Incremental Digital Progress isn’t Enough

Overall, consumers report an improvement in digital banking since before the pandemic. 35% of our respondents say their bank’s online offerings have gotten “much better.” Another 40% say their online banking experience is “marginally better.”

On the face of it, this is great news for the banking industry. Progress is always positive. But in today’s ultra-competitive landscape, marginal improvements are actually an invisible death knell. Nowadays, digital is the default. Few major banks expect customers to interact with them via fax machines or snail mail. Everyone has a digital app. The playing field is tougher than ever, and it’s going to take real innovation for banks to set themselves apart.

For example, harnessing digital payments is now a must. Fortunately, North American banks created a common brand called Zelle, helping them keep up with P2P fintechs after years of falling behind.

Two of the world’s largest banks have embedded their treasury services into Stripe, which in turn is embedded in Shopify to enable the eCommerce company to serve its merchants.

Simply put, banks need to keep investing in such transformative digital initiatives. Current efforts aren’t enough. Traditional banks in the US saw their income, as a share of GDP, shrink by -16% between 2009 and 2021. Meanwhile, it took fintech Chime just eight years to become the fifth-largest bank in the US, with approximately 12 million customers.

8 Years

This Time it has taken the fintech Chime to become the fifth-largest bank in the United States, with an estimated 12 million customers

But real innovation will help traditional banks keep pace with fintechs. Real innovation promises to take digital banking from “marginally better” to “much better” than before the pandemic.

Time is of the Essence

What kind of innovation do customers expect from their banks? What kind of technology will make the biggest difference to the customer experience?

We found that customers overwhelmingly prize speedy, efficient transactions with their financial institutions. 35% say that it should take under two hours to complete a personal loan application, and 39% say it should take under 24 hours. Unfortunately, all too often banks fall short on this.

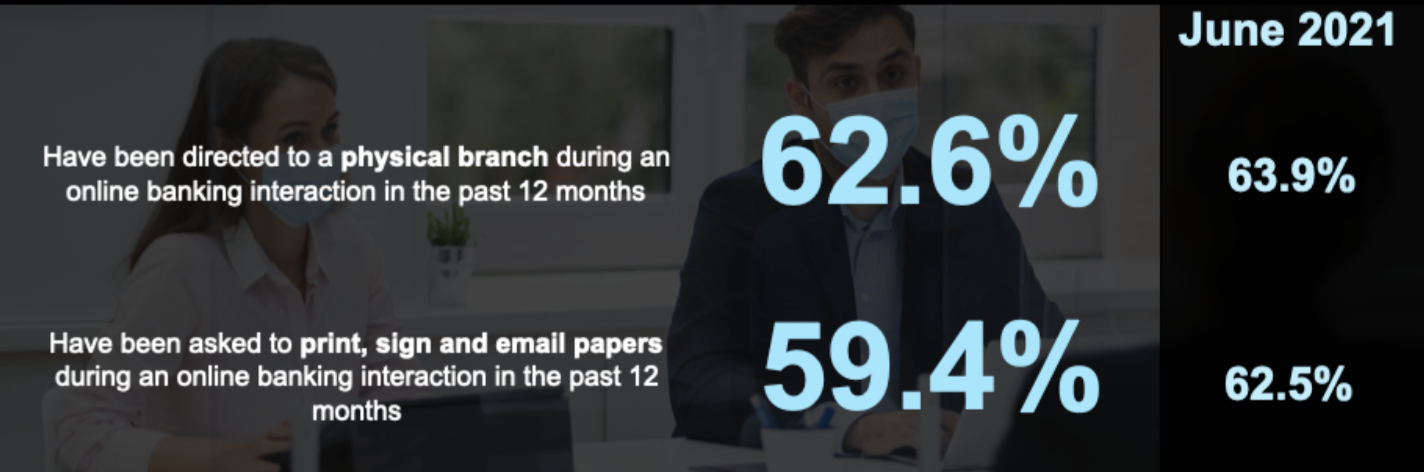

According to the survey, 62.6% of customers have been directed to a physical branch during an online banking interaction in the past 12 months (down a mere percentage point from June 2021). Another 59.4% have been asked to print, sign, and email papers during an online banking interaction during this time period (a three percent improvement from June 2021).

Even when customers are able to fully complete their application online, the technology or process doesn’t promote speed and efficiency.

