Lightico commissioned Forrester Consulting to conduct a Total Economic Impact™ (TEI) study and examine the potential return on investment (ROI) enterprises may realize by deploying its digital completion platform. The purpose of this study is to provide readers with a framework to evaluate the potential financial impact of Lightico on their organizations.

Lightico is an intuitive, cloud-based software platform that automates all aspects of customer digital completion. Organizations that require multi step, customer-facing processes, including form exchange, identification (ID) verification, and electronic signature (e-signature) collection, are able to consolidate these steps into a single, cost-effective application, enabling internal efficiencies and enhancing the customer experience.

To better understand the benefits, costs, and risks associated with this investment, Forrester interviewed a digital and treasury manager at a North American bank with two years’ experience using Lightico. Forrester used this experience to project a three-year financial analysis.

Prior to using Lightico, the organization had inefficient know your customer (KYC) and anti-money laundering (AML) procedures in place. It lacked an integrated digital solution that included all necessary features for account creation, loan processing, and other forms of customer communications. Task completion and document collection were linear in nature, requiring multiple sequential steps for completion. Many tasks were done manually, leading to human error and incomplete files that did not always meet the organization’s internal and external regulatory and compliance standards.

After the investment in Lightico, the organization offers its customers and internal loan department a streamlined, digital process for account and loan processing and other transactions involving documentation. The internal loan department communicates, reviews, and collects all required documents, and it completes audits through the Lightico platform. For the organization’s customers, Lightico nearly eliminated the need for in-person visits, which was particularly beneficial during the COVID-19 pandemic.

Key Findings

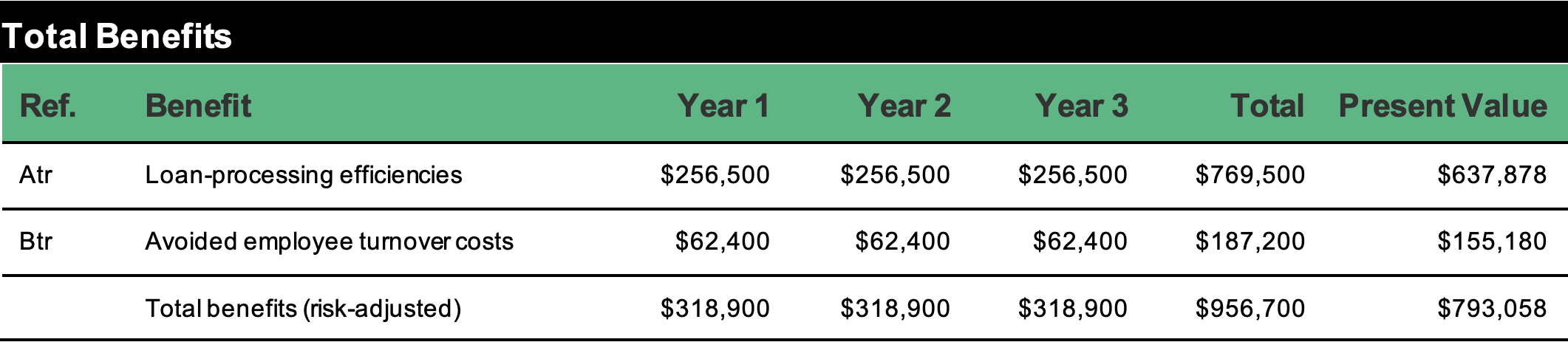

Quantified benefits. Risk-adjusted present value (PV) quantified benefits include:

