People Are Still Fearful of Face-to-Face Insurance Meetings

While many people have felt “pandemic fatigue”, which is characterized by people becoming complacent about coronavirus restrictions due to burnout, the data says different.

The survey results show that fears surrounding virus transmission are still alive and well. This is understandable given that most of the U.S. (and the world) had yet to be vaccinated against the virus, and new mutations threaten to undermine efforts to bring the pandemic to an end.

-1.png?width=730&name=callout%20(3)-1.png)

The Opportunity is There — For Insurers Willing to Grab It

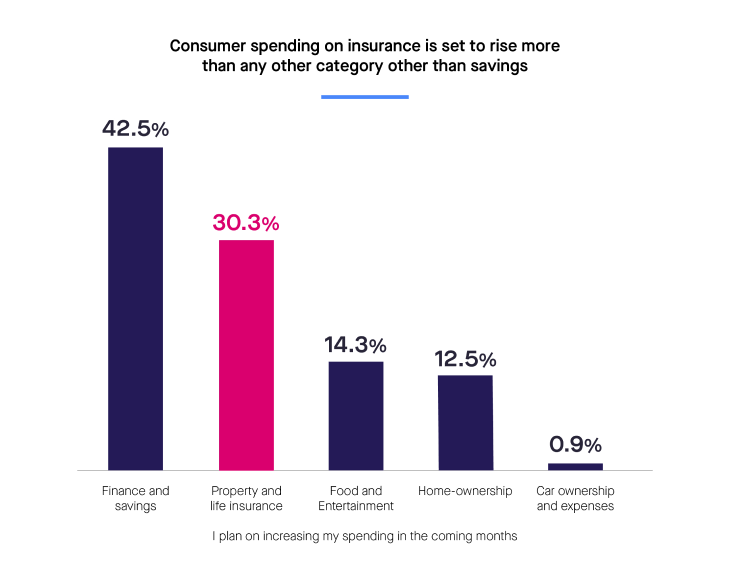

More than any other category, consumers are prioritizing putting their hard-earned money into insurance more than anything else, except personal savings. They view insurance as absolutely critical, with more than 30% saying they plan on increasing their spending on insurance in the coming months. This is significant, especially when considering that other essentials, such as food, homeownership, and car ownership are unlikely to see the same level of predicted growth.

And consumers’ behavior in the recent past suggests there is good precedent: a whopping 45% of consumers have shopped for car or home insurance in the past six months.

-1.png?width=730&name=callout%20(4)-1.png)

The coronavirus pandemic hasn’t stopped the insurance industry, not by a bit. The challenge now is capturing all this opportunity.

This is true for all forms of insurance that we investigated: property and casualty, health insurance, and more.

But there appears to be an especially important imperative to increase efforts to sell life insurance. In particular, it turns out that people who were sick or knew someone who was sick with the coronavirus are 60% more likely to make new life insurance purchases.

It’s very likely that experiencing or witnessing the debilitating effects of the pandemic first-hand makes people more likely to perceive worst-case scenarios not as a distant possibility, but as a very real threat that must be diligently prepared for. In any case, insurance companies have a special obligation to reach out to communities that were hit hardest by the pandemic.

But Obstacles to Selling Insurance Remain

Consumer interest in purchasing insurance products may be at an all-time high, but many insurers are accidentally squandering this opportunity.

The survey results show that insurers must improve the way they communicate with existing customers and prospects. As things stand, there is a major gap between how customers prefer to be contacted, and how insurers are actually communicating with them.

71% of respondents say they have struggled to connect with their insurers to ask questions or make modifications to their coverage. This still represents an improvement over consumer experiences in October, when 80% of respondents said the same. It’s likely that more insurance companies are getting savvy about their consumers’ changing needs. And those that fail to adapt will find it even harder to compete given the slow but steady improvements in customer communication across the industry.