For instance, a bank may allow a customer to download a loan application form, but it’s a PDF, which requires the customer to have special software installed and is less intuitive to fill out and submit than a web form

In other cases, the loan application form may be straightforward and web-based — but the bank comes back several days later informing the customer of missing documents, or of errors in the form that require a new form to be filled out. All of this prolongs loan turnaround time, harming the customer experience, burdening agents, and delaying a profitable source of income for the bank.

Customers prize speed when it comes to account opening, too, Nearly half (47%) say it should take under two hours to open a new bank account. Again, most major players do allow customers to open an account online. But many banks still make it difficult, if not impossible, for customers to fully onboard from a single digital channel of their choosing. Consider the following actual interaction with a major US bank:

In this case, applying for a credit card — a typical part of the onboarding process — is stymied by the customer’s inability to apply via the mobile chat. In today’s instant gratification world, customers expect to be able to carry out all banking tasks from their smartphone (if they choose). Forcing them to wait until they are in front of a computer or laptop, as this representative suggests, prolongs the onboarding process. And the more time passes, the higher the chance of the customer losing interest and opening up an account with a more innovative competitor.

In This Economy, Banks Will Need to Fight Harder

Our current economic climate is also pushing banks to go beyond making incremental improvements, and launching a true digital transformation.

Our survey found that anxiety about personal finances is plaguing practically everyone, to varying degrees. 48% of customers say they are “very concerned” about their finances given rising inflation and the possibility of a recession. Another 48% are “somewhat concerned.” Only 4% are “not all all” concerned.

This concern has a real impact on consumer banking behavior, or it soon will. Given rising inflation, 50% of consumers plan to save more. Only 24% plan to invest more. This means that consumers are likely pulling their money out of investments, and will require fewer related advisory services from their bank.