-

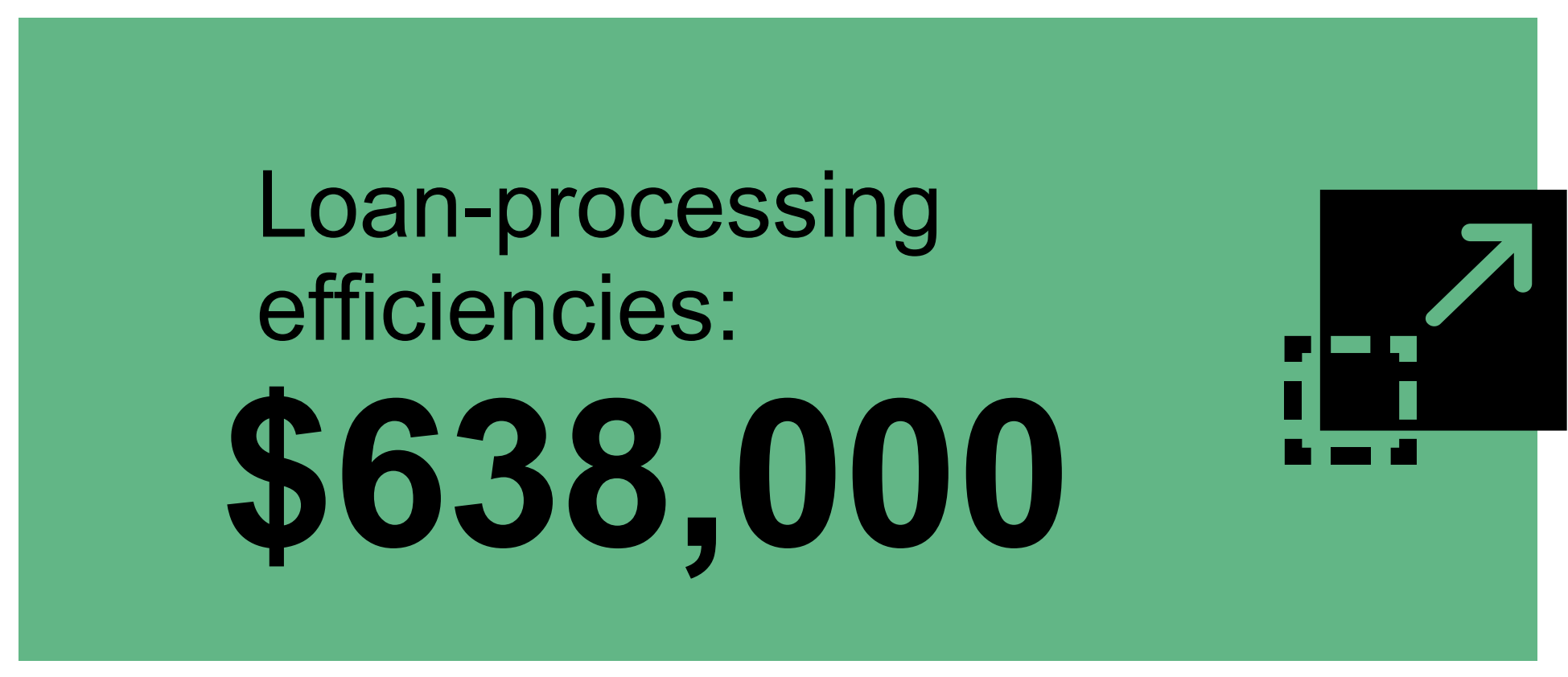

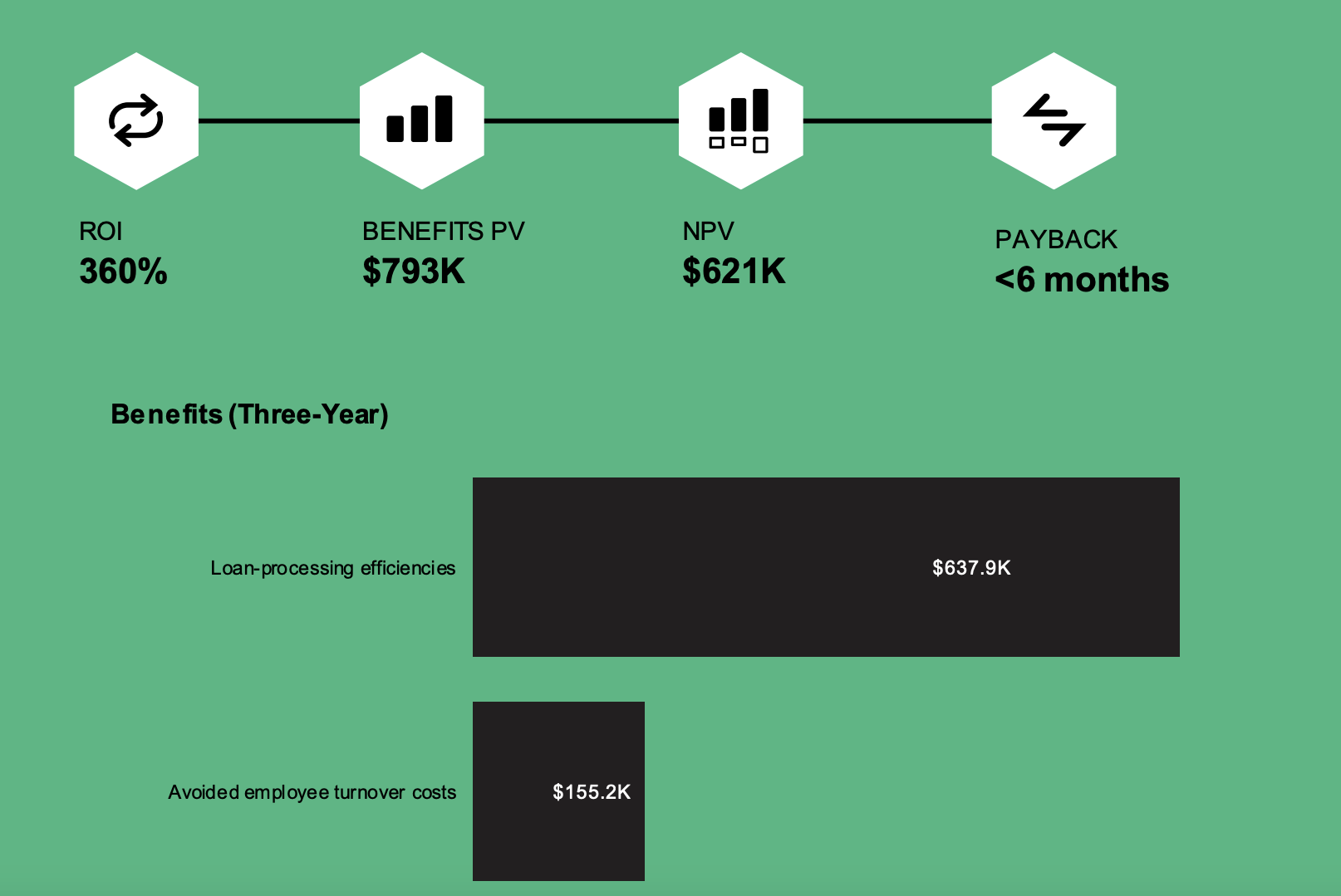

Loan-processing efficiencies. Lightico automates and facilitates every step of the loan origination process, enabling an organization to complete loan applications more efficiently and resulting in the execution of more loans. Communications, document sharing, identification verification, signature collection, and all other KYC and AML requirements are handled digitally. The average annual savings of this benefit is more than $250,000, generating a three-year, risk-adjusted present value (PV) savings of nearly $638,000

-

Avoided employee turnover costs. Because loan department employees can accomplish more in less time with the Lightico digital completion toolset, employee satisfaction is improved substantially. As a result, the organization enjoys a dramatic reduction in turnover of approximately 10%. The annual turnover cost savings result in a three-year, riskadjusted PV of $155,000.

Unquantified benefits. Benefits that are not quantified for this study include:

-

Improved customer experience. With an automated, streamlined toolset, customers can communicate, exchange required items, and comply from any remote location in a safe, efficient manner. The interviewee attributed the bank’s decrease in abandoned applications to Lightico’s nimble, customer-friendly solution. For the organization, this results in a 15-point increase in its Net Promoter ScoreSM (NPS). 1

-

Reduced paper costs. Moving most of its transactional business to the Lightico digital platform allows the bank to substantially reduce its need for paper. According to the interviewee, the organization realizes a 10% to 15% reduction in paper costs.

- Improved scalability and collaboration. Lightico enables the organization to improve its loan origination process from a linear system to one that allows the loan department to handle multiple cases requiring multiple items simultaneously. Additionally, processes are customized through Lightico to offer accessibility and visibility to permitted users, allowing comprehensive documentation review and eliminating errors.