-1.png?width=730&name=callout%20(5)-1.png)

To Capitalize On Opportunities, Focus on Digital ROI

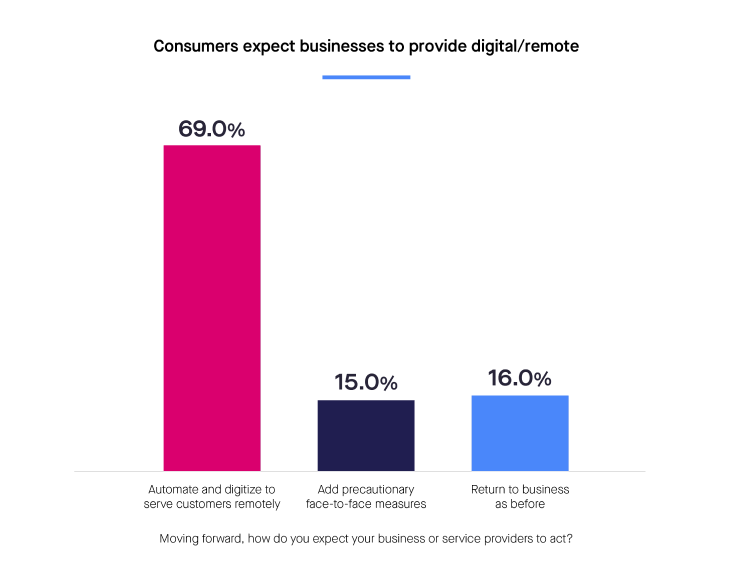

Insurers should take this time to revisit how they are communicating with their customers. The survey shows that customers want their insurers to communicate with them, but they’d prefer it to be through primarily digital channels — and not just as a stopgap.

In fact, nearly 70% of consumers say they expect the companies they interact with to “automate and digitize” services. A mere 15% are interested in slapping safety measures onto face-to-face interactions. And just 16% want to return to traditional, face-to-face ways of purchasing and getting service.

Done right, insurers stand to sell more policies at a time when Americans respond better to digital offerings than ever before.

Customers are ready, willing, and able to buy insurance — but providers must make it easy for them, even once the pandemic ends. Mandatory face-to-face meetings and inconvenient, non-digital channels such as fax machines and printers will continue to inhibit sales going forward.

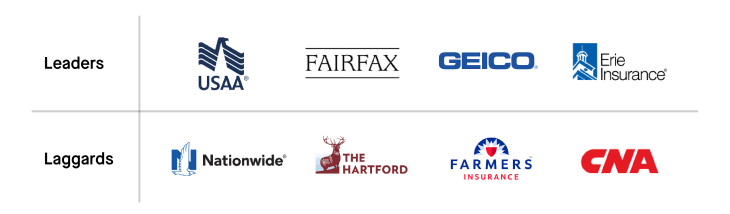

Leaders and Laggards in Digital Capabilities

Despite overall patterns and trends, insurance companies differ greatly in their ability to serve customers on their terms — in other words, digitally. Looking at apps, websites, touchpoints, omnichannel, etc. is one way to look at the ‘level of digital capabilities,’ but this can sometimes miss what consumers are actually experience. We asked, customers to simply rank their digital customer experience for their insurance providers to see what was their overall impression.

We found that there are definite leaders and definite laggards (as well as everyone in between). Here are the most striking results across insurance categories.

