What is IDP?

IDP leverages and combines Artificial Intelligence (AI), Large Language Models (LLM) , Optical Character Recognition ( OCR), and natural language processing (NLP) to seamlessly extract data from a diverse array of documents, including scanned forms, handwritten content, and digital submissions.

IDP accurately identifies and interprets textual content within documents, transforming unstructured data into structured, machine-readable formats. This automated extraction process not only expedites the input of applicant information into data systems but also significantly reduces the burden of manual data entry or 'human-in-the-loop' validation for underwriting analysts and other loan processing personnel.

Discover the Transformative Power Lightico AI-Powered IDP

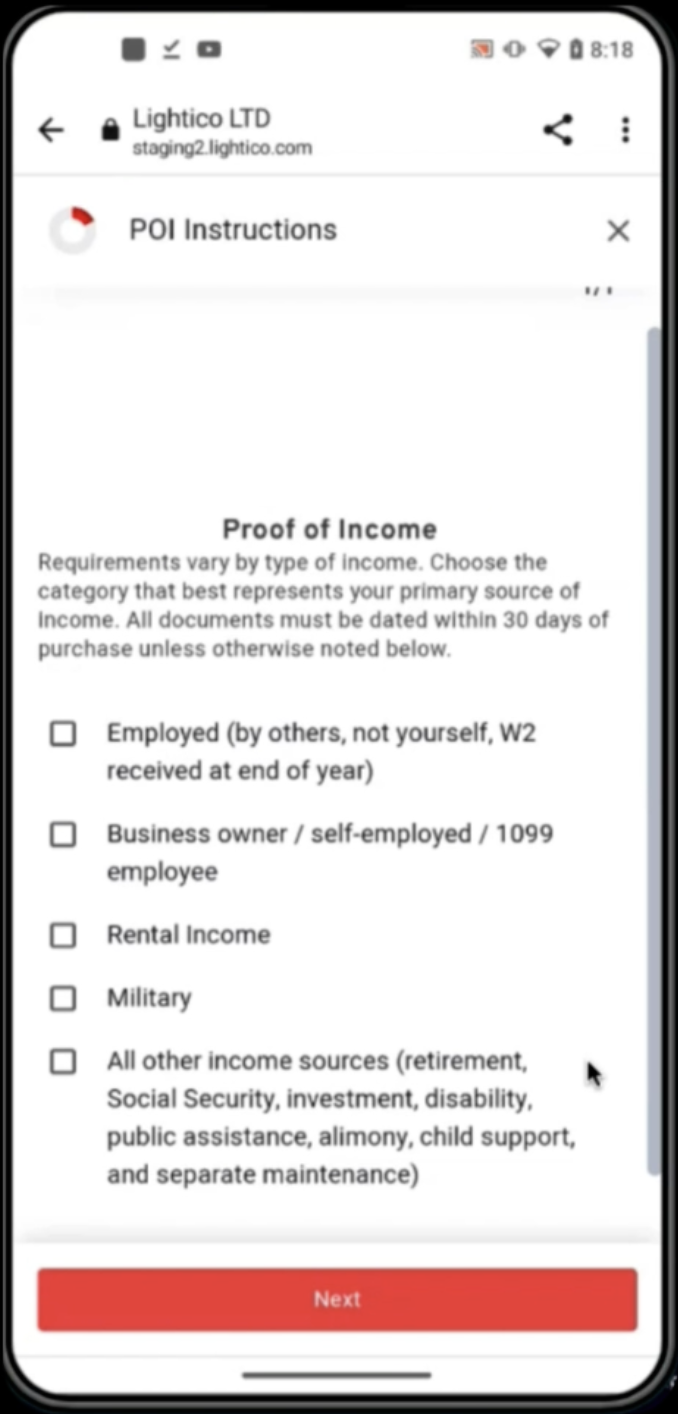

Refined Document Classification: Lightico's AI adeptly categorizes incoming documents, from pay stubs to utility bills and W2s, simplifying document management. This organizational strength expedites identification and retrieval of essential paperwork during loan processing.

Efficient Data Extraction and Association: Seamlessly extracting pivotal borrower information such as names, salary details, and addresses, Lightico meticulously associates them with relevant attributes within documents. This streamlines data extraction crucial for contract generation and assessment, enhancing accuracy and expediting processes.

Seamless Interaction via Natural Language: Lightico’s natural language interface empowers loan officers with effortless document interaction. This intuitive feature enables swift retrieval of pertinent borrower details, augmenting the pace of decision-making.

Q&A Data Query Capabilities: Interact with your documents through a natural language interface, making it effortless to find and retrieve the information you need. Common Questions can be pre-configured, or manually entered.

Photo ID Authenticity Verification: Trust in the authenticity of photo ID documents with Lightico's robust verification capabilities.

Data Validation: Ensure the accuracy of data within your documents by cross-referencing with customer records reducing the risk of errors.