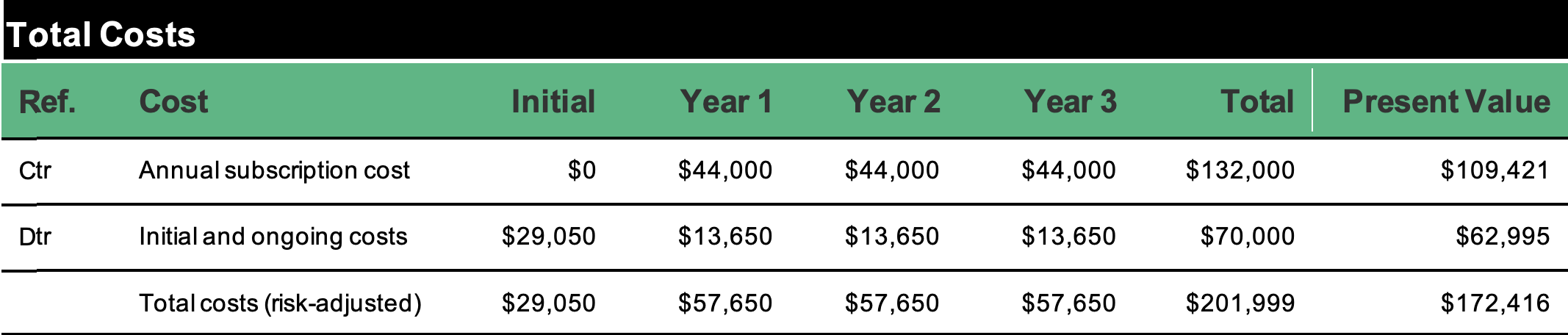

Costs. Risk-adjusted PV costs include:

-

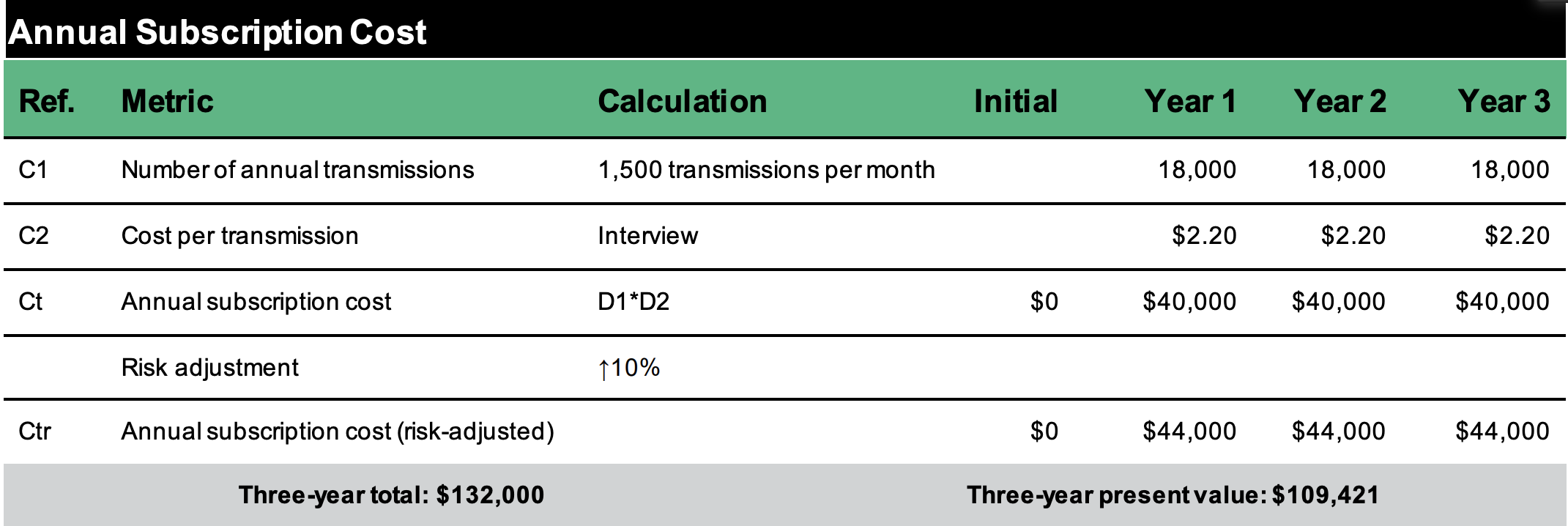

Annual subscription costs. The organization pays a set fee of $2.20 per transmission. At 1,500 transmissions per month, the result is a three-year, risk-adjusted PV of $109,000.