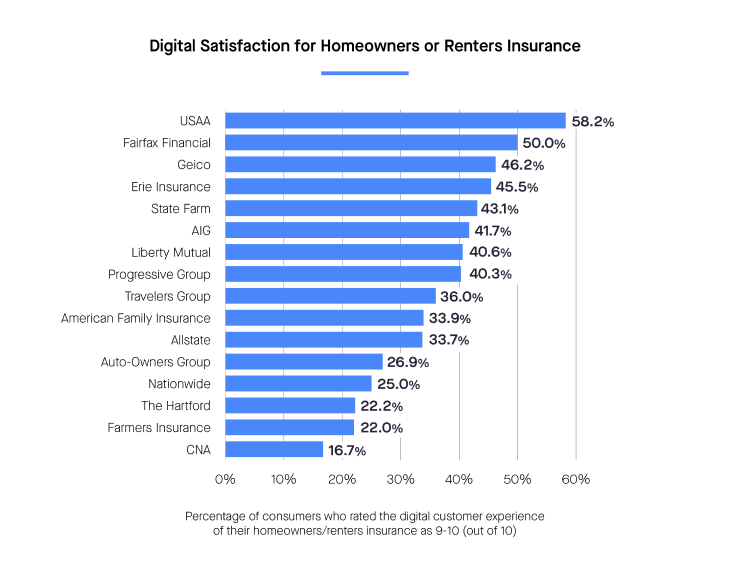

Leaders and Laggards in Homeowners/Renters Insurance

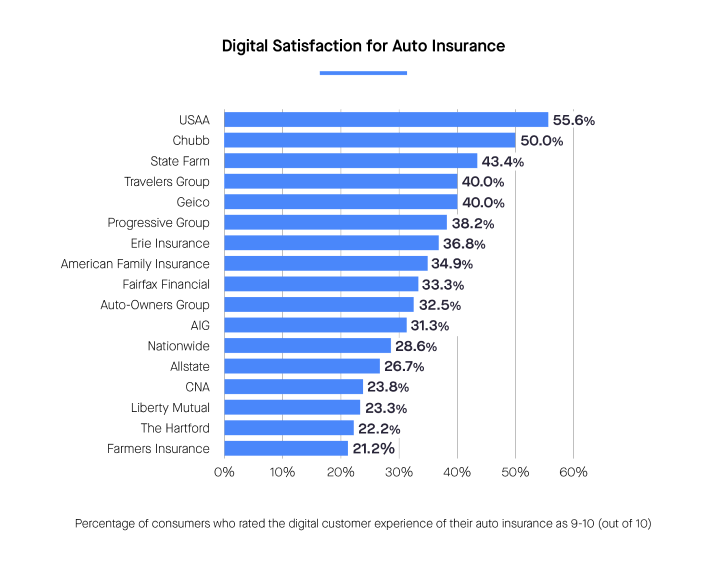

Leaders and Laggards in Auto Insurance

Leaders and Laggards in Auto Insurance

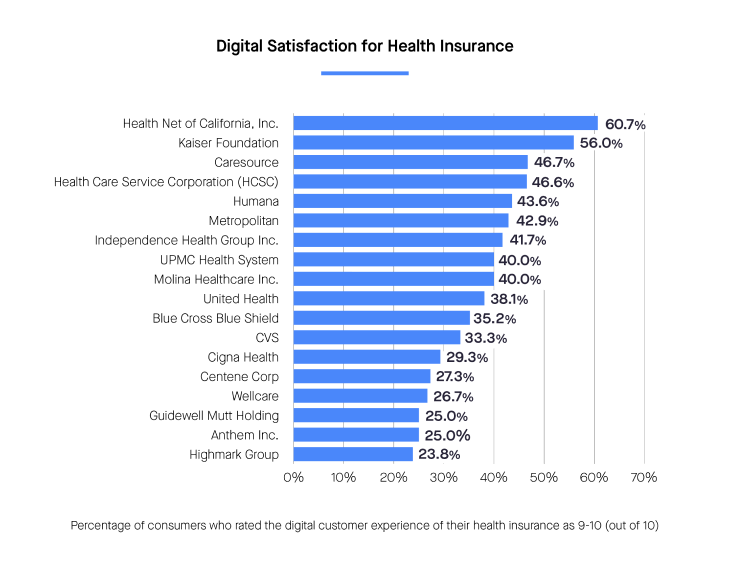

Opportunities For 2021: Put Customers First With Greater Automation and Digitization

If the coronavirus pandemic holds any lesson for insurance companies, it’s that they need to proactively win customers over. Flashy marketing campaigns and attractive prices are important, but they are not everything.

Today’s insurance customer is more risk-averse than ever, which seems to be driving much of this increased interest in purchasing insurance. But it’s up to insurance companies to capitalize on this flood of interest. And that means structuring sales and claims processes to be convenient, frictionless, and digital.

As we’ve seen, there is wide variability in insurance companies’ preparedness to serve customers on their terms.

By accommodating consumer preferences for digital processes, insurance companies can make sure they are among the leaders, setting the bar for everyone else rather than scrambling to catch up. This is indeed a powerful position to be in.

Feel the Power of Streamlined Digital Insurance

Try the Interactive Experience