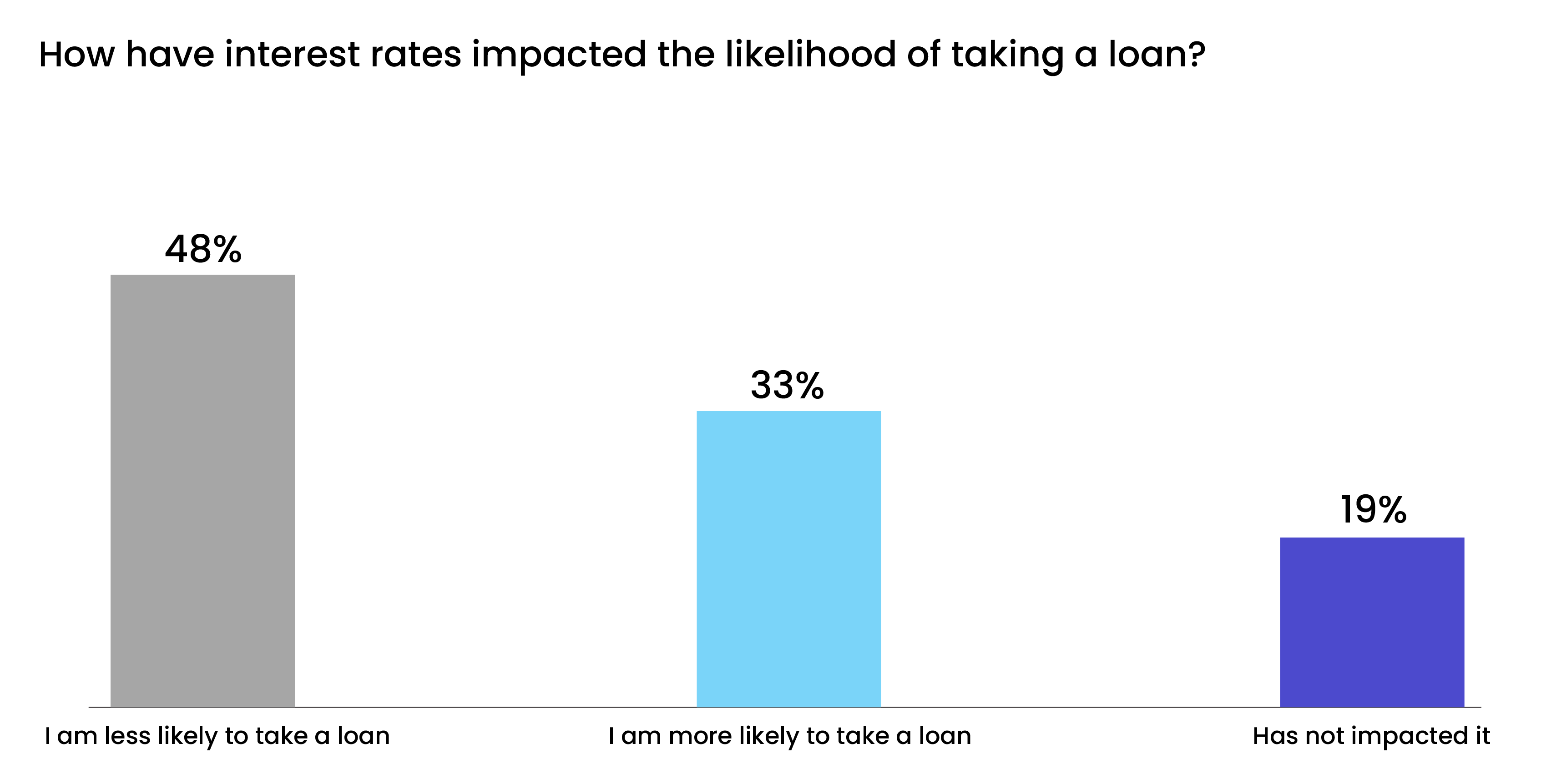

In addition, higher interest rates have reduced consumer demand for loans. 48% of banking customers say they are now “less likely” than before to take a loan.

What this means is that banks will need to make it as appealing and low-friction as possible if they want a chance to attract customers to high-yield activities such as investing and borrowing money. Stick to the status quo, and customers will play it safe and bury their treasure away, limiting the bank’s opportunities.

The current environment is also seeing growing mistrust and skepticism among customers. As customers become more savvy (as well as more cautious about their finances), they are on alert for being taken advantage of. Not so long ago, fintechs and neobanks freely charged hidden origination, transaction, and late payment fees. But now, the world’s most innovative banks are using technology for good, not evil.

For example, many of the apps provided by digital competitors are specifically designed to help customers manage their finances better, avoiding penalties and interest charges. Take UK-based fintech Wise, which was founded to enable quick and easy cross-border transactions that “avoid sneaky bank exchange rate markups and high fees.” It also allows customers shopping online to reduce costs by paying in the currency of the country they are buying from.

According to Accenture, banks could see a 9% increase in retail revenue by rebuilding customer trust and introducing innovative advisory services. Even as customers hold onto their wallets, banks can break through by offering digital services that actively promote the customer’s best interest.

A Digital Brain Needs a Human Heart

Digitization is a necessary precondition for a bank’s success — but it isn’t a guarantee of it. On its own, technology is cold and alienating. On its own, it cannot engender loyalty. There will always be a faster app, a sleeker interface, a better payment system out there.

According to Accenture, between 2018 and 2020, the proportion of consumers who have full confidence in their bank to look after their long-term financial wellbeing dropped from 43% to 29%. Why?

It’s likely that, as Accenture states, digitization has led many banks to “become functionally correct but emotionally devoid.” The coronavirus created the conditions for a rapid embrace of technology, both on the bank and consumer’s side. But now we are starting to sense that something vital has been lost. Banks need to get back to forming meaningful connections with their customers. This means that technology will need to be supplemented with human interactions.

To be sure, making in-person meetings for banking tasks is widely seen as undesirable. 37% of customers would be less likely to take care of a financial task if it required a trip to a branch. But customers do want the option to talk to a human being, especially when they seek guidance. In fact, seven out of ten customers say they would welcome a digital experience that includes human advice on simple (72%) and complex banking products (68%). The role of the agent has been elevated: agents are no longer seen as executors of bureaucratic operations. Customers expect them to be trusted guides.

7 out of 10

Those who would welcome a digital experience that includes human advice on simple (72%) and complex banking products (68%)

It’s becoming clear that customers envision a relationship with their bank as being digital-first, while augmented by the human touch. Two-thirds of Millennials want to text with their bankers, but few banks offer that service. By combining technology and humanity in an authentic way, banks can promote greater loyalty.

The Lightico Digital Completion Platform

These findings are encouraging for technology providers such as Lightico that are designed to help traditional banks increase their desirability amid the rise of fintechs, an unpredictable economy, and increasing customer expectations.