-

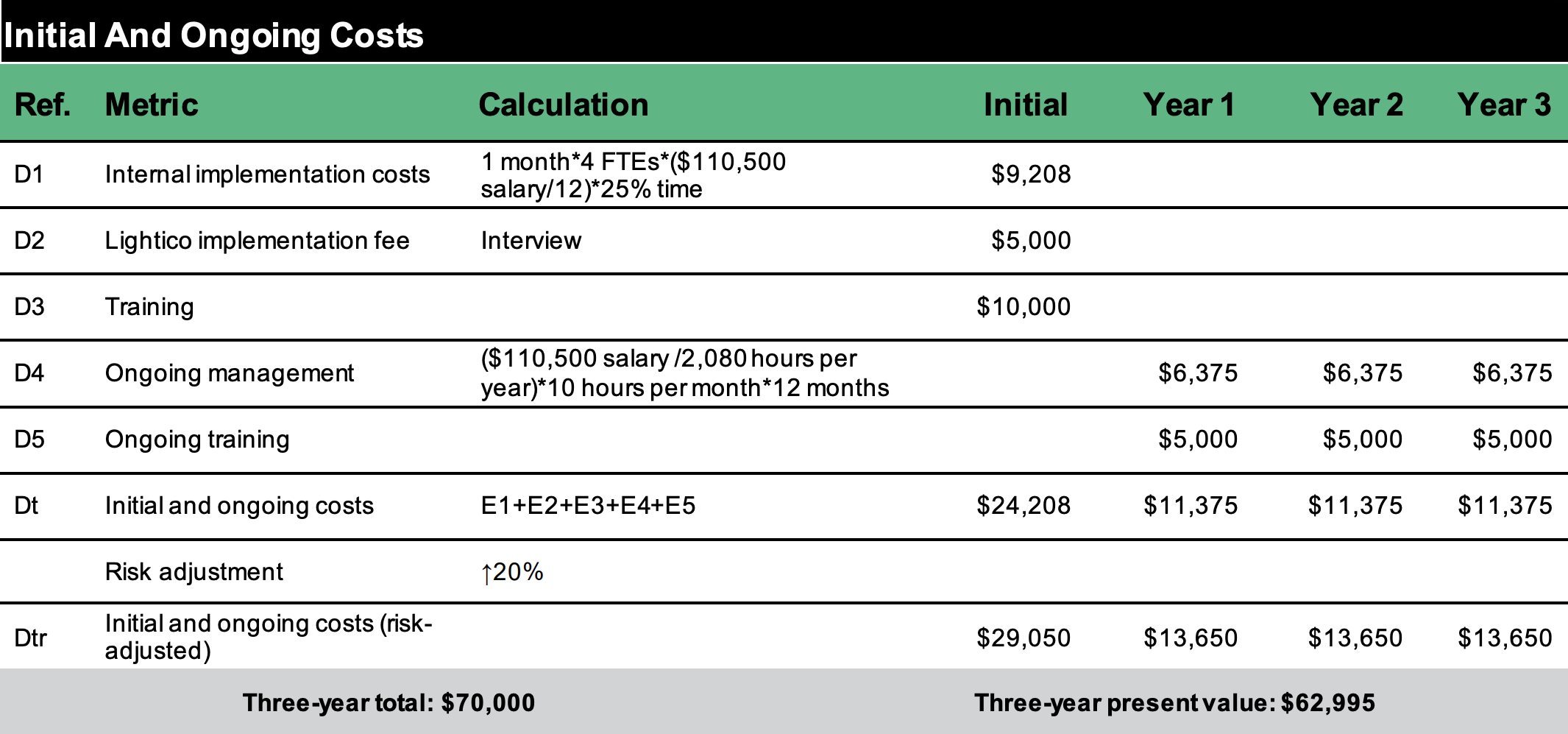

Initial and ongoing costs. Initial costs include four FTEs at 25% time earning a fully loaded annual salary of $110,500 required to implement the new platform. Initial costs also include a $5,000 implementation fee and $10,000 to cover internal training expenses. Ongoing costs include management time of 10 hours per month for one FTE earning a salary of $110,500, as well as $5,000 for internal training time. The total threeyear, risk-adjusted PV of initial and ongoing costs is just under $63,000.

