The Problem: Digital Silos & Legacy Processes Create Painfully Broken Insurance Journeys

Too often customers are bounced between different channels (like face-to-face, portals, phone calls, email, and printers) just to open a new policy, modify an existing one, or submit a claim. Digital silos that are poorly integrated demand additional steps from customers to complete and rely on manual legacy processes like PDF, scan and even fax.

These high-friction and needlessly lengthy sales and servicing cycles are costing insurers and brokers new and existing customers to competitors, while inflating costs, draining employee productivity and creating compliance nightmares.

Today's Typical Broken Insurance Journey

Siloed systems and legacy processes make it impossible for customers to complete quickly, compliantly, and remotely.

Customers attempt to complete their transactions online or over the phone, but are frequently bounced to additional channels — adding friction and frustration:

.gif?width=730&name=broken-journey-animation%20(1).gif)

The Challenges of Current Insurance Interactions

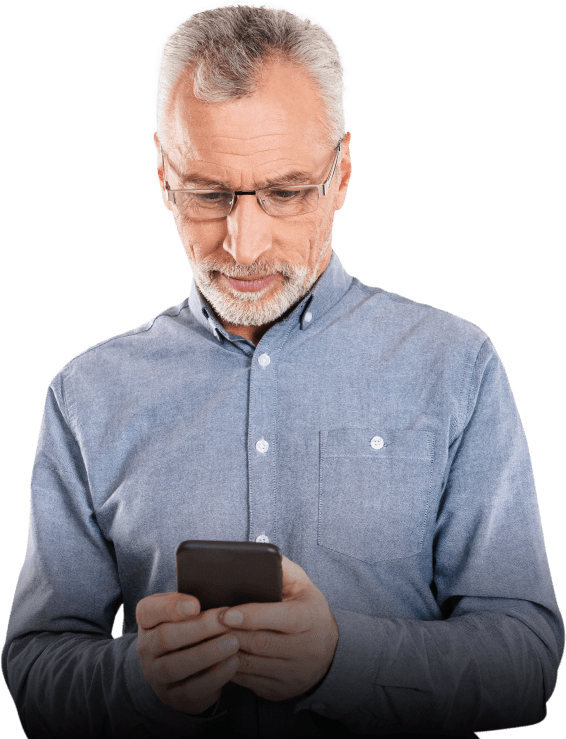

Customers Are Mobile & Impatient

Today’s consumers expect the same visual, fast, and intuitive experiences they're used to receiving from brands like Apple and Amazon from their insurer. Choppy insurance processes that rely on multiple touchpoints, limited access and in-person visits won’t cut it.

Insurers Need to Support Customers Across Many Touchpoints

Customers expect seamless and complete experiences across all touchpoints. Whether they interact via website, their mobile phone, at the office, an app or call a call center, insurers must deliver easy and complete customer service.

Siloed Digital Solutions Bounce Customers Across Channels

Despite insurers' enormous investments in digital solutions, customers have yet to benefit from end-to-end digitization of their experience. Instead, they enjoy only partial digital experiences stitched together with manual, cumbersome processes.

Reliance on Agents to Complete Many Tasks

Customers are often forced to speak with an agent to complete a basic task like changing an address or finding a document. Not only does this frustrate customers that are used to 24/7 access to information, it burdens capable insurance advisors with menial work that needlessly burns them out and takes their efforts away from higher value activities.

Complex & Changing Compliance

Requirements are frequently updated, which means that insurers and brokers need to keep their processes up-to-date. This means that maintaining a compliant stance slows down decision making and impacts onboarding and service efficiency.

The Impact of Broken Insurance Journeys

Digitally broken insurance processes damage the KPIs insurers value most, leading to:

![]()

Poor Completion Rates

Disjointed onboarding and new policy cycles lead prospects to drop off from the process due to confusion or frustration.

Long Turnaround Time

Customers who fail to complete insurance requests quickly and digitally are at a higher risk of abandonment or churning.

Inflated Costs

Integration and maintenance of digital silos burdens IT resources while manual processes ramp up Cost per Claim.

![]()

Low NPS

Net Promoter Score (NPS) is harmed during both onboarding and servicing due to poor customer experience.

![]()

High Agent Turnover

Agents are dissatisfied due to choppy and ambiguous processes.

Burdensome Compliance Procedures

Human errors and misunderstandings are rampant for both agents and customers, complicating compliance.

The Solution: Digitally Complete Every Insurance Process with Lightico's Digital Completion Cloud

Lightico's Digital Completion Cloud enables insurers to digitize all customer-facing interactions throughout their customer's lifecycle, from onboarding and new policy sales to processing claims and servicing. One end-to-end digital workflow lets insurers complete processes quickly, and in the way that's easiest for their customer — directly on their mobile phone.

With all functionality seamlessly integrated, insurers can collect signatures, digital forms, and documents from customers, review supporting documents together in real-time, and notify them on completion. Lightico makes frontend processes more efficient so insurers can minimize back-office overhead, swiftly complete processes and accelerate time to ROI while enhancing customer loyalty.

Businesses can automate and orchestrate end-to-end journeys with no-code workflows. They can set, monitor and improve journeys to ensure they meet both customer expectations and business needs.

And they can plug into secure systems through pre-built integrations and robust APIs to maximize efficiency and productivity across all touchpoints.