Today’s business environment calls for adding a complete customer-centric lens to digital investments. This is why the Lightico Digital Completion Cloud was born. The Digital Completion Cloud is a platform that intelligently and easily allows entire customer-facing processes to be completed without the need for undue human involvement. This requires moving from a narrow, siloed approach to features towards an end-to-end view of processes leveraging intelligent automation, digitalization, and integrations.

As we’ve seen, banks are struggling to distinguish themselves — most are technologically adequate, but fail to provide truly frictionless experiences. Digital banking has still seen incremental improvements over the past few years. The human touch is often lost in the process. And broken customer journeys, excessive digital and non-digital touchpoints, and slow turnaround times are still a problem.

The Digital Completion Cloud addresses all of these issues, and is marked by the following attributes:

-

Agent-guided: Banks share and collect all tasks requiring completion in real-time with customers.

-

All in one place: Banks can consolidate all customer-facing tasks into a single interactive experience.

-

No-code automation: Any business user can design flows that automate the full journey and tailor it to each customer.

-

Fully integrated: Banks can get more out of their existing systems via APIs.

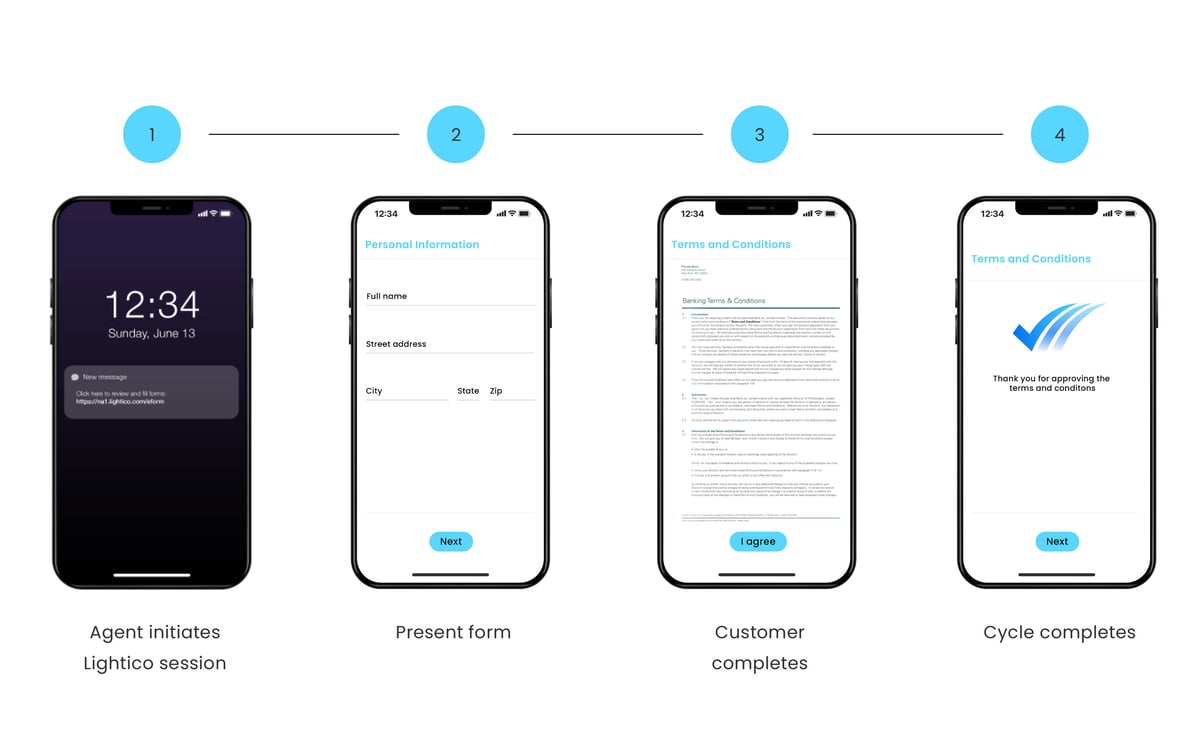

A Lightico session can be initiated for practically any banking task, including onboarding, loan origination, change of personal information, credit card application, and much more. Agents guided customers through the task, which allows them to upload eSignatures, forms, documents, and ID for verification via their mobile phone or a webpage.

Learn How Lightico Can Accelerate Banking Processes Throughout Your Customer Lifecycle

Experience the Interactive Video