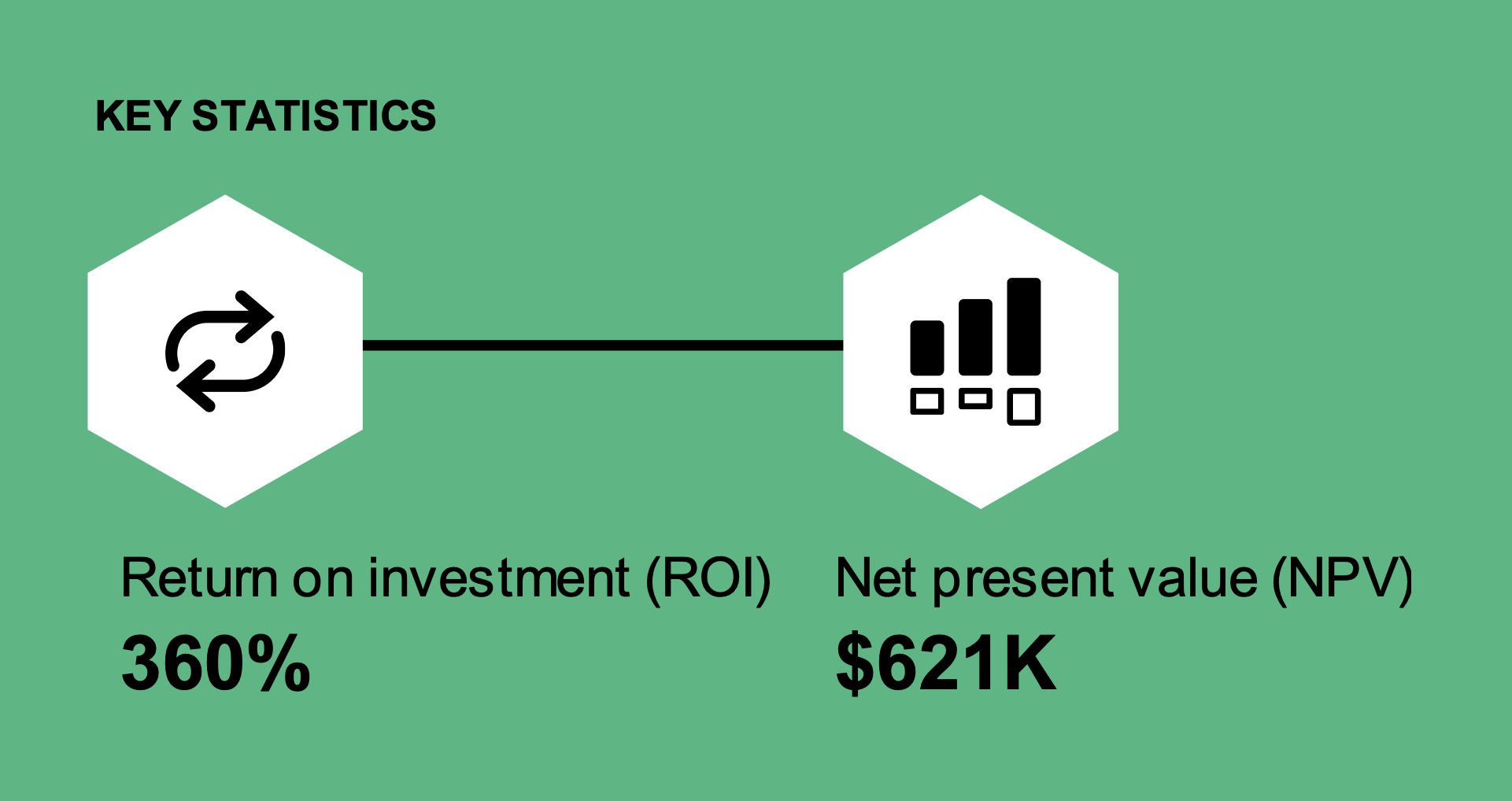

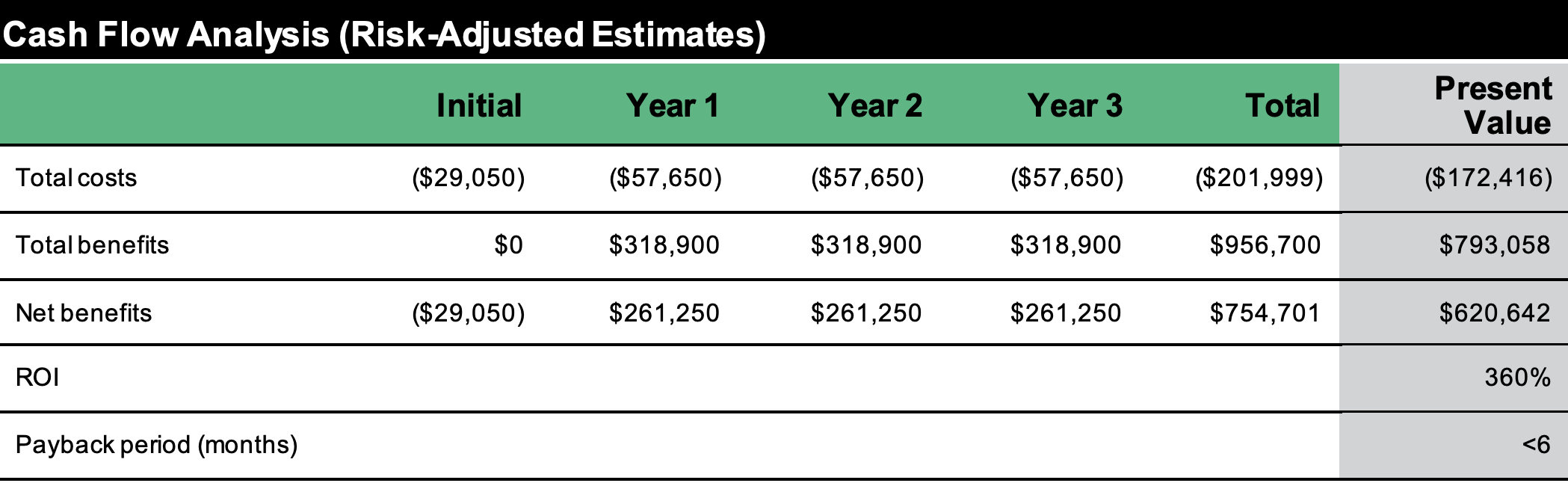

The interview and financial analysis found that this customer experiences benefits of $793,000 over three years versus costs of $172,000, adding up to a net present value (NPV) of $621,000 and an ROI of 360%.

Tei Framework and Methodology

From the information provided in the interviews, Forrester constructed a Total Economic Impact™ framework for those organizations considering an investment in Lightico.

The objective of the framework is to identify the cost, benefit, flexibility, and risk factors that affect the investment decision. Forrester took a multistep approach to evaluate the impact that Lightico can have on an organization.

DUE DILIGENCE

Interviewed Lightico stakeholders and Forrester analysts to gather data relative to the solution.

CUSTOMER INTERVIEW

Interviewed decision-makers at an organization using Lightico to obtain data with respect to costs, benefits, and risks.

FINANCIAL MODEL FRAMEWORK

Constructed a financial model representative of the interview using the TEI methodology and risk-adjusted the financial model based on issues and concerns of the interviewed organization.

CASE STUDY

Employed four fundamental elements of TEI in modeling the investment impact: benefits, costs, flexibility, and risks. Given the increasing sophistication of ROI analyses related to IT investments, Forrester’s TEI methodology provides a complete picture of the total economic impact of purchase decisions. Please see Appendix A for additional information on the TEI methodology.

DISCLOSURES

Readers should be aware of the following: This study is commissioned by Lightico and delivered by Forrester Consulting. It is not meant to be used as a competitive analysis. Forrester makes no assumptions as to the potential ROI that other organizations will receive. Forrester strongly advises that readers use their own estimates within the framework provided in the study to determine the appropriateness of an investment in Lightico. Lightico reviewed and provided feedback to Forrester, but Forrester maintains editorial control over the study and its findings and does not accept changes to the study that contradict Forrester’s findings or obscure the meaning of the study. Lightico provided the customer name for the interview but did not participate in the interview.

The Lightico Customer Journey

Drivers leading to the Lightico investment

Interviewed Organization

Forrester interviewed a Lightico customer with the following characteristics:

-

The interviewee is a digital and treasury manager at a North American bank that opens 1,000 loans per month.

-

An average of 1,500 transmissions are performed per month, including document exchange, ID verification, e-signatures, and other communications.

-

The interviewee manages 100 employees in the loan origination department.

Key Challenges

In its previous environment, the organization managed most of its customer account needs through in-person meetings, emails, and phone calls, which were time-consuming and limited the amount of documentation the loan department could process. The department also experienced high loan abandonment and exception, or error, rates due to the inability to collect and review all necessary documentation in an efficient manner. Lastly, the burden on customers was high, creating a poor experience.

The interviewed organization struggled with common challenges, including:

-

Lack of a digital loan completion solution. In the organization’s legacy environment, loan processing required face-to-face interactions to collect documentation and signatures. However, customers began to increasingly prefer a digital experience. Due to these digital industry changes, the organization needed to find a solution to remain competitive.

-

Time-consuming completion processes. To meet compliance and regulatory standards and minimize the risk of default or fraud, bank documents needed to be manually collected, organized, and reviewed. Absent a streamlined, automated solution, it often took weeks to identify and flag problems, such as missing or false application information.

-

Need for a lightweight, cost-effective solution. The organization searched for a cloud-based platform that fully met its digital transformation needs but also provided a low total cost of ownership (TCO).

“If we had not implemented Lightico before COVID, we would not have been able to function at near the capacity that we did. Almost everything that was accomplished during the pandemic was due to Lightico. Customers and employees had to do things through text and calls, and thankfully, we could do this with Lightico. If we hadn’t had it, we would have been almost at a standstill.”

- Digital and treasury manager, banking

Solution Requirements

The interviewed organization searched for a solution that could:

-

Provide a user-friendly, efficient, and secure, cloud-based tool for all customer-facing transactions.

-

Deliver all necessary digital functionality while meeting budget limitations.

-

Allow customization for select processes and integration with existing applications.

-

Be easily adopted by all relevant employees within the organization.

For this use case, Forrester has modeled benefits and costs over three years.

“The Lightico solution integrates in a way that is much better than our legacy environment. That was one of the main reasons we chose it. Its APIs are very, very easy. In fact, the ability to make a form from our documents and have the information automatically fed to the appropriate department was huge. That is something we didn’t have before, and even when we looked at the competitors, the integration lift was significantly larger than with Lightico. Our IT team loves the ease of use with Lightico’s API structure.”