How the Digital Completion Cloud streamlines entire customer journeys:

Truly Real-Time

All required documents are quickly collected, and digitally completed in real-time on your mobile phone. By removing the waiting period, costs, frustrations, and turnaround time are reduced.

All In One Place

Insurers can manage all customer-facing tasks (including eSignatures, ID verification, document collection, Ts & Cs, payments) from one system.

Intelligent & Automated

Any business user can design intelligent workflows that automate the full journey and customize it to each customer or use case, preventing missed steps and silos.

Fully Integrated

Insurers get more value from their existing

system via pre-built and fully integratable

APIs. Enjoy fast time to operations and value with low risk.

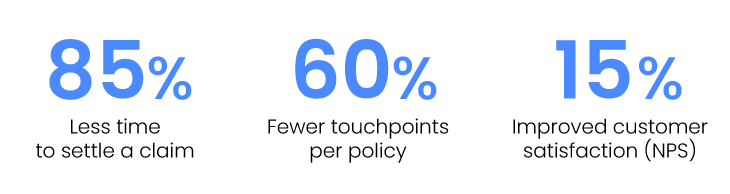

The Business Impact of Digitally Complete Journeys

The Lightico platform streamlines entire insurance processes by integrating these core capabilities:

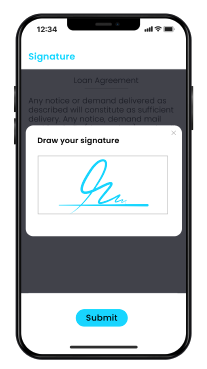

Real-time eSignatures

Customers easily provide consent through legally binding, mobile-optimized eSignatures.

Results:

Faster signature collection, better compliance, improved NPS.

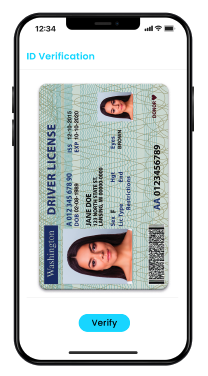

ID Verification

Verify ID & documents in real-time for KYC and reduced fraud risk.

Results:

Better alignment, higher closure rate, and lower cancellations.

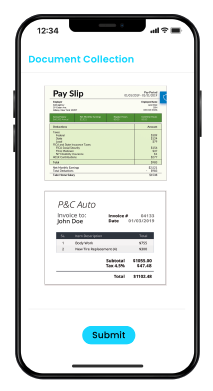

Document Collection

Speed cycle times by up to 80% with instant document collection.

Results:

Faster turnaround time, higher NPS.

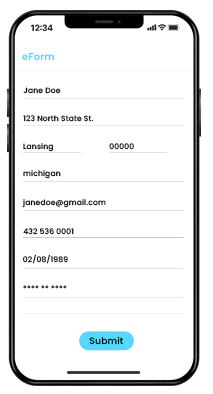

eForms

Eliminate rework by converting clunky forms into smart, mobile-friendly forms based on conditional logic.

Results:

Better alignment, improved NPS.

Instant Ts & Cs

A no-code workflow based on business logic automatically generates the digital T&C and relevant documents for signature based on the chosen offering. This helps prevent human error and eliminates the need for lengthy agent scripts.

Results:

Zero errors, higher compliance rate, slashed AHT.

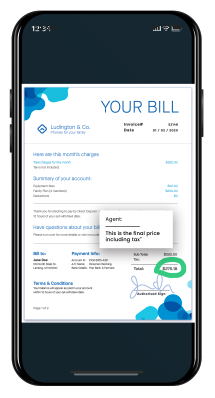

Shared Review

Customers and agents co-view the customer’s policy or claim at the end, adding a final layer of clarity and cementing trust.

Results:

Higher closure rate and first call resolution (FCR).

No-Code Workflows Scale Customized Insurance Journeys

Traditional solutions force insurers to turn to their IT department each time they want to make a change. In many cases a change request needs to be raised with the vendor. This leads to inefficiencies and potential compliance lapses.

In contrast, we believe in empowering the people who know the processes best to make immediate adjustments to workflows without delay. Insurers and brokers that deploy Lightico’s solution benefit from zero coding requirements from IT and development teams. Our customers easily configure and update workflows, forms, fields, and offerings from a user-friendly, drag-and-drop admin console.

Optimize Onboarding, Policy Sales, & Claims Processing With Automated Workflows

No-code workflows enable easy configuration of entire customer journeys. Add key capabilities and conditions to workflows to optimize KPIs in an agile way.

The Difference of Digital Completion

Accelerate Customer Acquisition, Policy Sales, & Claims

Onboard new customers, open up new policies and process claims faster by automating the collection of forms, signatures, documents and payments.

Lift Customer Satisfaction

Ensure a headache-free, frictionless experience for greater satisfaction and loyalty.

Ensure Compliance & Mitigate Fraud

Ensure a secure audit trail and reduce the risk of fraud while maintaining full compliance.

Cut Management Costs

Slash turnaround time and eliminate rework and staff overhead to keep the costs of processing down.

![]()

Eliminate Paper Waste & Reach ESG Goals

Greatly reduce carbon footprint and strengthen sustainability by replacing paper documents with entirely digital processes.

Learn about more insurance processes you can accelerate with Lightico: