent chasing customers for documents and signatures.

- Damaged NPS as a result of lengthy, unclear, and often painstaking manual processes.

- Lowered employee productivity due employees fielding excessive customer calls and complaints and handling paperwork.

Higher employee turnover and associated costs as agents are frustrated with mundane, manual tasks that prevent them from focusing on tasks that make a positive impact

How Banks Can Make True Self-service Happen with Digital Completion

To eliminate the costs, delays and friction caused by broken customer self-service, banks today need to swap the digital silos and manual legacy processes for one end-to-end digital solution designed for the way customers expect to do their banking today.

A Digital Completion solution integrates these workflows seamlessly into a bank’s existing infrastructure using flexible APIs. To scale yet customize automated workflows across a wide variety of customer-facing banking processes, this solution should require no code by IT, and should enable project managers to easily set up their own business rules and make adjustments on the fly by applying conditional logic.

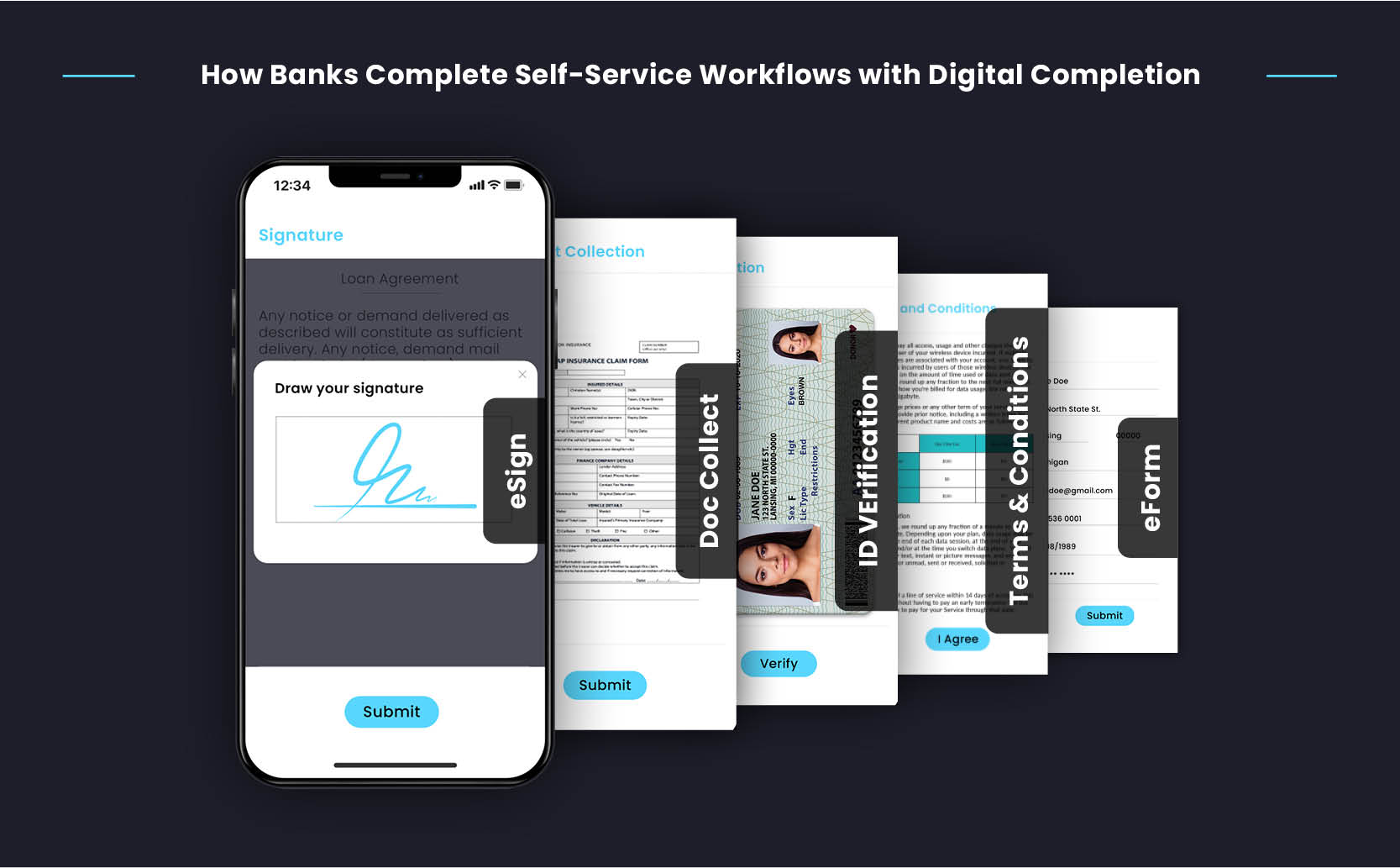

This allows for one completely digital self-service customer experience from start to finish, and just as importantly enables them to complete each step from their smartphone.

One intuitive digital session guides the customer through workflow tailored for precisely their scenario, allowing them to complete eForms and digitally sign them, verify ID, upload supporting records or documents, and instantly grant consent to the terms and conditions of an agreement.

One Digital Journey Enhances Agent-Assisted Interactions & Powers Productivity

Human interaction is still vital to accelerating customer-facing banking processes while delighting customers. Self-service banking options and agent assistance do not have to be mutually exclusive: Banks can benefit from both with Digital Completion capabilities that help agents guide a customer through a digital self-service process from beginning to close.

Instead of printing out forms and other banking documents, an agent sends the customer an SMS or email with a link that starts an interactive session through Interactive Voice Response (IVR), website engagement, or any other self-service link option. From here, the agent can help answer any questions the customer has - this helps the customer complete the process with minimal stress or friction while enabling the bank to process loans and transactions far more efficiently.

The Total Economic Impact of Digitally Complete Self-Service Banking

Eliminating needless time and effort on processes that can be digitized significantly enhances banks’ relationships with their customers - and their employees.

Leading research firm Forrester recently conducted a commissioned study to assess the Total Economic Impact™ banks are reaping from Lightico’s Digital Completion solution.

Forrester’s study assessed that using Lightico generates a 360% return on investment for banks. And while many businesses must often wait 3-5 years to see ROI on their technology investments, banks digitally completing their customer journeys with Lightico are gaining this return in 6 months or less.

What makes these bottom-line results possible in so little time with Digital Completion?

- Banks processing loans far more efficiently: Digitizing every step of the loan application process alone is saves over 250K cost-savings annually

- With legacy processes gone, employees are more productive and committed: Freeing up employees to accomplish more in less time lifts employee satisfaction, reducing employee turnover by 10% and associated costs by 155K every year

- Digital processes also minimize the need for paper, helping slash paper costs by 10%-15%

- Customer experience improves and abandonment lowers with Digital Completion, lifting Net Promoter Score by 15 points

By implementing a Digital Completion solution, banks and financial institutions can instantly close more valuable banking transactions through end-to-end digital self-service, improving both their customers’ experiences and empowering employees to work productively and deliver greater value to their bottom-line.

Learn how Lightico

can accelerate your organization's banking processes.