-Digital and treasury manager, banking

Key Assumptions

-

North American bank

-

1,000 loans processed per month

-

100 FTEs in loan department

-

Loan service representative annual salary of $39,000

-

Experienced high turnover in legacy environment

Analysis Of Benefits

Quantified benefit data

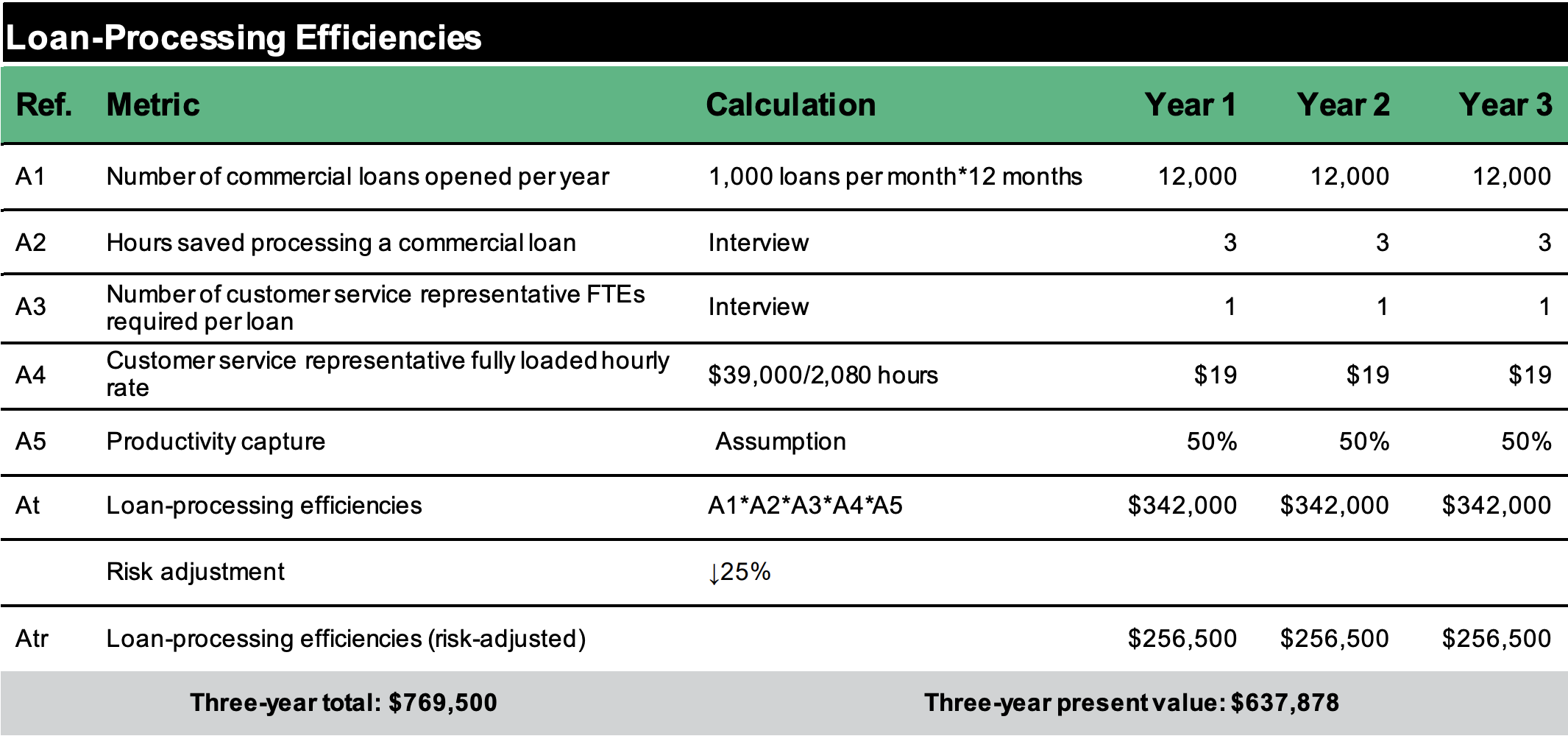

Loan-Processing Efficiencies

Evidence and data. The interviewee revealed the following about the organization’s use of Lightico:

-

Automating the document-sharing, ID verification, and e-signature collection processes allowed the organization to significantly reduce the time needed to complete the loan origination process.

-

The interviewee reported that in addition to gained efficiencies, loan documentation was more accurate, requiring less follow-up.

-

The digital and treasury manager commented: “The operational efficiencies provided by Lightico have reduced the time needed to process an account by several hours over several days. We are able to process more accounts in less time and process them more completely, with no leftover pieces needing attention."

Modeling and assumptions. For the financial analysis, Forrester assumes that:

-

One thousand loans are completed per month, with each loan requiring one FTE.

-

Three hours are saved per loan processed.

-

The fully loaded salary for the FTE is $39,000.

-

Forrester assumes a 50% productivity capture, as not all time gained equals productive time.

“With our larger commercial accounts, we often have multiple owners. Lightico allows us to collect necessary documents and signatures simultaneously, while significantly reducing our ‘exceptions.’ The tool ensures that we receive all the documents and signatures without having to manually track down missing items.”

- Digital and treasury manager, banking

Risks. Loan-processing efficiencies will vary with:

-

The volume of loans processed.

-

Salary, depending on industry and geographical location.

-

Baseline skillset and efficiency of loan department employees.

Results. To account for these risks, Forrester adjusted this benefit downward by 25%, yielding a three-year, risk-adjusted total PV (discounted at 10%) of $638,000.