Document Indexing and Storage: Let our AI take the guesswork out of where your documents belong. Lightico automatically indexes and stores documents appropriately based on their type and content.

AI-Powered Workflow Engine for Unmatched Efficiency

Automated Operational Excellence: Lightico’s AI-integrated no-code/low-code workflow engine creates a cohesive customer experience and in-house or outsourced development productivity. Build once and deploy everywhere. When regulations and internal compliance demands change, make the change one time and have it reflected in all channels instantly.

Accelerated Development Cycles: Leveraging pre-built AI models, and Lightico's center of excellence, Lightico expedites development cycles, allowing swift integration and deployment of customized lending functionalities, reducing time-to-market for new products, processes, and customer facing use cases.

Continuous Adaptive Learning: Lightico’s solution continuously adapts and evolves through learning from past processes, optimizing workflows, ensuring ongoing efficiency, and accuracy enhancements.

Benefits & Impact of IDP in Auto Finance

Reduced cost: Lightico IDP significantly minimizes the financial burden associated with manual data entry tasks such as repetitive "stare and compare" reviews, printing, posting, rekeying information, and processing. By automating these labor-intensive processes, Lightico IDP not only reduces salary and overhead costs but also enhances overall operational efficiency and accuracy.

Improved completion rates: Lightico IDP workflows streamline the document capture process, ensuring that all necessary documents are promptly and accurately captured at the point of sale. By reviewing these documents in real-time, any errors or discrepancies can be swiftly identified and rectified on the spot, rather than being flagged for separate and delayed processing. This proactive approach not only enhances efficiency but also reduces the likelihood of errors slipping through the cracks, ultimately leading to a smoother and more seamless journey for both applicants and loan processing personnel.

Improved time to completion: Lightico IDP produces efficient loan processing timelines, with fewer delays and bottlenecks that can often slow down the approval process. By automating data extraction and verification tasks, documents are processed promptly and accurately, reducing the waiting time for applicants and improving overall operational efficiency.

Reduce fraud – Lightico IDP's advanced capabilities in automatic data/document verification/validation and cross-referencing of information are instrumental in effectively mitigating the risk of fraud. By harnessing the power of AI and machine learning, Lightico IDP ensures a robust validation process that significantly reduces the likelihood of fraudulent activities slipping through the cracks. This comprehensive approach not only enhances security and trust in the lending process but also provides a seamless and reliable experience for both applicants and loan processing personnel. Trust in the accuracy and authenticity of data is paramount.

Improved accuracy: IDP has a considerably higher level of accuracy than human review. This advanced technology eliminates the margin of error that often accompanies manual data entry processes, ensuring that the extracted information is precise and reliable. By leveraging AI, IDP not only enhances the accuracy of document interpretation but also minimizes the risk of human oversight or misinterpretation. This increased level of precision not only boosts operational efficiency but also instills confidence in the data being processed, ultimately leading to more informed decision-making and improved outcomes in the loan origination process.

Improved compliance and auditing: With IDP, fail-safe processes are implemented to ensure that every case is automatically reviewed in strict accordance with compliance requirements. This meticulous approach eliminates the risk of human error, providing a robust system where regulatory standards are consistently met. By leveraging the power of AI and machine learning, IDP offers a seamless and reliable method of auditing that instills confidence in the accuracy and integrity of the data being processed. This comprehensive compliance framework not only enhances security and trust in the loan origination process but also guarantees a smooth and error-free experience.

Higher Customer NPS and Satisfaction: Customers get what they want faster, with less hassle, leading to improved customer retention and higher conversion rates. This streamlined process not only enhances customer satisfaction but also fosters loyalty and repeat business. By providing a seamless and efficient experience, customers are more likely to return for future transactions and recommend your services to others. Additionally, the reduced wait times and simplified procedures contribute to a positive impression of your company, ultimately resulting in higher conversion rates and a stronger customer base.

Higher Agent and Employee Experience (EX): By automating mundane tasks and simplifying complex processes, Lightico IDP empowers agents with the tools they need to excel in their roles. This not only boosts productivity and efficiency but also enhances job satisfaction, leading to improved agent retention rates. With streamlined workflows and automated functionalities, agents can focus on high-value tasks, fostering a positive work environment and ultimately contributing to a more engaged and motivated team.

These powerful capabilities seamlessly integrate with Lightico's robust platform features, like our powerful workflow builder. Whether you choose to leverage our innovative document request feature or independently handle documents already within your system, or even retrieve documents from other systems through API webhooks, Lightico's cutting-edge AI-Powered Document Analysis becomes your ultimate solution for streamlining operations, improving accuracy, and optimizing document collection and analysis to new heights.

Effortlessly collect, analyze, extract, and process crucial information from countless documents, empowering your business with unparalleled efficiency.

Say goodbye to manual document handling and embrace the future of AI document collection and analysis with Lightico.