This guide outlines banking in the digital world.

In this report, you’ll discover:

- Key areas for digitization

- Exact digital interventions and the metrics impacted

- Ways to secure immediate return on digitization

Please complete the form to access the free guide

The value of digital banking is well established by now: it’s convenient for customers, highly scalable, reduces the overhead costs of in-branch banking, and reduces turnaround times. The strengths of digital banking are also the drawbacks of in-branch banking; namely, branches are often less convenient for customers, difficult to scale, expensive to maintain, and prolong turnaround times due to paperwork and administrative upkeep.

Given the advantages of digital banking and the shortcomings of branch banking, there is an elephant in the room that must be addressed: why keep the branch around at all? Is it only a matter of time before the federal regulations that currently make it difficult to close branches loosen up and enable banks to do away with in-person banking once and for all?

The long row of bank tellers has been shrinking for years now, giving the appearance that the branch’s importance has diminished in favor of digitization. But that isn’t quite the right characterization. Rather, branches still very much have a future, but their role must be reimagined for the modern consumer’s needs.

Digitization is enabling today's branches to shift away from processing mundane tasks and empower bank agents to focus more on providing higher-quality and expanded advice, services, and products.

The branch isn’t dead—but it needs to evolve to meet new expectations and realities.

The High Cost of Low-Value

Branch Banking

Before the rapid digitization of banks, and before the coronavirus restrictions altered consumers’ digital habits, the branch was where you went where you wanted to get something done perfectly. After all, what could be more foolproof or comfortable than showing up to the local branch and handling a banking transaction with a familiar face?

What we overlooked is just how expensive it is to maintain bank branches that mostly handle routine transactions that could be easily completed digitally.

Banks invest an average of $2-4 million to open a new branch, and another $600,000 to $800,000 a year to operate it. Profitability may be negligible or take many years to be reached.

Banks invest an average of $2-4 million to open a new branch, and another $600,000 to $800,000 a year to operate it.

While real estate costs are a significant drain on banks’ funds, they are an inherent part of having a physical branch. Shutting down or merging branches is a major decision and may not always be possible or desirable. Instead, banks should look at a source of needless yet easily controllable waste: physical paperwork.

The Dodd-Frank Act, Basel II, and many other regulations increased the burden on banks to comply with new rules. This has led to evermore documents, forms, and signatures that are handled by the physical branch rather than more cost-effective and efficient digital systems.

Here are some of the areas and KPIs that take a hit when banks require customers to come to physical locations to fill out compliance paperwork—all of which directly impact the bank’s bottom line:

Completion Rates

Bank tasks are often abandoned if they require too much frustrating physical paperwork or branch visits. Account opening is arguably the most significant to a bank’s bottom line,

as each customer that fails to onboard represents a lost lifetime value. Credit card and

loan applications are also frequently abandoned due to insufficiently digital processes

and these missed opportunities are also costly for banks.

Remember that customers that begin a process always have the intention to complete it — otherwise, they wouldn’t have started it to begin with! Customers who can fill out and

submit their application 100% online are more likely to get to the finish line than those

who are bounced to non-digital channels or a physical branch.

Onboarding Rates

Once banking prospects have shown intent to sign up for an account, the last thing

banks should do is make that process harder than necessary for them. Yet research conducted by Deloitte has found that 40% of consumers have abandoned a bank’s account opening process, primarily due to lengthy paperwork and too many personal questions asked.

Far too many banks still require customers who are interested in opening an account to

schedule an appointment, fill out stacks of forms, and manually sign each page of

legalese. Customers who simply don’t have the time for this are liable to seek out a true

digital-first bank that won’t require them to take time out of their day to fill out mind-numbing forms.

.png?width=730&name=img%20(2).png)

Time to Funding

Whether they’re buying a home, a car, or something else, consumers no longer have

the patience for long loan application processes — and the inevitable waiting period

that accompanies these processes.

A recent Lightico study found that 42% of borrowers who abandoned their car loan

applications did so because it took too long to get funded.

Chasing customers for documents, printing and scanning forms, and dealing with

re-work when forms come back with errors all contribute to excessively long time to

loan funding.