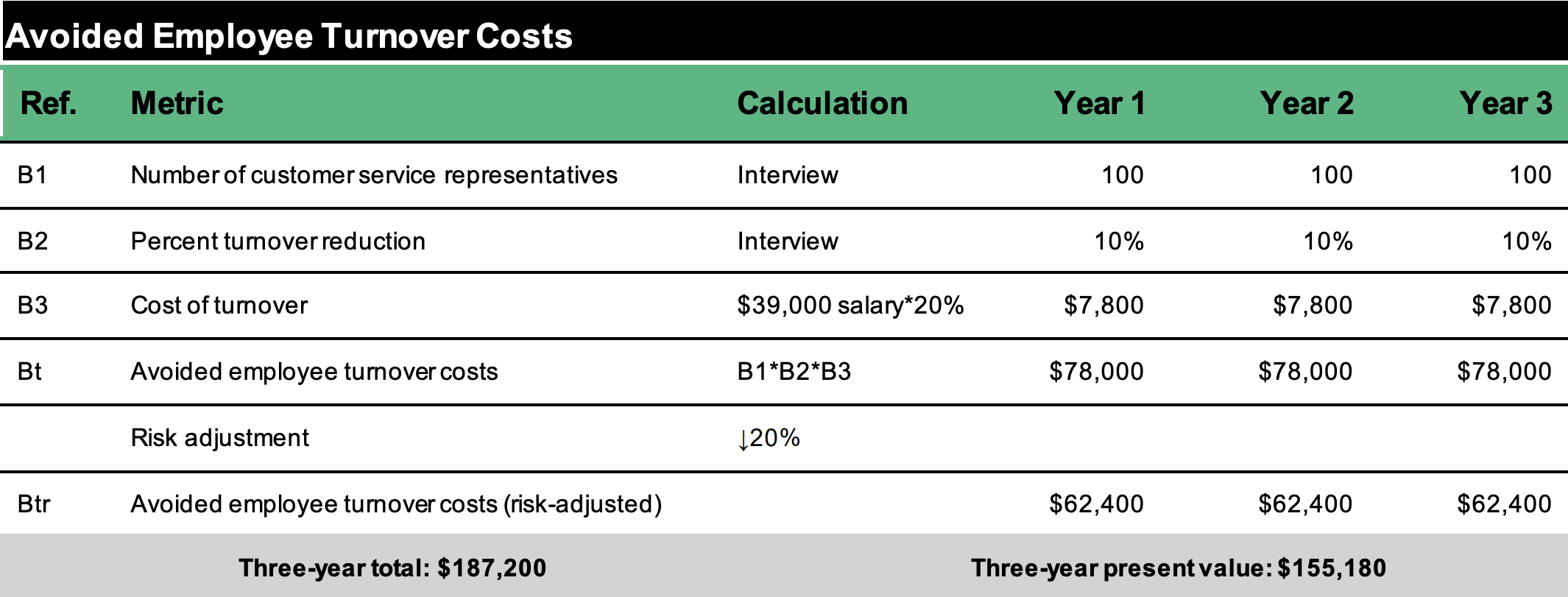

Avoided employee turnover costs

Evidence and data. The interviewee revealed the following about the organization’s use of Lightico:

-

Lightico enabled employees to accomplish more in less time, thereby significantly improving the organization’s employee experience. The interviewee noted that upon the adoption of Lightico, the organization realized a 15-point growth of its NPS score.

-

Loan processing was typically a high-turnover department within the bank. The improved employee satisfaction attributed to Lightico translated into notable turnover cost savings.

- “With Lightico, it is easier for our employees to accomplish their jobs. We have seen our retention rate increase, and we don’t need to replace positions because fewer people are needed. The accounts department was able to take on more and cover more ground,” said the digital and treasury manager.

Modeling and assumptions. For the financial analysis, Forrester assumes that:

-

The number of customer service representatives in the loan department totals 100.

-

The organization realizes a 10% reduction in turnover.

-

The cost of turnover is 20% of salary.

Risks. Avoided employee turnover costs will vary with:

-

The total number of customer service representatives within an organization.

-

The cost of turnover, depending on industry and geographical location.

-

Legacy turnover rate.

Unquantified Benefits

Additional benefits that the customer experienced but was not able to quantify include:-

Improved customer experience. Streamlining all aspects of the loan-processing journey, Lightico fulfills the organization’s customer experience expectations. It takes a cumbersome manual process and turns it into a fast and transparent one that runs like a digital transaction. The manager stated: “The overall feedback that we have received from customers is overwhelmingly good. Not only good, but exceptional.”

-

Reduced paper costs. Processing new accounts and loans in a digital environment significantly reduces the need for paper supplies. “We were able to decrease our paper costs by 10% to 15%, which, when you talk about how much paper costs, is actually quite considerable,” noted the interviewee.

-

Reduction of regulatory and compliance issues. Lightico allows the bank to have more general oversight of its loan completion steps. Through its automation, steps are completed quickly and more accurately, leading to a decrease in exceptions that can be timeconsuming and lead to regulatory fines or penalties. Automated processes are also easier to audit. The interviewee said: “Lightico makes us look better in the eyes of the examiners because of our improved process. We are able to get customer documents and signatures quickly and have considerably fewer exceptions that require attention. Our examiners are thrilled with our new process and the ensuing results.”

-

Improved scalability and collaboration. The automated simplicity of Lightico coupled with its measured results make it a desirable solution for all branches of the bank. “Once the other teams at the bank saw the customer satisfaction, employee satisfaction, and ease of use, they all wanted to use Lightico for their customer-facing tasks,” reported the interviewee. Lightico also promotes external growth by facilitating the simultaneous onboarding of large numbers of acquired accounts. The interviewee noted: “We recently acquired a bank. Lightico enabled us to migrate that bank’s existing customers into our online platform in less than one day. My team members were in multiple locations, but they were all able to get everything done quickly from their remote locations.”

Flexibility

The value of flexibility is unique to each customer. There are multiple scenarios in which a customer might implement Lightico and later realize additional uses and business opportunities, including:

-

Adaptability to internal processes. The Lightico platform can streamline other bank processes beyond account processing. The interviewee reported: “Lightico is not only easy for the customer; it is also super-efficient for the bank. We are finding additional ways to use the platform to reduce the need for paper and physical files.”

-

Ability to customize. In addition to providing digital completion tools in a single application, Lightico allows the bank to use its client communications to customize its interaction in real time to best match the customer’s transactional needs. “With Lightico, you are able to communicate and have the friendly experience that we consider important to our business. We have clients in a wide variety of locations, both urban and rural. We can talk with clients from their homes or from their tractors, and customize that discussion to best meet their needs,” commented the interviewee.

-

Flexibility would also be quantified when evaluated as part of a specific project (described in more detail in Appendix A).

Analysis Of Costs

Quantified cost data

Annual Subscription Cost

Evidence and data. The interviewee revealed the following about the organization’s use of Lightico:-

The organization performs 1,500 transmissions per month.

-

The subscription cost per transmission is $2.20.

Risks. The total annual subscription costs will vary with:

-

Volume of transmissions, depending on type and size of organization.

-

Subscription cost, depending on application and volume.

Results. To account for these risks, Forrester adjusted this cost upward by 10%, yielding a threeyear, risk-adjusted total PV (discounted at 10%) of $109,000.

Initial and Ongoing Costs

Evidence and data. The interviewee revealed the following about the organization’s use of Lightico:

-

Implementation required four FTEs for one month.

-

Ongoing management is handled by the digital and treasury manager and mostly entails user access permission reviews and relationship management.

-

Ongoing training expenses are insignificant due to the user-friendly nature of the platform. Most training is focused on relevant internal policies.

-

For the financial analysis, Forrester assumes that:The four FTEs involved in the implementation dedicated 25% of their time.

-

The fully loaded salary of each FTE involved in the implementation and ongoing management equals $110,500 per year.

-

The organization paid a one-time implementation fee of $5,000, and the initial training cost to the organization $10,000.

-

Ongoing training per year is $5,000 and covers internal resource time.

Risks. The total initial and ongoing costs will vary with:

-

Salaries of the management team, depending on industry and geographical location.

-

Baseline skill set and experience of the management team.

-

Level of change management required, depending on the size of the organization and adaptability of team members.

“Lightico is so very user-friendly, to the point where we barely needed to train. The only pieces that we trained on were the chat feature, explaining what we consider proper and not proper for a chat. Training on how to use Lightico was very minimal.”