Customer Loyalty

According to research conducted by Bain & Company, financial services companies

who increase their customer retention by 5% see a 25% jump in profits. Increasing customer satisfaction leads to greater loyalty, which has a direct positive impact on

banks’ bottom lines.

A Singapore-based bank called DBA found that its digital customers generate almost twice the income as its non-digital customers. That’s because they cost less to acquire,

take out more loans, invest more, and have higher deposits.

A Singapore-based bank called DBA found that its digital customers generate almost twice the income as its non-digital customers.

All of these are KPIs that are negatively impacted by branch-centric, paperwork-heavy processes that could be digitized but aren’t. When customers are forced to show up at a physical branch to finalize forms and documents or provide their signature, branches consume banks’ resources rather than add value.

In addition, all the money and employee energy being poured into processing physical aperwork is time not spent on higher-order activities.

Tasks like counting and sorting bills, printing forms, and scanning and uploading them are taking key personnel away from the very customers they are employed to serve. Meanwhile, this time-consuming mundane work frequently demands extra staffing, driving up costs.

Consumers Demand Digital

Excessive in-branch banking doesn't just make it more difficult for banks to meet their KPIs—it's out of alignment with consumer expectations. Customers get no extra value from a branch employee handling their physical paperwork—quite the opposite, they are put off by it given the digital alternatives.

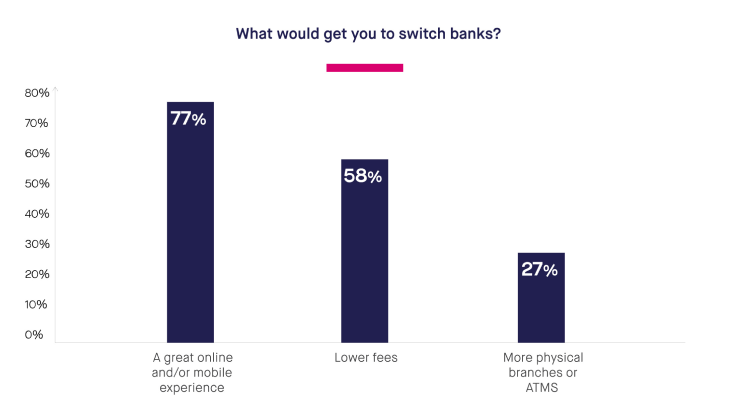

A Lightico survey of over 1,000 US banking customers found that the vast majority of customers (78%) would be more likely to switch banks if the alternative offered a great online and/or mobile experience. A mere 27% would make the switch if the alternative had more physical branches or ATMs. Notably, this survey was conducted before the coronavirus pandemic began, demonstrating that the demand for digital was rising fast even before digital became a necessity.

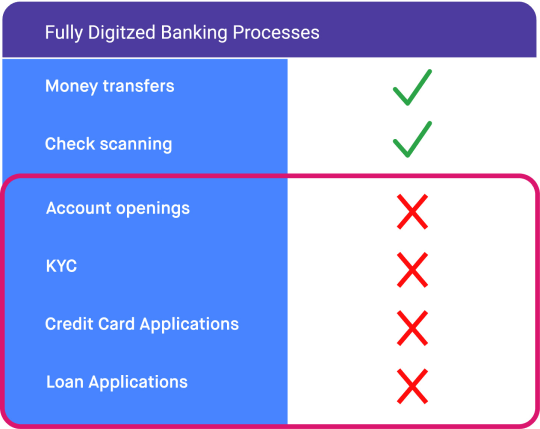

This shouldn’t come as a surprise. While nearly all banks now offer digital banking, complete digital journeys—in which customers can start and finish the same task entirely online—are still the exception when it comes to many banking activities. For example, we have found that most banks allow money transfers and check scanning to be completed entirely online or via mobile phone. However, when it comes to opening an account, providing KYC information, and applying for a credit card application or loan, customers are frequently redirected to physical branches even if they can begin the process online.

It’s common that at the last mile of the customer journey, when customers are eager to finish up and move on, that they are redirected to a physical branch to complete extra paperwork in-person. Their expectations of a smooth and effortless process are dashed as they are forced to print out forms, find time in their busy schedule to visit their local branch, and wait for a bank employee to become available.

When this happens, customer trust is tarnished, as customers thrive off predictability and clarity. And nothing could be less predictable or clear than beginning a task online and being bounced to a non-digital channel.

The coronavirus made such broken digital journeys a near impossibility to sustain. As the infectious disease swept the globe, banks, like all businesses, were shaken out of their complacency and moved to fully remote transactions where they didn’t exist before.

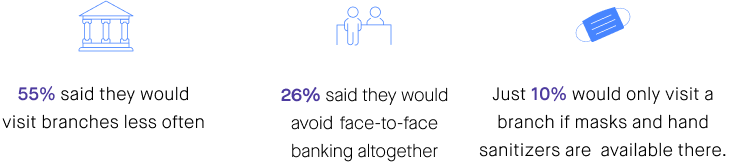

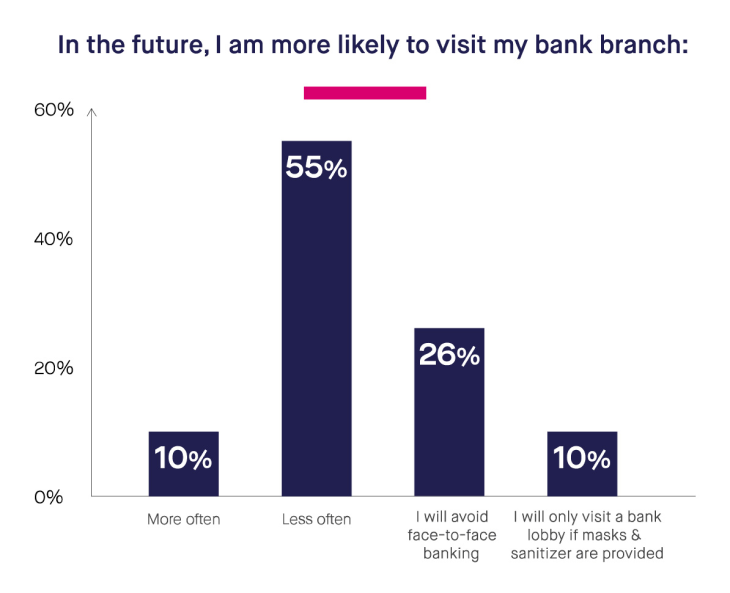

55% of consumers plan to visit branches less often in the future.

Many banks began adopting and promoting digital transaction capabilities such as eSignatures, remote document collection, chatbots, and text messaging-based customer communication.

Initiatives that would’ve taken years for cautious banks to implement were put into place in a matter of weeks. It took a major crisis, complete with branch closures and soft closures, to force these much-needed changes. But banks rose to the occasion, successfully transitioning to remote processes.

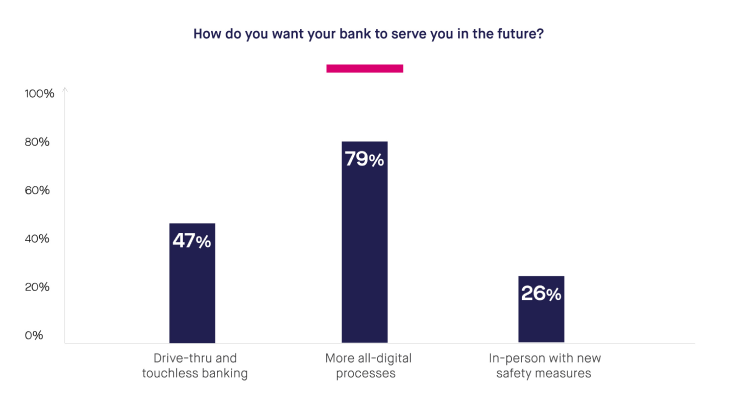

As lockdowns were lifted across the country, we surveyed another group of 1,028 Americans to see what they want from their bank branch going forward—even one the pandemic is over.

What we found was that customers were in no rush to return to the physical branch. Customers now demand streamlined, unbroken digital journeys, and are even willing to skip visits if it means they must visit a physical branch. In fact:

The voice of the customer has spoken, and it calls for reduced branch dependence, and more digital options. When asked about how they want to be served by their bank in the future, 79% said they wanted more all-digital processes, followed by 47% who looked forward to drive-thru and touchless banking.