- Digital and treasury manager, banking

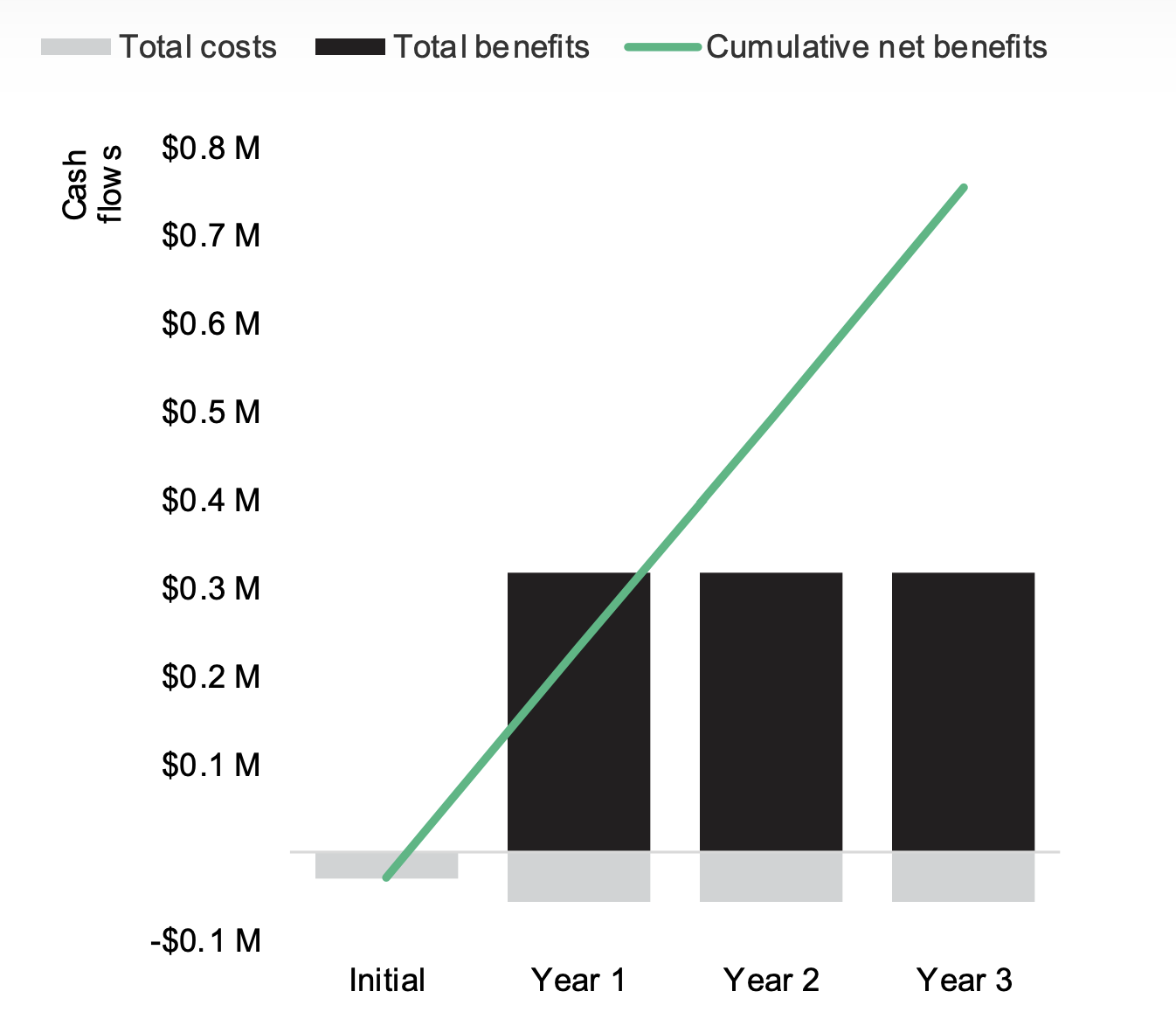

Financial Summary

Consolidated Three-Year Risk-Adjusted Metrics

Cash Flow Chart (Risk-Adjusted)

The financial results calculated in the Benefits and Costs sections can be used to determine the ROI, NPV, and payback period for the organization’s investment. Forrester assumes a yearly discount rate of 10% for this analysis.

These risk-adjusted ROI, NPV, and payback period values are determined by applying risk-adjustment factors to the unadjusted results in each Benefit and Cost section.

Appendix A: Total Economic Impact

Total Economic Impact is a methodology developed by Forrester Research that enhances a company’s technology decision-making processes and assists vendors in communicating the value proposition of their products and services to clients. The TEI methodology helps companies demonstrate, justify, and realize the tangible value of IT initiatives to both senior management and other key business stakeholders.

Total Economic Impact Approach

Benefits represent the value delivered to the business by the product. The TEI methodology places equal weight on the measure of benefits and the measure of costs, allowing for a full examination of the effect of the technology on the entire organization.

Costs consider all expenses necessary to deliver the proposed value, or benefits, of the product. The cost category within TEI captures incremental costs over the existing environment for ongoing costs associated with the solution.

Flexibility represents the strategic value that can be obtained for some future additional investment building on top of the initial investment already made. Having the ability to capture that benefit has a PV that can be estimated.

Risks measure the uncertainty of benefit and cost estimates given: 1) the likelihood that estimates will meet original projections and 2) the likelihood that estimates will be tracked over time. TEI risk factors are based on “triangular distribution.”

The initial investment column contains costs incurred at “time 0” or at the beginning of Year 1 that are not discounted. All other cash flows are discounted using the discount rate at the end of the year. PV calculations are calculated for each total cost and benefit estimate. NPV calculations in the summary tables are the sum of the initial investment and the discounted cash flows in each year. Sums and present value calculations of the Total Benefits, Total Costs, and Cash Flow tables may not exactly add up, as some rounding may occur.

PRESENT VALUE (PV)

The present or current value of (discounted) cost and benefit estimates given at an interest rate (the discount rate). The PV of costs and benefits feed into the total NPV of cash flows.

NET PRESENT VALUE (NPV)

The present or current value of (discounted) future net cash flows given an interest rate (the discount rate). A positive project NPV normally indicates that the investment should be made, unless other projects have higher NPVs.

RETURN ON INVESTMENT (ROI)

A project’s expected return in percentage terms. ROI is calculated by dividing net benefits (benefits less costs) by costs.

DISCOUNT RATE

The interest rate used in cash flow analysis to take into account the time value of money. Organizations typically use discount rates between 8% and 16%.

PAYBACK PERIOD

The breakeven point for an investment. This is the point in time at which net benefits (benefits minus costs) equal initial investment or cost.

Appendix B: Endnotes

1 Net Promoter, NPS, and the NPS-related emoticons are registered U.S. trademarks, and Net Promoter Score and Net Promoter System are service marks, of Bain & Company, Inc., Satmetrix Systems, Inc. and Fred Reichheld.