Looking Ahead:

Eyes on the Customer, Not on the Paperwork

Today’s bank branches are still riddled with legacy processes — markers of an earlier era that they haven’t quite moved on from: physical paperwork, printers, scanners, and fax machines are all common accouterments at the branch. These vestiges still exist due to banks’ fears surrounding compliance, and the very real penalties of failing to comply with KYC and AML regulations. Compliance is critical, but mountains of physical paperwork is no longer a requirement to stay compliant.

Furthermore, the paperwork-heavy approach comes at a high price: the diminished quality of the customer experience, and exorbitant overhead and processing costs. All the time bank employees spend chasing customers for physical paperwork, maintaining the cash inventory, dealing with error-filled forms, and interacting with cumbersome non-digital channels such as printers and scanners is time not spent with the very people whom they are tasked to serve.

The branch of the future demands a new type of bank employee: a universal banker. This is an employee who is both tasked with helping customers complete routine interactions, as well as guiding and advising customers on issues of great importance, such as investments, account types, savings, and mortgage refinancing. More than three-quarters of US retail bank customers are interested in receiving financial advice or guidance from their bank, according to the J.D. Power 2019 U.S. Retail Banking Advice Study.

.png?width=730&name=img%20(3).png)

Branches that free themselves from traditional physical paperwork processing can devote more time and resources to personalized help, even in the digital age. This will also serve to differentiate traditional banks from branchless neobanks.

For routine transactions, the universal banker can allow customers to fill out forms, upload documents, provide a signature, and even get ID verified through a secure mobile or online interface.

As these platforms are typically based on encrypted technology and are in compliance with KYC regulations, they can usually take the place of time-draining and costly physical paperwork. Onboarding new customers, new loan applications, and loan modifications are just some of the activities that can be safely shifted to the digital sphere, with a banker providing real-time guidance over the phone if needed.

.png?width=730&name=img%20(4).png)

5 Power Plays to Maximize the Value of Branches

A full digital transformation of the bank branch can be an involved process, especially if it involves changing core systems. Fortunately, it’s the customer-facing systems that most impact agents’ and customers’ experiences and time. By digitizing the following customer-facing processes, branches can divert time and resources away from routine transactions and towards higher-value activities.

![]()

Play 1: Get eSignatures Completed Remotely, Quickly

![]()

Allow homebound customers to sign contracts, forms, and agreements from their cell phones. Banks can use mobile eSignatures to send documents directly to the customer’s cell phone via text message for immediate attention and easy completion. Unlike wet signatures and email eSign solutions, mobile eSignature solutions do not require going to a physical branch, dealing with snail mail, checking email inboxes, or even downloading annoying phone apps.

![]()

Play 2: Get Forms Completed Remotely, Easily, and Error-Free

Agents shouldn't be burdened with chasing customers to fill out forms or fix error-filled fields. User-friendly eForms provide customers with an intuitive interface so they can complete all the required information correctly the first time, eliminating rework and chasing.

![]()

Play 3: Instantly Collect Required Documents From Customers

Simplify document collection by enabling customers to use their cellphone cameras to easily snap and instantly submit pictures of these documents. Those collected documents are then associated with the customer file and securely stored with the rest of the customer records in the businesses’ CRM. This accelerates compliance processes and speeds cycle time by 80%, minimizing the back and forth between agents and customers.

Play 4: Collect PCI-compliant Payments Instantly

Digital solutions help customers buy what they need easily. They make collecting payments instant, convenient, and fully PCI-compliant. Today, too many banks have adopted non-compliant payment procedures that expose customer data to fraud risks and jeopardizes the company’s good name. The mayhem of the coronavirus has led to an increase in fraud attempts, making it more critical than ever to implement secure, mobile-friendly ways to process customer payments.

.png?width=730&name=img%20(5).png)

A Hybrid Digital and Branch Model

For Maximum Value

To ensure the continued relevance and cost-effectiveness of traditional banks into the future, branches can be reimagined as hubs of customer education and even product sales rather than sites of paper-pushing. Customers ought to be able to complete forms, documents, and identity verification processes remotely, digitally, and securely. The technology already exists to enable it. Customers must also be able to turn to their local branch and receive informed and personal advice when it comes to managing their finances.

By shifting bank employees away from tasks that can be digitized and automated, they can be newly empowered to bring more value both to customers and the bank itself.